Good morning.

The Fast Five → ‘Sell America’ trade revived by latest Fed attack, Wall Street shrugs, Alphabet’s $4 Trillion rise cements status as AI trade winner, Paramount sues Warner Bros. Discovery in takeover attempt, and Apple picks Google’s Gemini to run AI-powered Siri…

Calendar: Full Calendar »

Today:

Consumer Price Index, 8:30A

Tomorrow:

Producer Price Index, 8:30A

Your 5-minute briefing for Tuesday, Jan 13:

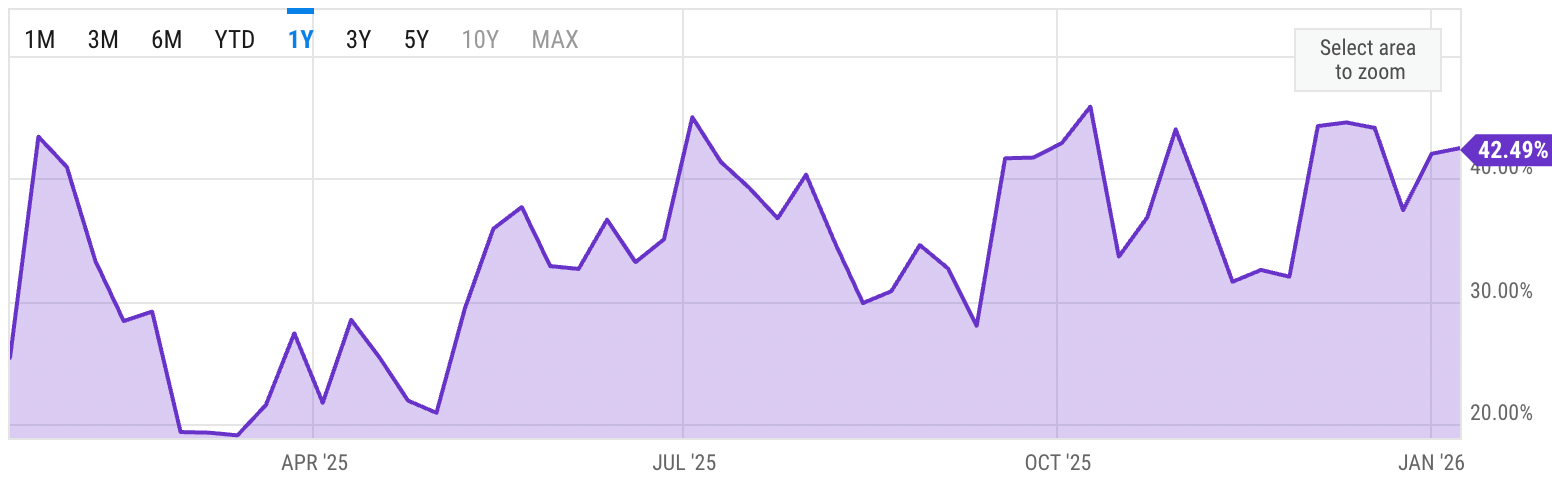

US Investor % Bullish Sentiment:

↑ 42.49% for Week of JAN 08 2026

Previous week: 42.04%

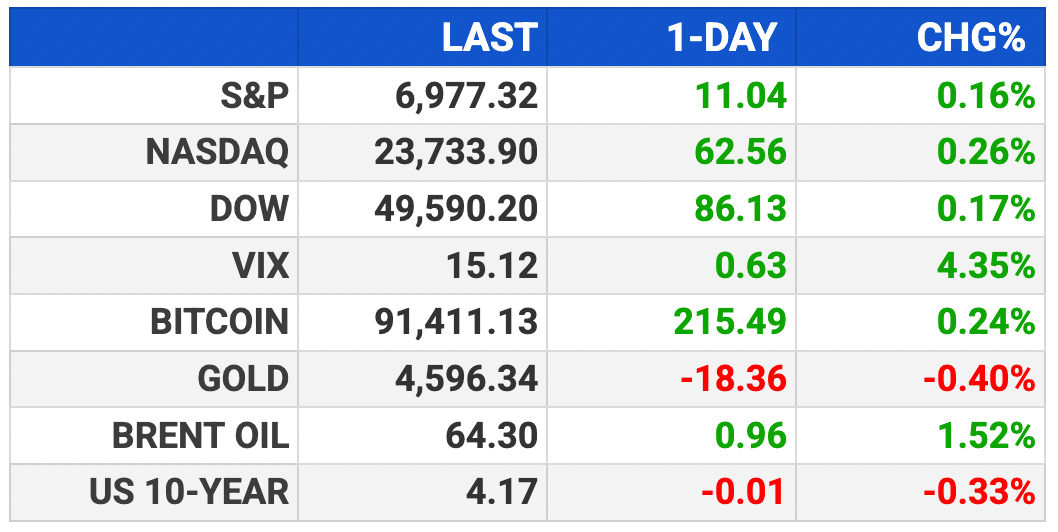

Market Wrap:

Futures near flat Dow -45, S&P -0.1%, Nasdaq -0.1%

Monday set new highs for S&P, Dow as Powell headlines faded

Tuesday CPI ahead with 2.7% YoY expected for December

Two cuts priced for 2026 with the first around June

JPM reports Tuesday pre-open then BAC, Citi, Morgan Stanley

Banks hit by 10% credit-card rate cap talk

Trump flagged a 25% tariff on countries doing business with Iran

EARNINGS

Here’s what we’re watching this week:

Today:

*Delta Air Lines $DAL ( ▼ 1.19% ) - earnings of $1.57 per share (+21.7% YoY)

*JP Morgan Chase $JPM ( ▼ 0.29% ) - earnings estimate to $4.97 from $4.87

WED: *Bank of America $BAC ( ▲ 0.66% ), *Citigroup $C ( ▲ 0.51% ), *Wells Fargo $WFC ( ▲ 1.7% )

THU: *Blackrock $BLK ( ▼ 0.32% ), *Goldman Sachs $GS ( ▲ 0.54% ), *Morgan Stanley $MS ( ▲ 0.98% )

A U.S. "Birthright" Claim Worth Trillions

A small government task force just finished a 20-year project.

They probably didn't realize their findings would allow everyday citizens to stake a claim on a $500 trillion national treasure.

But they did. And under U.S. law your birthright claim is now active.

This opportunity won't stay under the radar for long.

- a sponsored message from Behind The Markets -

HEADLINES

“Sell America” sentiment rippled through markets on Monday after the Trump admin escalated its attacks on the Federal Reserve, fanning concerns over the central bank’s autonomy in setting interest rates.

Stock futures steady after Fed drama as CPI inflation looms (more)

Powell probe rattles Washington, but Wall Street shrugs (more)

US urges partners, allies to increase minerals supply chain resiliency (more)

Trump admin finalizing Taiwan trade pact (more)

Gold, silver surge as 'assault on Fed' sparks rush to metals (more)

Japan's Nikkei hits all-time high on Wall St rally (more)

Alphabet hits $4 trillion market capitalization (more)

Apple picks Google’s Gemini to run AI-powered Siri coming this year (more)

Paramount sues Warner Bros. Discovery in hostile takeover attempt (more)

Capital One, Amex shares sink on Trump’s credit-card threat (more)

Palantir co-founder to invest in Nigeria drone firm (more)

BlackRock cuts hundreds of jobs (more)

Citi set to cut about 1,000 jobs this week (more)

Golden State Warriors’ parent valued at $11B in stake sale (more)

Former F1 champ Nico Rosberg raises $100M for VC firm (more)

Google teams up with Walmart to enable shopping within Gemini AI (more)

DEALFLOW

M+A | Investments

Marvell to acquire XConn Technologies

Route acquires Frate Returns

Standard AI acquires Pathr.ai

Haemonetics acquires Vivasure Medical

Brado receives investment from Santé Ventures

Cast AI receives strategic investment

VC

Hadrian, a developer of automated factories for aerospace and defense, raised expanded capital at a $1.6B valuation

Orca Bio, a biotech company developing cell therapies, raised $250M in aggregate funding

AirNexis Therapeutics, a biotech company developing therapeutics for pulmonary diseases, raised $200M in Series A funding

MEDIPOST, a biotech company developing therapies for inflammation-driven degenerative diseases, raised $140M in funding

Torq, an agentic AI security operations provider, raised $140M in Series D funding

Kinaset Therapeutics, a clinical-stage biopharma company, raised $103M in Series B funding

Cytotheryx, Inc., a cell therapy company developing treatments for liver disease, raised $60M in Series A funding

VieCure, a software platform for oncology care, raised $43M in funding

Vantaris Surgical, a medical device company for kidney stone treatment, raised $30M in Series A funding

VelaFi, a stablecoin-powered financial infrastructure platform under Galactic Holdings, raised $20M in Series B funding

Avenue Biosciences, a protein engineering technology company, raised $5.7M in Seed extension

Neuramint, a Web3 AI company developing an AI agent platform, raised $5M in Seed funding

CRYPTO

BULLISH BITES

🛡 Meme-stock traders rush to Powell’s defense.

🤯 The man betting on insider trading as prediction markets boom.

💵 The haves, have-nots, have-lots economy.

🦄 More than 100 new tech unicorns were minted in 2025 — here they are

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.