Good morning.

The Fast Five → Stocks sell off a day after furious rally, Apple sluggishness in China casts shadow on upbeat results, DOJ investigating Nvidia’s acquisition, US probes surging grocery prices, and Intel to cut 15,000+ jobs …

⚠️ From Chaiken Analytics: Why Are Tech Stocks Falling in August?

Calendar: (all times ET)

Today: Employment report, 8:30 AM

Your 5-minute briefing for Friday, August 2:

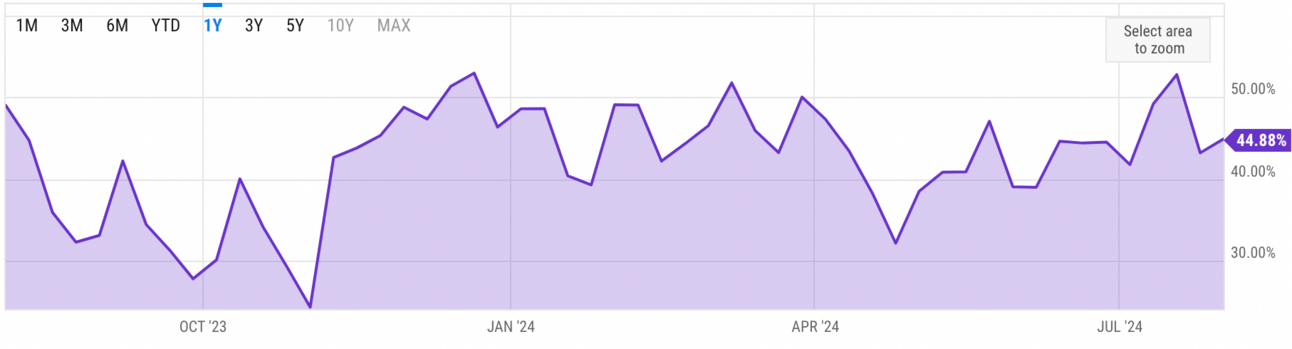

US Investor % Bullish Sentiment:

↑44.88% for Wk of August 01 2024

Last week: 43.17%. Updates every Friday.

Market Wrap:

Stock futures fell: S&P -0.3%, Dow -0.2%, Nasdaq -0.5%.

Regular session: Dow -1.2%, S&P -1.4%, Nasdaq -2.3%.

Market worried Fed is too late on policy.

Small-cap rally at risk, Russell 2000 -3%.

Today: July payrolls unemployment rate.

EARNINGS

Here’s what we’re watching:

Full earnings calendar here.

LIMITED-TIME OFFER from BILL.COM

Take a demo, get a Blackstone Griddle

Automate expense reports so you can focus on strategy

Uncapped virtual corporate cards

Access scalable credit lines from $500 to $15M

HEADLINES

Dow closes nearly 500 points lower as investors’ recession fears awaken (more)

Initial jobless claims rise to one-year high as hiring slows (more)

Productivity surges 2.3%, beating forecasts (more)

US targets surging grocery prices in latest probe (more)

Treasuries rally extends into seventh day as US payrolls loom (more)

DOJ investigating Nvidia's acquisition of AI startup (more)

Mortgage rates fall slightly to lowest level since February (more)

BOJ likely to hike in October after big shift (more)

Apple sales rise 5%, topping estimates revenues jump (more)

Apple files motion to dismiss DOJ antitrust lawsuit (more)

Amazon slips, forecast disappoints for third quarter (more)

Intel to cut 15,000 jobs, suspend dividend in turnaround push (more)

Luxury powerhouses are seeing profits eroded by a Chinese gray market (more)

Time to Sell NVDA? 50-Yr Wall Street Legend Weighs In

Wall Street investors are selling their shares at a record pace.

Even AI superfan Cathie Woods is offloading her shares.

With the stock already up 63% in 2024 alone – is it too late to get in?

One legendary stockpicker – with 50 years' experience on Wall Street – just gave his answer, here.

- sponsored message -

DEALFLOW

M+A | Investments

Caesars sells World Series of Poker to online gambling operator for $500M (more)

CD&R explores sale of American Greetings (more)

Occidental closes $12B CrownRock deal (more)

R1 to go private in $8.9B deal with TowerBrook, CD&R (more)

Altice sells Teads to Outbrain in $1 Billion ad tech deal (more)

Hedge fund tycoon Marshall closes in on deal for Spectator (more)

Boost Insurance Holdings, Inc., an infrastructure platform for MGAs, brokers, agents, and insurance providers, secured an equity investment from BHMS Investments (more)

VC

Outpace Bio, a cell therapy company using AI-powered protein design to program immune cells for improved function inside patients battling solid tumors, raised $144M in Series B financing (more)

Agrovision, a healthy superfruit platform, raised $100M in equity financing at over $1 Billion valuation (more)

Thumbtack, a tech company enabling people to improve their homes, received $75M in financing (more)

Protect AI, an AI and machine learning security company, raised $60M in Series B funding (more)

TS Conductor, a manufacturer of advanced electric power lines, closed a $60M growth funding round (more)

Ema, a gen AI company creating the universal employee of the future, added $36M to its Series A funding which now totals $50M (more)

Mindera Health, Inc., a company developing next-gen medical tech to enable skin analytics at the molecular level, closed $14M financing (more)

Sybill, an AI assistant for sales teams, raised $11M in Series A funding (more)

Athena Security, a leader in concealed weapons detection system software, closed a $10M seed funding round (more)

Tezi, an autonomous AI recruiter, raised $9M in seed funding (more)

Bee, an AI developer of a wearable assistant, raised $7M in seed funding (more)

Sora Fuel, a startup producing sustainable aviation fuel using water, air and renewable energy, raised $6M in seed funding (more)

When, an AI offboarding solution to help employees navigate post-employment transitions by offering more affordable alternatives to COBRA, closed a Seed funding round of $4.6M (more)

SafeGuard Privacy, a SaaS compliance platform allowing platforms to comply with global privacy laws, closed a $3.6M funding round (more)

Mintify, builder of an NFT order book, raised $3.4M in funding (more)

Streamkap, a real-time data exchange to sync data between systems and companies, raised $3.3M in seed and pre-seed funding (more)

PortfolioPilot.com, an AI-driven financial advisory platform from Global Predictions, closed a $2M seed funding round (more)

CRYPTO

BULLISH BITES

🚨 Summer Stock Alert: Why are hedge funds dumping AI stocks? *

🔥 Heating Up: Microsoft now lists OpenAI as a competitor in AI and search.

👎 Ouch: The 10 worst states to retire in the U.S.—No. 1 isn’t California or New York.

🤺 Talent Hub: The entire U.S. men's Olympic fencing team went to Harvard.

🫘 Only In Beantown: Sports that would have been introduced if Boston hosted the 2024 Olympics.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.