Good morning.

The Fast Five → Dimon: US economy is battling a slowdown after record BLS revision, Wall Street has a consumer spending problem, Oracle stock soars as CEO says cloud revenue set explode, Treasury bulls out in force awaiting inflation data, and here’s everything Apple just announced…

📌 Gold just hit a new high. And with the uncertainty all around, many experts believe it could go even higher. Weiss Ratings' gold expert Sean Brodrick and his team have called the tops and bottoms in gold over the last two decades. And in his presentation, Sean shares a more lucrative way to ride this gold surge » (ad)

Calendar: (all times ET) - Full Calendar

Today:

Producer Price Index, 8:30A

Tomorrow:

Consumer Price Index, 8:30A Unemployment Claims, 8:30A

Your 5-minute briefing for Wednesday, Sept 10:

US Investor % Bullish Sentiment:

↓ 32.69% for Week of SEP 04 2025

Previous week: 34.60%

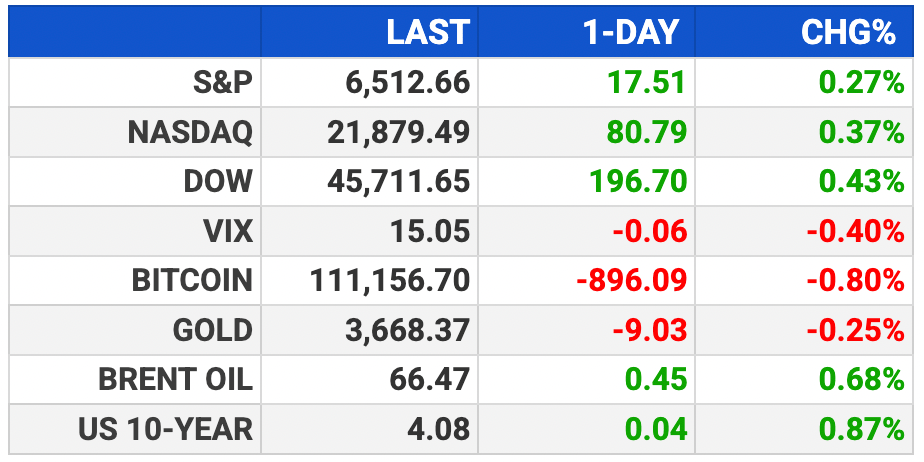

Market Wrap:

S&P futures +0.2%, Nasdaq +0.1%, Dow –80 pts (-0.2%)

All 3 indexes closed at records Tue

Oracle +26% on 1,529% multicloud DB growth

Nvidia +2% in sympathy with Oracle

PPI today, CPI Thursday — both seen +0.3% MoM

Fed on track for Sept cut unless inflation runs hot

EARNINGS

Here’s what we’re watching this week:

Today:

*Chewy $CHWY ( ▲ 2.84% ) - earnings of $.33 per share (+37.5% YoY) on $3.1B revenue (+6.9% YoY)

THU: *Kroger $KR ( ▼ 0.13% )

Adobe $ADBE ( ▲ 1.35% ) - $5.18 eps (+11.45 YoY) on $5.9B revenue (+9.3% YoY)

Billionaires are Piling Into this Gold Investment

Gold just set a new record high breaking $3,500 per ounce.

And main street investors are rushing to cash in.

Costco, for example, can’t keep it on their shelves as everyday Americans are clamoring for gold bars and coins.

But Wall Street billionaires are not buying bullion right now.

Instead, they’re loading up on a different type of investment.

It’s a little-known way that has given investors a chance to make 13 times … 21 times … 157 times … even a surprising 1,000 times more than physical gold.

All without buying another ounce of gold.

Eliza Lasky

Weiss Advocate

- a message from Weiss Ratings -

HEADLINES

S&P 500 and Nasdaq notch record high closes, investors bet rate cut (more)

Treasury bulls out in force as Wall Street awaits inflation data (more)

Supreme Court will hear Trump tariffs case on fast track (more)

Fed seen on track for three rate cuts this year, starting next week (more)

Fed rate cut now signals 3% inflation is the new 2% (more)

Gold vaults to record high on rate cut momentum (more)

Oil settles higher after Israeli attack on Qatar (more)

Here’s everything Apple just announced (more)

Oracle stock soars as CEO says AI will fuel cloud revenue explosion (more)

Nebius shares soar 50% on Microsoft AI deal (more)

US electric car uptake will slow further on Trump policies (more)

Blackstone invests $250 million in new hedge fund Covara (more)

JPMorgan expects Q3 investment banking revenue to grow in double digits (more)

Copper miners sign a $53 billion mega-merger (more)

Saylor model struggles as crypto treasury hype turns to doubt (more)

Mistral AI doubles valuation to $14 billion with ASML investment (more)

DEALFLOW

M+A | Investments

Novartis to acquire Tourmaline Bio for $1.4 billion

Phillips 66 buys remaining stake in major US refineries from Cenovus for $1.4B

Exxon Mobil buys a Kentucky battery-materials factory

Applied Systems acquires Cytora

Magnite acquires streamr.ai

Anglo American to merge with Teck Resources (~$53B)

VC

QuEra, a developer of advanced neutral-atom quantum computers, expanded its $230M Series B financing round

Harbor Health, a primary and specialty care clinic group and health insurance company, raised $130M in new funding

Speedchain, a global provider of modern commercial card programs and expense management solutions, raised $111M in equity and debt financing

Higgsfield, an AI-native video reasoning engine, raised $50M in Series A funding

Palm Tree Crew, a global entertainment, hospitality and investment holding company, raised $20M in Series A funding

Sapphire Technologies, a manufacturer of power generation equipment, raised $18M in Series C financing

LightSpun, an AI-powered dental insurance administration platform, raised $13M in Series A funding

Runware, a performance and price-focused AI-as-a-Service provider, raised $13M in Seed funding

Nuclearn, an AI platform designed specifically for nuclear operations, raised $10.5M in Series A funding

Cassidy, a context-powered AI automation platform for enterprises, raised $10M in Series A funding

Sphinx, a company building AI for data, raised $9.5M in Seed funding

Metal, an AI platform built for private market investors, raised $5M in funding

MCatalysis, a deep tech company focused on the fuels and chemicals sector, raised an undisclosed amount in Seed funding

CRYPTO

BULLISH BITES

🌎 Tariff-exposed industries are losing jobs.

🤔 Is Sam Altman laying the groundwork for OpenAI’s long-rumored social media push?

🍹 Gen Z doesn’t drink much. But when they do, it’s this cocktail.

🚘 Porsche’s first-ever hybrid 911 Turbo S hits 60 in 2.4 seconds.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.