Good morning.

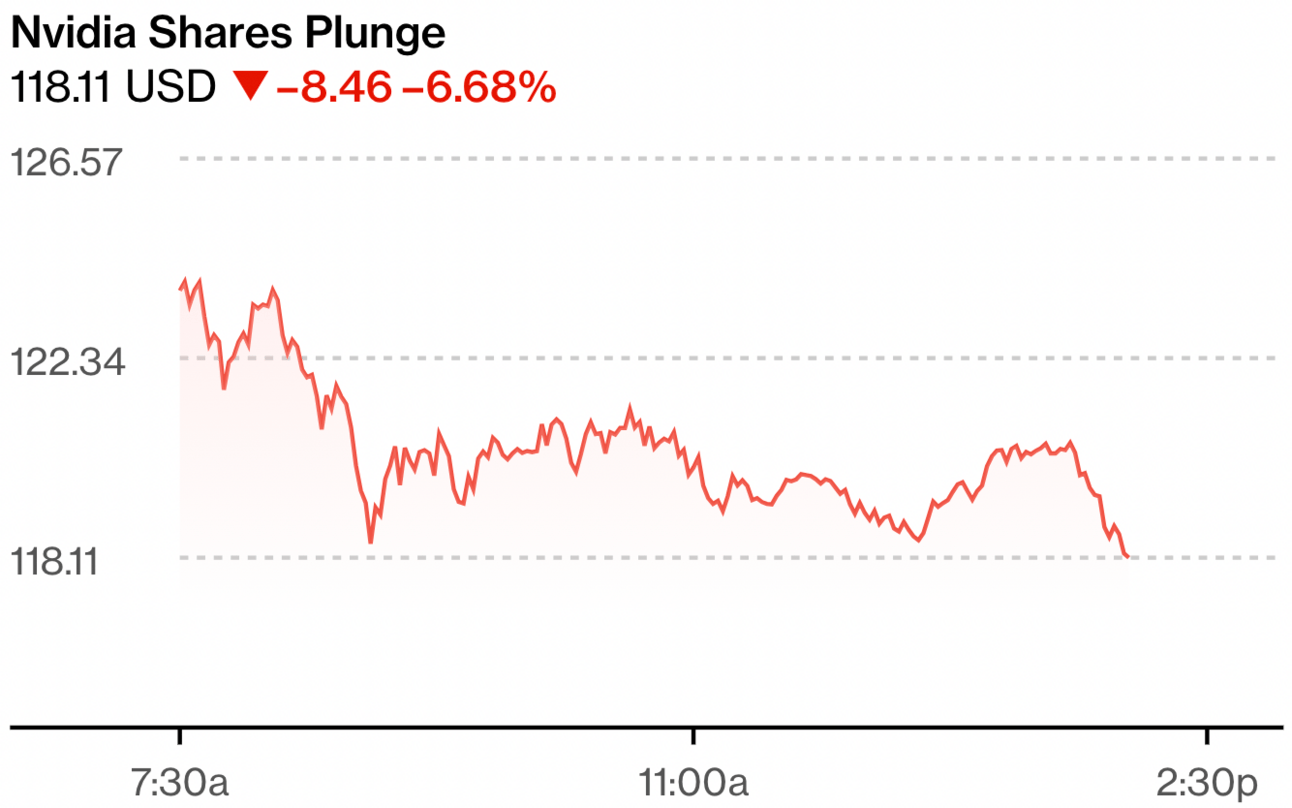

The Fast Five → Nvidia’s three-day selloff has traders scouring charts for support, ocean shipping prices are near pandemic-era highs, David Rubenstein says Fed rate cuts not likely before election, Trump Media stock (DJT) soars 30%, and Julian Assange is ‘free’…

Calendar: (all times ET)

Today: | Consumer confidence, 10:00a |

WED 6/26: | New home sales, 10:00a |

THU 6/27: | Initial jobless claims, 8:30a |

FRI 6/28: | PCE index, 8:30a |

Your 5-minute briefing for Tuesday, June 25:

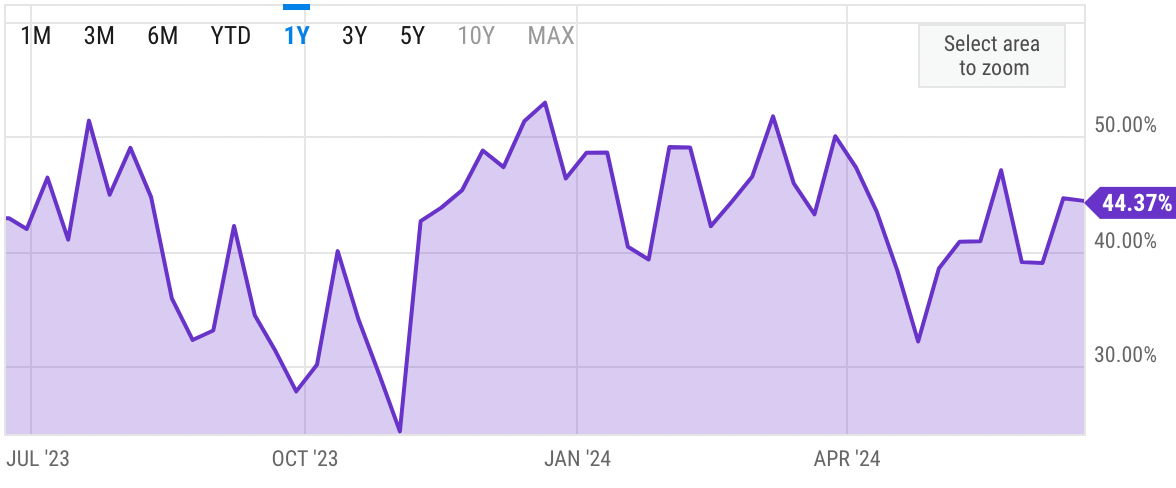

US Investor % Bullish Sentiment:

↓ 44.37% for Wk of June 20 2024 (Last week: 44.59%)

Market Recap:

Dow +260.88 points (0.67%) S&P -0.31%; Nasdaq -1.09%.

Tech fell 2%+; energy up 2.7%; financials & utilities ~1%.

Nvidia fell 6.7%; still up 140% YTD.

AI enthusiasm lifts market despite rate cut concerns.

S&P 500 up 14% YTD after 31 record closes.

May PCE inflation data due Friday.

EARNINGS

Here’s what we’re watching this week:

Today:

FedEx (FDX) - earnings of $5.36 per share on $22.1B revenue (+0.7% YoY)

Micron Technology (MU) - earnings of $0.51 per share on $6.7B (+77.6% YoY)

Nike (NKE) - earnings of $0.84 per share (+27.3% YoY) on $12.9B revenue (+0.2% YoY)

Full earnings calendar here.

2024 Opportunities Await: Explore "9 Stocks To 10x"

HEADLINES

David Rubenstein says Fed not likely to cut rates before the election (more)

Fed floats weaker version of planned bank-capital overhaul (more)

US approves Freddie Mac pilot program to buy second mortgages (more)

Julian Assange is ‘free,’ will plead guilty to leaking national security secrets (more)

Hedge funds turn most bearish on US gasoline in five years (more)

Nvidia enters correction territory as slump erases $400B (more)

Trump Media stock (DJT) soars 30%, breaking weekslong decline (more)

Apple is first company charged with violating EU's DMA rules (more)

Novo Nordisk to build $4B factory in US amid weight-loss drug shortages (more)

Target taps Shopify to juice its Amazon-like platform (more)

Shein files for London IPO as US listing stalls (more)

Pfizer testing new non-GLP-1 mechanism for weight-loss drug, CEO reveals (more)

Oracle warns that a TikTok ban would hurt business (more)

From Stansberry Research

"This Could be Worth Even More than A.I."

Whitney Tilson's nailed many of the most famous stocks of the last 25 years – including Netflix, Amazon, and Apple.

Now he's pounding the table on a new technology rolling out across America, which early estimates say could create more wealth than A.I., the personal computer, and the smartphone combined.

- please support our sponsor -

DEALFLOW

M+A | Investments

KKR seeks $20 billion for new North America buyout fund (more)

Rite Aid wins $200M dispute over Elixir sale to MedImpact (more)

Russia's MTS to buy back foreigners' blocked shares for $29M (more)

Covestro opens door to ADNOC deal after it raises bid to $12.5B (more)

Resource Innovations, a tech-enabled services company focused on energy efficiency and sustainability, acquired Cadeo, a clean energy consulting firm (more)

Naomi Watts, actress and advocate for women’s health, and L Catterton, a consumer-focused investment firm, announced their partnership in the acquisition of Stripes Beauty (more)

JF Fitness, a Crunch Fitness franchisee serving the Mid-Atlantic and Southeastern U.S., received an investment from Trive Capital and 808 Capital Partners (more)

VC

BillionToOne, a precision diagnostics company, raised $130M in Series D funding at an over $1B+ valuation (more)

HeyGen, an AI video generation platform for businesses, raised $60M in Series A funding at a $500M post-money valuation (more)

The Picklr, an indoor pickleball franchise, raised a Series B funding, at $59M valuation (more)

Daydream, a search and discovery shopping platform, raised $50M in Seed funding (more)

Amplify Life Insurance, a digital platform for wealth-building through permanent life insurance, raised $20M in Series B funding (more)

Maxterial, a material science company, raised nearly $8M in Series A funding (more)

MEandMine, a startup for classroom well-being using AI to identify psychological risks in children, raised $4.5M in funding (more)

Coeptis Therapeutics (COEP), a biopharmaceutical company developing cell therapy platforms closed on $4.3M in financing (more)

Backstroke, a generative AI messaging platform, raised $2M in Seed funding (more)

CRYPTO

BULLISH BITES

🇺🇸 Influence: How Jeff Yass became one of the most influential billionaires in the 2024 election.

📈 Google CEO: This is likely bigger than electricity *

🚖 Inside Look: How a cyberattack took 15,000 car dealers offline.

🏎 Ferrari: Ferrari races into new territory with line of $500,000 electric cars.

🍷 Haute: The best new rosé wines aren’t from France.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.