Good morning.

The Fast Five → Stocks fall as AI selloff goes global, Biden says time for ‘younger voices’, Tesla earnings miss causes biggest slump since ‘20, S&P and Nasdaq worst day since ‘22, and Ether ETFs see net inflows of $106M on first day…

📈 From Chaikin Analytics: Time to sell NVDA? 50-yr Wall Street legend weighs in »

Calendar: (all times ET)

Today: | GDP, 8:30 AM |

FRI, 7/26: | PCE index, 8:30 AM |

Your 5-minute briefing for Thursday, July 25:

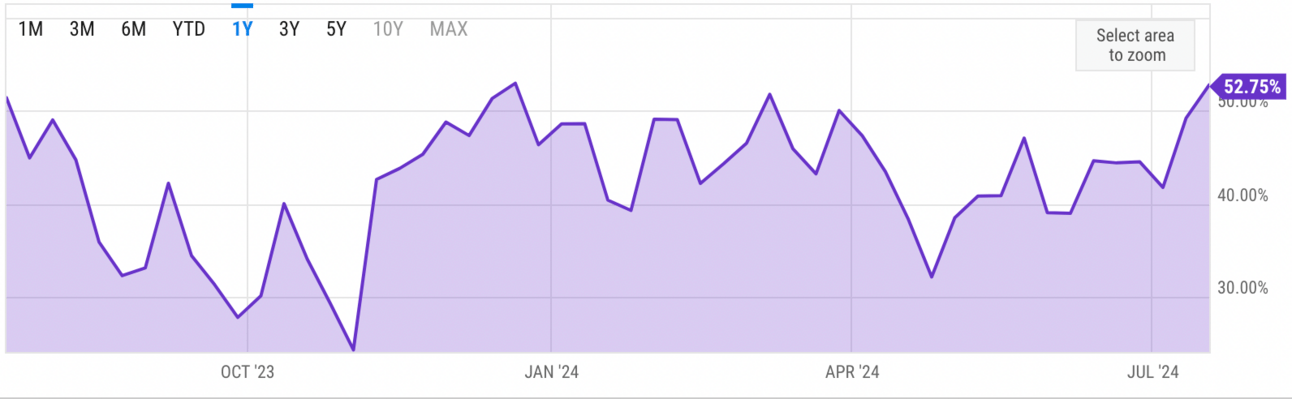

US Investor % Bullish Sentiment:

↑ 52.75% for Wk of July 18 2024 (Last week: 49.18%)

Chart updates every Friday.

Market Recap:

Stocks sold off Wed; S&P and Nasdaq had worst session since 2022.

S&P 500 -2.31%, Nasdaq -3.64%, Dow -1.25%.

Alphabet -5%, Tesla -12.3%, Nvidia -6.8%, Meta -5.6%, Microsoft -3.6%.

Overbought market, high earnings bar, weak equity period caused sell-off.

Weak US manufacturing data; PMI fell to 49.5 in July.

New home sales in June below expectations.

EARNINGS

HEADLINES

Biden Says Time for ‘Younger Voices’ in Oval Office Speech (more)

Megacap stock selloff shows investor concerns about too much tech (more)

US business activity edges higher; pricing power diminishing (more)

New home sales fall to seven-month low in June (more)

Gold rises on softer dollar, traders eye more US data (more)

Oil prices finish higher as US oil, fuel inventories ease (more)

China central bank surprises by lending again at lower rates (more)

Bank of Canada cuts rates, sees weaker economy in 2024 (more)

Japan's population falls at the fastest rate in decades (more)

US spot Ether ETFs see net inflows of $106M on first day (more)

Kering hit 7-year low after weak forecast, revenue drop on low China sales (more)

Stellantis reports 48% drop in first-half net profit on weak sales (more)

Our No. 1 Stock for the Rare

"Millionaire Window" Opening NOW

According to Wall Street legend Whitney Tilson, an extremely rare window in the markets is about to open.

It's an often-misunderstood market setup we've only seen 13 times since 1920.

The last time this happened, it minted a million brand-new millionaires – in a single year. But Tilson says this unique window in the markets could close much sooner than anyone realizes, leaving most investors in the dust, while making a select few incredibly rich.

- sponsored message -

- We’re on a short break this week -

The Dealflow, Crypto, and Bullish sections

will resume on Monday 7/29.

| Sponsored |

| Maximize 2024: Uncover "9 Stocks Poised for Growth |

| As we step into 2024, seize strategic opportunities in the market. Discover "9 Stocks Set to Soar," handpicked for their potential. Act Now: Before diving into our report, consider the opportunities 2024 holds. The time is ripe.Go HERE to Get Their Names And Ticker Symbols |

| By clicking the link you are subscribing to the Summa Money Newsletter and may receive up to 2 additional free bonus subscriptions. Unsubscribing is easy |

| Privacy Policy/Disclosures |

What did you think about today's briefing?

Have a comment or suggestion?

💌Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.