Good morning.

The Fast Five → Pentagon’s $1B stake to shake up defense industry, Wall Street scrambles to defuse Trump’s credit card onslaught, Nvidia to invest $1 billion in AI drug discovery lab, silver hits record, and global central bankers rally behind Fed's Powell…

Calendar: Full Calendar »

Today:

Producer Price Index, 8:30A

Tomorrow:

Unemployment Claims, 8:30A

Your 5-minute briefing for Wednesday, Jan 14:

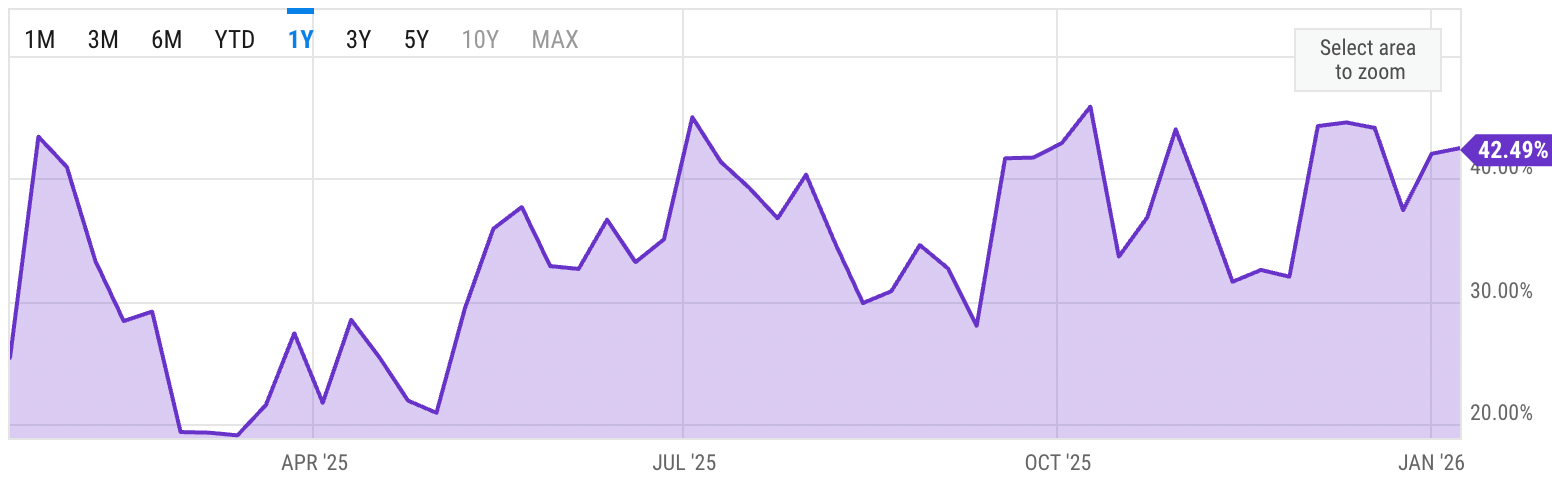

US Investor % Bullish Sentiment:

↑ 42.49% for Week of JAN 08 2026

Previous week: 42.04%

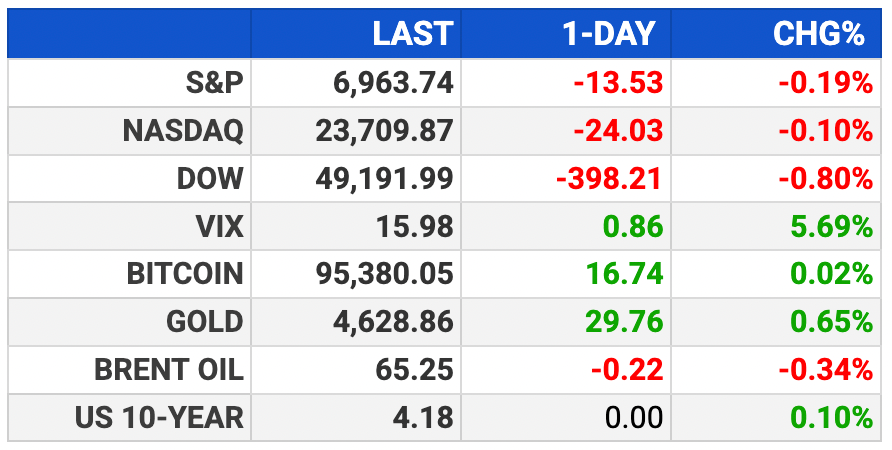

Market Wrap:

Futures little changed Dow -39, S&P near flat, Nasdaq +0.1%

Tuesday slipped S&P -0.2%, Dow -400, Nasdaq -0.1%

Wednesday BAC, Wells, Citi report plus December PPI

Financials dragged with JPM -4% and peers lower

Oil jumped over 2% on Iran headlines and energy stocks rose

Policy and Powell noise kept pressure on risk sentiment

EARNINGS

Here’s what we’re watching this week:

Today: *Bank of America $BAC ( ▲ 0.66% ), *Citigroup $C ( ▲ 0.51% ), *Wells Fargo $WFC ( ▲ 1.7% )

THU: *Blackrock $BLK ( ▼ 0.32% ), *Goldman Sachs $GS ( ▲ 0.54% ), *Morgan Stanley $MS ( ▲ 0.98% )

New Banking Law #S.1582 Could Unlock

$21 Trillion for Americans

Jeff Brown believes the largest banks in America could soon begin to replace every single dollar in your bank account…

With a better, more technologically advanced dollar…

Potentially making a lot of people rich in the process.

Get the details here, because this could be a $21 trillion money revolution.

- a sponsored message from Brownstone Research -

HEADLINES

Global central bankers rally behind Fed's Powell (more)

US core CPI rises 0.2%, bucking estimates for bigger rebound (more)

Here's the inflation breakdown for December (more)

US tariff revenue just dropped by almost $3B (more)

Trump targets card swipe fees after interest rate threats (more)

Wall Street scrambles to defuse Trump’s credit card onslaught (more)

JPMorgan says ‘everything’ on table to fight 10% credit card cap (more)

Hedge funds turn chaos into cash for best gains in 16 years (more)

Silver hits record, gold rises as US data fuels rate-cut bets (more)

US clears path for Nvidia to sell H200s to China via new rule (more)

Meta begins job cuts as it shifts from Metaverse to AI devices (more)

Netflix weighs all-cash WBD bid to fend off Paramount (more)

Former Neiman Marcus chief picked to lead Saks through bankruptcy (more)

DEALFLOW

M+A | Investments

U.S. Bancorp to buy BTIG for up to $1 billion

Synchrony Medical receives investment from NJIEF

VC

Mirador Therapeutics, a medicine company developing new therapies for inflammatory and fibrotic diseases, raised $250M in Series B funding

Onebrief, an operating system for command, raised $220M in Series D funding

Aspen Power, a distributed generation platform for clean energy, received a $200M strategic capital commitment from Deutsche Bank

JetZero, developer of a commercial all-wing airplane, raised approximately $175M in Series B financing

Defense Unicorns, a developer of airgap software for national security mission systems, raised $136M

Deepgram, a real-time API platform underpinning the Voice AI economy, raised $130M in Series C funding

Proxima, a biotech company developing AI-driven drug discovery for proximity therapeutics, raised $80M in Seed funding

Inquis Medical, developer of a thrombectomy system, raised $75M in Series C funding

Wasabi Technologies, a hot cloud storage company, raised $70M

Accelsius, a company specializing in liquid cooling for AI and high-performance computing, raised $65M in Series B funding

WitnessAI, an AI security platform, raised $58M in funding

WithCoverage, an AI-enabled risk management platform, raised $42M in Series B financing

HPS/PayMedix, a healthcare financing and payments solutions provider, raised $33M in financing

Juvena Therapeutics, a clinical-stage biotechcompany, raised $33.5M in Series B funding

Converge Bio, an AI platform for accelerated drug development, raised $25M in Series A funding

WeatherPromise, a tech company providing weather guarantees, raised $12.8M in Series A funding

RISA Labs, an AI operating system for oncology, closed an $11.1M Series A funding round

Enspire DBS Therapy, Inc., a clinical-stage company developing therapy for post-stroke recovery, raised $10.3M in Series B1 funding

Cloudforce, a provider of frontier AI solutions for regulated industries, raised $10M in Series A funding

OurPetPolicy, a platform for managing pets and emotional support animal fraud, raised $8M in Series A funding

CRYPTO

BULLISH BITES

🤔 Powell investigation has little financial or political upside.

🚫 Exec: Trump’s Wall Street home-buying ban won’t fix housing shortage.

🏓 Nike signs its first pickleball deal.

💀 Are You Dead?: The viral Chinese app for people living alone.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.