Good morning.

The Fast Five → 2026 is AI's "show me the money" year, Warren Buffett serves last day as CEO, Google wraps up best year since 2009, Tesla sales outlook darkens, and everyday traders go from fringe players to dominant market force…

📌 Futurist Eric Fry says it's a "Season of Surge" for these three stocks — One company to replace Amazon… another to rival Tesla… and a third to upset Nvidia. These little-known stocks are poised to overtake the reigning tech darlings in a move that could completely reorder the top dogs of the stock market. Eric Fry gives away names, tickers and full analysis in this first-ever free broadcast. Watch now... (ad)

Calendar: (*Shutdown may affect key data. All times ET) - Full Calendar »

Today:

None watched

Tomorrow:

ISM Manufacturing PMI, 10:00A

Your 5-minute briefing for Friday, Jan 2:

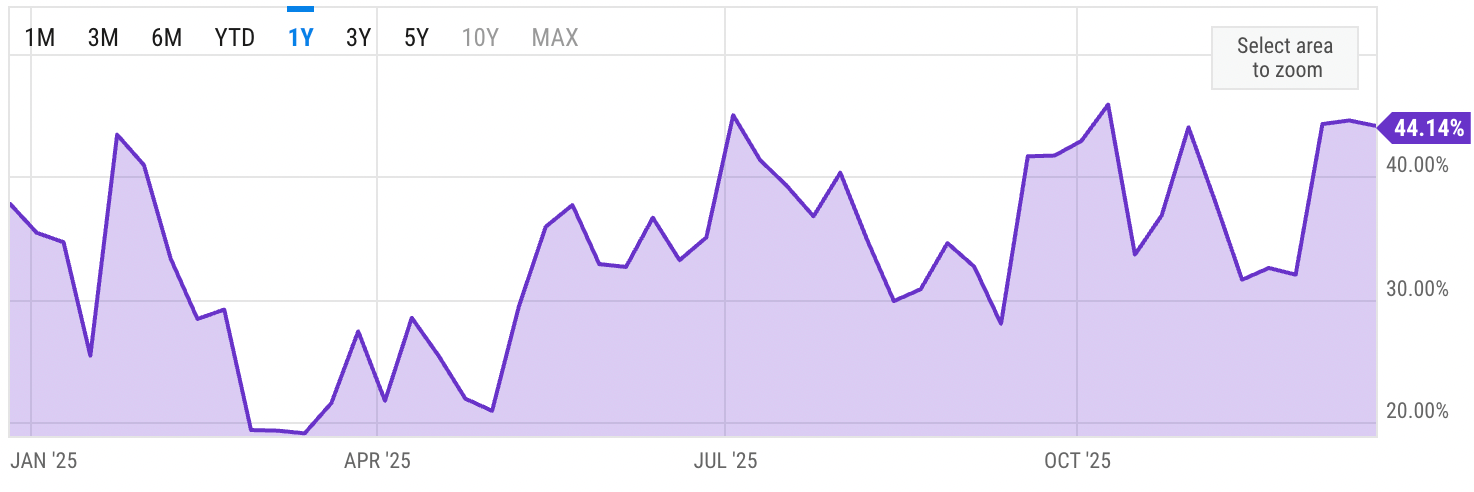

US Investor % Bullish Sentiment:

↓ 44.14% for Week of DEC 18 2025

Previous week: 44.59%

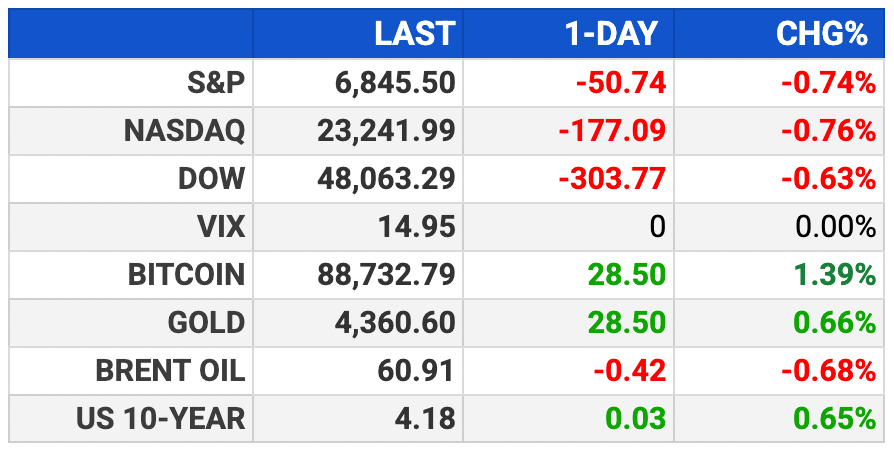

Market Wrap:

S&P 500 -0.7% Wednesday; Nasdaq -0.8%, Dow -0.6%

Still a big 2025: S&P +16.4%, Nasdaq +20.4%, Dow +13.0%

April tariff shock faded; investors now assume less tariff drama in 2026

Santa-rally window has been soft, hinting at near-term chop

AI led, but the “Mag 7” split: Alphabet +65% YTD, Amazon +5%

Non-tech winners showed up: gold +64%, silver +141%

EARNINGS

No noteworthy earnings scheduled this week.

The Verdict is In for AI Stocks in 2026

Move your money out of overpriced AI stocks before the tech trade breaks down in 2026. Get into these smaller, lesser-known names that are showing the potential to dethrone the Mag 7 in 2026.

Make sure three alternatives to Nvidia, Tesla, and Amazon are on your radar before markets open tomorrow.

- a sponsored message from Investor Place Digest -

HEADLINES

Stocks climb with tech leading, silver advances (more)

Everyday traders go from fringe players to dominant market force (more)

US draws bulk of state-owned investment in ‘25 as assets hit record $60T (more)

US grants TSMC licence to import US chipmaking tools into China (more)

US jobless claims slide to cap a bumpy year for job market (more)

Dire year for dollar has little light at end of tunnel in 2026 (more)

Google wraps up best year on Wall Street since 2009 (more)

Tesla sales outlook darkens despite Musk’s self-driving euphoria (more)

Boeing awarded $2.7B contract for Apache helicopter support (more)

Lockheed Martin gets $328.5M Taiwan military sale contract (more)

Neuralink plans 'high-volume' brain implant production by 2026 (more)

Polymarket and Kalshi hit it big on 2025 fintech funding surge (more)

Saks Global prepares for bankruptcy after missing debt payment (more)

DEALFLOW

M+A | Investments

None listed today

VC

Lemon Slice, a builder of tech that transforms a single photo into interactive, conversational video, raised $10.5M in Seed funding

Traini, a pet emotional intelligence startup, closed a $7.5M funding round

BriefCatch, a legal-writing platform used by law firms and courts, raised $6M in Series A financing

Vibranium Labs, an AI-powered incident management solutions to resolve infrastructure issues in real time, raised $4.6M in Seed funding

CRYPTO

BULLISH BITES

📊 5 Wall Street investors explain how they’re approaching the coming year.

💰 A 5 million percent return in 60 years leaves Warren Buffett’s legacy unmatched.

🔮 Revisiting turn-of-the-millennium predictions.

📔 This new coffee-table book showcases 100 rare and revolutionary watches.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.