Good morning.

The Fast Five → Investors face whiplash from Trump's Venezuela gamble, all eyes on jobs numbers, oil majors pushed to invest big in Venezuela, emerging-market stocks set for record high, and BYD surpasses Tesla as EV world leader…

📌 You think the volatility is over? Think again... because it’s just getting started. In fact, according to a strange investment secret discovered just before the Great Depression... the current economic chaos is just a preview. What’s coming next could be much worse. We’ve identified five stocks you should absolutely avoid as this market shift plays out — you'll want to see this list » (ad)

Calendar: (*Shutdown may affect key data. All times ET) - Full Calendar »

Today:

None watched

Tomorrow:

ISM Manufacturing PMI, 10:00A

Your 5-minute briefing for Monday, Jan 5:

Market Wrap:

Futures steady Sunday night after US strike in Venezuela, Maduro captured

Futures: Dow +7 pts, S&P +0.1%, Nasdaq +0.3%

Maduro and wife flown to New York; US narco-terrorism charges add risk

Trump floated a temporary US role; Rubio later walked it back

Oil slipped; Venezuela output under 1m bpd limits supply shock

Next macro focus Friday’s December jobs report; consensus +54k

EARNINGS

No noteworthy earnings scheduled this week.

WED: Albertsons $ACT ( ▼ 0.36% ), Jefferies $JEF ( ▲ 0.49% )

Constellation Brands $STZ ( ▲ 1.15% ) - $2.64 EPS (-18.8% YoY) on $2.16B revenue (-12.2% YoY)

THU:

Greenbriar $GBX ( ▲ 1.52% ) - EPS of 79 cents (-54.1% YoY) on $655.5M revenue (-25.2% YoY)

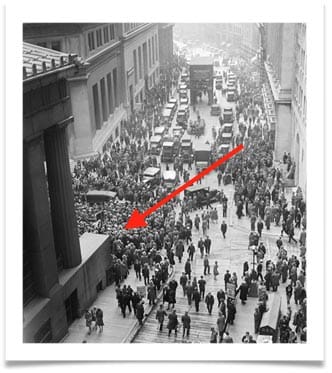

Take a Look at This Picture:

It's the New York Stock Exchange right after the 1929 crash.

But did you know …

A strange investment secret — discovered just a few short weeks before this image was taken — correctly predicted the crash?

Even crazier, this secret accurately called every major financial event in recent history …

Now, this secret is signaling something very scary is about to hit the stock market in 2026 …

- a sponsored message from Weiss Advocate -

HEADLINES

Stocks climb, oil volatile as investors assess Venezuela implications (more)

Wall Street carries big expectations after best run since 2009 (more)

Rubio touts US refineries' ability to process Venezuela's oil (more)

US pushes oil majors to invest big in Venezuela if they want to recover debts (more)

Dollar firms as traders look past Venezuela to flurry of US data (more)

Gold jumps on haven demand after Maduro (more)

Oil trades sideways despite political turmoil in Venezuela (more)

China’s BYD surpasses Tesla as world leader in electric car sales (more)

Emerging-market stocks set for record high on tech optimism (more)

2026 set to be a bumper year for M&A, IPOs (more)

DEALFLOW

M+A | Investments

None listed today.

VC

CHAMP Titles, Inc., a provider of digital solutions to motor vehicle agencies, raised $55M in funding

Biobeat Technologies, a blood pressure monitoring startup, closed $50M Series B funding

Vyriad, Inc., a clinical-stage biotech company developing targeted genetic therapies for cancer, closed a $25M Series B tranche

Dazzle AI, a company on a mission to close the gap between what people want and what they can do with AI, raised $8M in Seed funding

CRYPTO

BULLISH BITES

🇻🇪 Why the US went after Maduro.

🎉 A banner year for markets in 2025.

🤖 CES 2026: All the latest from the biggest tech show.

🛍 Inside Saks Fifth Avenue's fight for its life.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.