Good morning.

The Fast Five → Gold, silver have best year since 1979, Alphabet to buy data center partner in $4.75B deal, Ellison ups ante in WBD battle, bond traders’ bet big, and Jim Beam closing Kentucky distillery…

📌 Will you potentially make money or lose money in the US stock market in 2026? According to the 50-year legend who invented one of Wall Street’s most popular buying and selling indicators – the answer has nothing to do with AI, quantum computing, or cryptos. Instead, it all comes down to the #1 stock he recommends you BUY now…And the #1 stock he recommends you SELL now. (ad)

Calendar: (*Shutdown may affect key data. All times ET) - Full Calendar »

Today:

ADP Employment (tentative)

Prelim GDP, 8:30A

Tomorrow:

Unemployment Claims, 8:30A

Your 5-minute briefing for Tuesday, Dec 23:

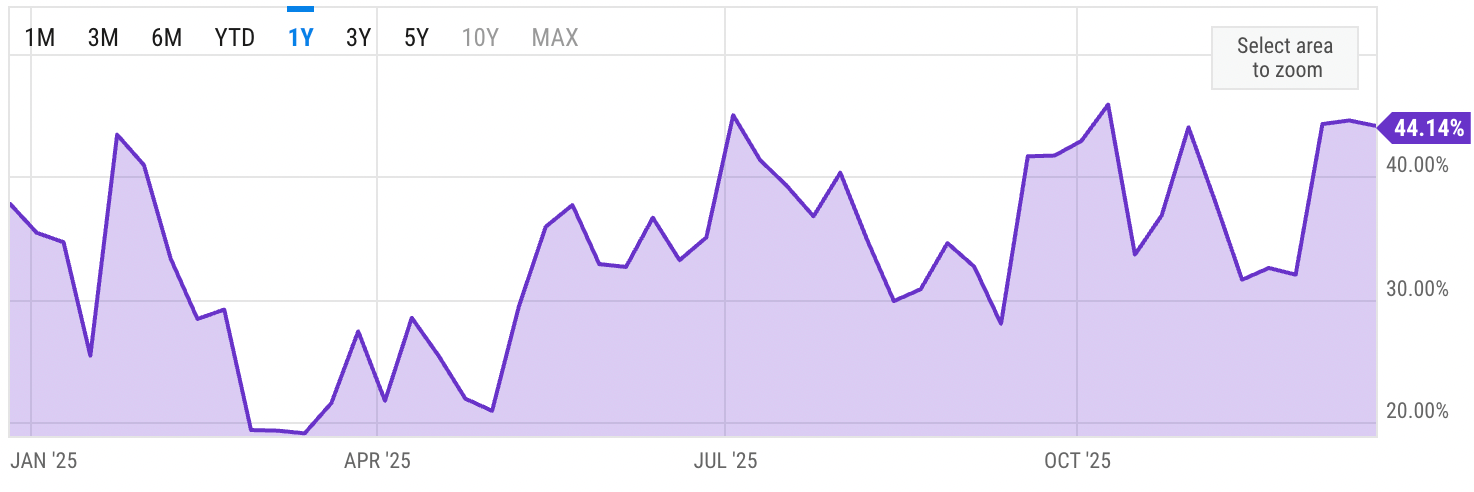

US Investor % Bullish Sentiment:

↓ 44.14% for Week of DEC 18 2025

Previous week: 44.59%

Market Wrap:

Futures near flat after strong holiday-week start

Dow -9; S&P flat; Nasdaq +0.1%

S&P posts 3rd straight gain; Nvidia +1.5%

10 of 11 sectors higher; materials, financials led

Gold, silver hit records; miners jumped

Dow +0.5%, Nasdaq +0.5%

EARNINGS

No noteworthy earnings scheduled this week.

A MESSAGE FROM THE CHAIKIN ANALYTICS

Wall St Legend Names #1 Stock of 2026

It's a bold new recommendation from one of the boldest men to ever rule Wall Street.

His award-winning stock-rating system has pinpointed 8 of the top 10 stocks of the year every year for nearly a decade. (An 80% hit rate.)

His last recommendations shot up 100% and 160%.

And now he says this single ticker (not NVDA, TSLA, or any of the Mag 7) could double your money or MORE in the next 12 months.

I just sat down with him and got all the details, along with his top stock for the year ahead.

Kelly Brown

Host, Chaikin Analytics

- a message from Chaikin Analytics -

HEADLINES

Stocks kick off holiday week with 3rd day of gains (more)

US freezes five big offshore wind projects, shares dive (more)

US unveils plans for new ship under Trump's 'golden fleet' bid (more)

Bond traders’ big bet targets US 10-year back to 4% within weeks (more)

US economic growth likely remained strong in third quarter (more)

AI spending spree drives global tech debt issuance to record high (more)

Larry Ellison ups ante in WBD battle with $40B guarantee (more)

Nvidia to begin H200 chip shipments to China by mid-February (more)

Novo surges after winning US approval for weight-loss pill (more)

FanDuel, CME Group launch prediction markets in five US states (more)

Jim Beam closing Kentucky distillery for a year (more)

Saks weighs bankruptcy year after raising billions for turnaround (more)

BofA’s Moynihan says AI’s economic benefit is ‘kicking in more’ (more)

Thiel-backed bank set to double valuation to $4.35B (more)

Palmer Luckey's digital bank valued at over $4 billion (more)

DEALFLOW

M+A | Investments

Alphabet to acquire data center and energy infrastructure company Intersect

Trian-backed group to buy Janus Henderson for $7.4B

Coinbase acquires The Clearing Company in prediction market push

Samsung Biologics to buy US drug production facility from GSK for $280M

VC

No listings

CRYPTO

BULLISH BITES

💪 How Nvidia ruled another year.

🤑 The United States of Klarna.

🎙 Netflix is betting on podcasts to become the new daytime talk show.

🎁 Gift Guide: 100+ holiday gift ideas for the person who has everything.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.