Good morning.

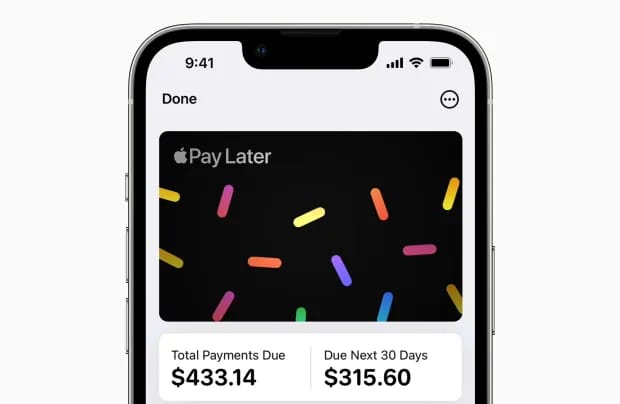

The Fast Five → S&P 500 hits 30th record of 2024, Apple shutting down Pay Later loans, GameStop sinks after annual shareholder meeting fails to deliver, US sues Adobe for hiding fees, and IRS to raise $50 billion by closing loophole exploited by wealthy…

Calendar: (all times ET)

Today: | US retail sales, 8:30a |

WED, 6/19: | MARKET CLOSED (Juneteenth) |

THU, 6/20: | Initial jobless claims, 8:30a |

FRI, 6/21: | Existing home sales, 10:00a |

Your 5-minute briefing for Tuesday, June 18:

US Investor % Bullish Sentiment:

↑ 44.59% for Wk of June 13 2024 (Last week: 38.97%)

Market Recap:

S&P +0.77%, Nasdaq +0.95% - seventh weekly gain in eight weeks.

Dow added 188.94 points, snapping 4-day losing streak.

Tech led gains: Microsoft +1%, Apple +2%, Alphabet, Amazon, Meta higher.

Nvidia hit new high but closed lower; Broadcom up 5.4%.

Market momentum questioned despite gains.

Investors await May retail sales data Tuesday.

EARNINGS

Here’s what we’re watching this week:

Darden Restaurants (DRI) - earnings of $2.62 per share (+1.6% YoY) on $2.98B (+7.4% YoY)

Friday: Carmax (KMX)

Full earnings calendar here.

Download our Report: Profiting from Electric Vehicle (EV) Stocks!

Get Ready for the Impending Crisis: Are You Prepared?

HEADLINES

Fed Chair Powell scheduled for July 9 Senate Banking testimony (more)

Boeing CEO to tell US Congress planemaker's culture is 'far from perfect' (more)

Supreme Court to hear Nvidia appeal of crypto sales lawsuit (more)

IRS to raise $50B by closing loophole exploited by the wealthy (more)

US sues Adobe for hiding fees, making it difficult to cancel (more)

US crude oil rallies more than 2% to top $80 per barrel, adding to last week’s gains (more)

China's housing market crash intensifies (more)

GameStop drops to session lows after annual meeting fails to offer details on firm’s strategy (more)

Apple extends rally with a record-breaking stock market value (more)

Berkshire Hathaway trims stake in Chinese EV maker BYD to 6.9% (more)

Ken Fisher’s fortune to more than double on private equity sale (more)

'Bond King' Bill Gross smashes several records in sale of rare stamp collection (more)

Trafigura agrees to pay $55 million to settle CFTC charges (more)

Nvidia's NEW "Silent Partners"

Many companies partnering with Nvidia have seen their own stocks go up …

That includes ASML, up as much as 471% …

Super Micro Computer, which has surged as much as 3,244%.

And Taiwan Semiconductor, which has soared as much as 4,744%.

With Nvidia now pivoting to a new $1 trillion AI superproject …

A new set of partners appear to be poised to benefit.

Find out who they are right away.

- sponsored message -

DEALFLOW

M+A | Investments

Primo Water and BlueTriton enter into merger agreement (more)

Carlyle completes purchase of Seattle women's soccer club (more)

GrubMarket, an AI-powered tech enabler and digital transformer for the food supply chain industry, acquired Parsemony, enterprise software services for food service suppliers (more)

Venezuela mulls proposal to extend PDVSA-Chevron oil joint venture through 2047 (more)

Finland’s Sampo to buy $4.7B valued Topdanmark (more)

Deutsche Bank buys €1.7B aviation loans from NordLB (more)

Seche Environnement to buy Singaporean hazardous waste firm ECO for $447M (more)

Evercoast, end-to-end 3D spatial video software, acquired Depthkit, a company specializing in volumetric capture (more)

Shift4, a company specializing in integrated payments technology, acquired a majority stake in Vectron Systems AG, a supplier of POS systems to the restaurant and hospitality verticals (more)

Clearhaven Partners, a software private equity firm, acquired Zixi, a cloud based and on-premises software-defined video platform (more)

Digits, an automated bookkeeping solution for startups, acquired Basis Finance, a budgeting and forecasting platform (more)

Qualus, a power services firm, acquired ASSET Engineering, a differentiated power engineering and consulting firm (more)

VC

Princeton Medspa Partners, a national medspa acquisition platform in medical aesthetics market, closed $120M in Growth financing (more)

Elion Therapeutics, a biotech company advancing the treatment of invasive fungal infections, closed a $81M Series B funding (more)

Princeton NuEnergy, a leader in lithium-ion battery direct recycling, closed a $30M Series A funding (more)

Tinybrid, a real-time data platform for data and engineering teams, raised $30M in Series B funding (more)

Constructor, an AI-powered product discovery and search platform for enterprise ecommerce companies, raised $25M in Series B funding, bringing the company’s valuation to $550M (more)

Autify, an AI platform for quality engineering, raised $13M in Series B funding (more)

Tender, a food tech startup, raised $11M in Series A funding (more)

Hona, a company specializing in client engagement software for law firms, raised $9.5M in Series A funding (more)

Valuebase, a provider of data-driven property valuations, raised $6.3M in Seed funding (more)

CRYPTO

BULLISH BITES

🤑 Rising up: How the US mopped up a third of global capital flows since Covid.

🚀 Next big bet: New AI Superproject could propel Nvidia to first $10 trillion company *

🔥 New trading: Why NYC’s hottest dining reservations will stay impossible to score.

⬆️ Surge: California's biggest utility expects power demand to double by 2040.

🍷 Next level: Chef James Kent saw the future of Wall Street dining.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.