Good morning.

The Fast Five → Bitcoin tanks to $60K, Strategy’s $12B loss headlines crypto’s worst day since ‘22 crash, WH launches direct-to-consumer drug site TrumpRx, Anthropic’s new model performs financial research, and investors hunt for bargains after ‘software‑mageddon’…

Calendar: Full Calendar »

Today:

Non-Farm Employment, 8:30A

Unemployment Rate, 8:30A

Monday:

None watched

Your 5-minute briefing for Friday, Feb 6:

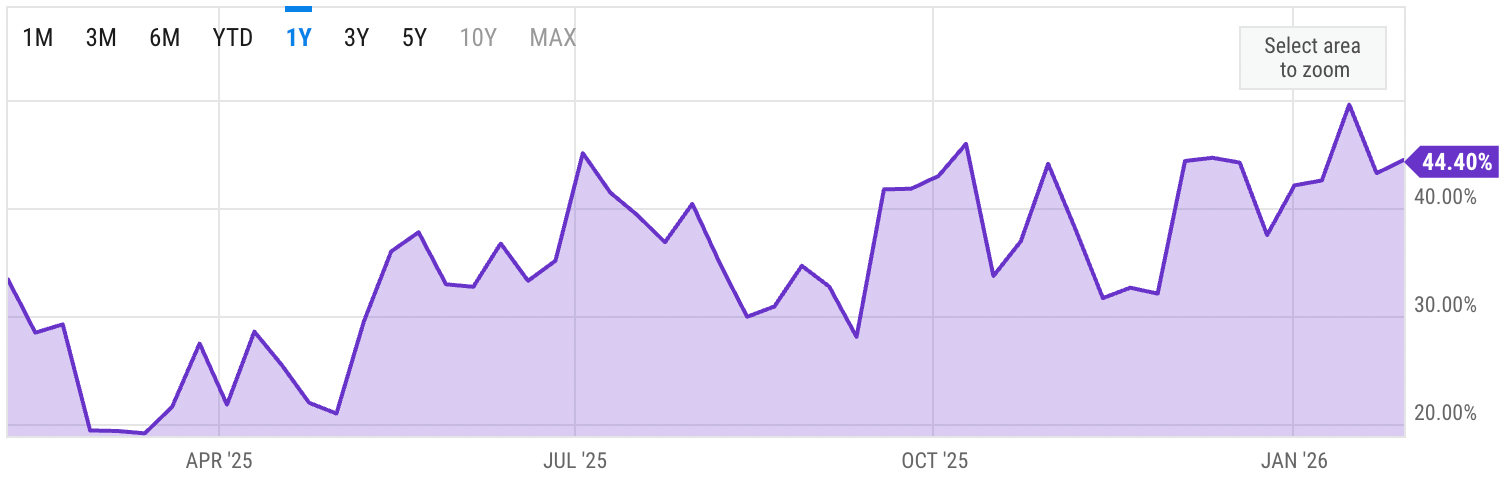

US Investor % Bullish Sentiment:

↓ 44.40% for Week of JAN 29 2026

Previous week: 49.50%

Market Wrap:

Futures slid Dow -168, S&P -0.6%, Nasdaq 100 -1.1%

Amazon plunged 11% after earnings and $200B capex guidance

Thursday sold off Dow/S&P -1.2% and Nasdaq -1.6%

Software rout deepened with IGV -5% and -11% on the week

Risk-off spread with bitcoin -16% and metals weak

EARNINGS

No earnings watched today. Full earnings calendar »

Is It Time to Sell Your Stocks?

Wall Street legend weighs in —

The warning signs were everywhere – even Wall Street’s own CEOs called for a selloff.

But before you sell a single stock, there’s something you need to see.

One of Wall Street’s longest insiders is stepping forward with his own market warning.

The last time he did this, retail investors went on to lose nearly 50% of their wealth.

- a message from Chaikin Analytics

HEADLINES

Wall Street ends sharply down as AI worries weighs (more)

Wall Street’s favorite trades collapse as market selloff deepens (more)

Investors hunt for bargains after ‘software‑mageddon’ (more)

Software rout is spreading pain to the debt markets (more)

White House launches direct-to-consumer drug site TrumpRx (more)

US jobless claims top all estimates in extremely cold week (more)

Companies announced most job cuts for any Jan. since 2009 (more)

Silver tumbles, oil drops in commodity sell-off (more)

Amazon’s $200B spending plan raises stakes in AI race (more)

Estée Lauder expects $100M tariff hit to profitability; stock sinks (more)

Reddit shares rise on reveals strong guidance, $1 bln buyback (more)

Roblox shares rocket on earnings beat, strong forecast (more)

Novo’s launch of weight-loss pill spoiled by Hims’ copycat (more)

AI arms race approaches IPO reckoning (more)

Rio walks away from Glencore mega merger on price impasse (more)

World Economic Forum opens probe into CEO over Epstein meetings (more)

DEALFLOW

M+A | Investments

KKR to buy Arctos in $1.4 bln deal

Littlejohn & Co. acquires 80/20

Savi acquires Fiducius

Magna5 receives majority investment from AEA Investors

LearnWell receives investment from Goldman Sachs Alternatives

VC

Cerebras Systems, an AI infrastructure company, raised $1 bln in Series H funding

Fundamental, an AI company building Large Tabular Model to drive predictions from enterprise data, raised $255M in Series A funding

Goodfire, a developer of interpretability tools for AI models, raised $150M in Series B funding

Connect Music, a music rights and tech company, raised $80M in funding

Accrual, an AI-native accounting platform, raised $75M in funding

Urban SDK, a provider of geospatial AI tech for local/state governments, raised $65M in growth funding

Turnstile, a quote-to-cash platform for sales startups, raised $29M in funding

Willie's Remedy+, a provider of THC-infused social tonics, raised $15M in Series A funding

Nullify, an AI workforce for product security, raised $12.5M in Seed funding

Pay With Spire, Inc., a modern Pay-by-Bank solution for everyday spend, raised $10M in Series B funding

Advance, a financial platform for insurance, raised $8.5M in Seed funding

SENAI, an online video intelligence platform, raised $6.2M in Seed funding

Flock AI, an AI-native visual commerce platform, raised $6M in Seed funding

Feltsense, an AI agent services company, raised $5.1M in Seed funding

CRYPTO

BULLISH BITES

🏆 The AI boom's surprising winners aren't even tech companies.

🗞 The WaPo wipeout.

💔 Divorce, hedge-fund style: Inside the breakup at Two Sigma.

🍑 Minute Maid puts frozen juice on ice after 80 years.

DAILY SHARES

Have feedback or a suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.