Good morning.

The Fast Five → The Dow climbs to a record 40,000 points, Dimon and Dalio sound the alarm on soaring US debt, Reddit inks deal with OpenAI, Biden signs sweeping aviation safety reform bill into law, and GameStop and AMC extend slump…

Calendar: (all times ET)

Today: | US leading economic indicators, 10:00a |

Your 5-minute briefing for Friday, May 17:

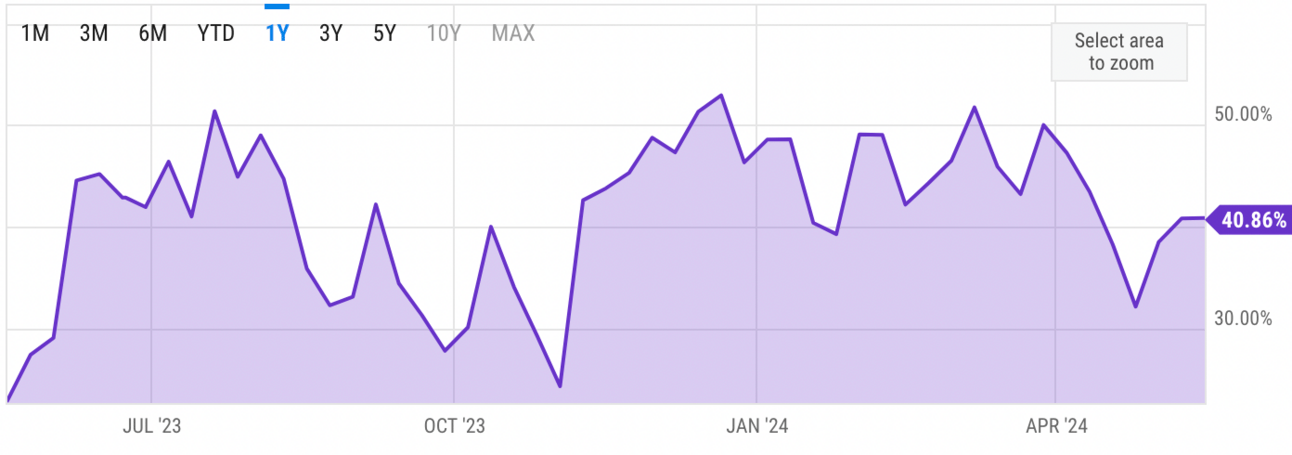

US Investor % Bullish Sentiment:

40.86% for Wk of May 16 2024 (Last week: 40.82%)

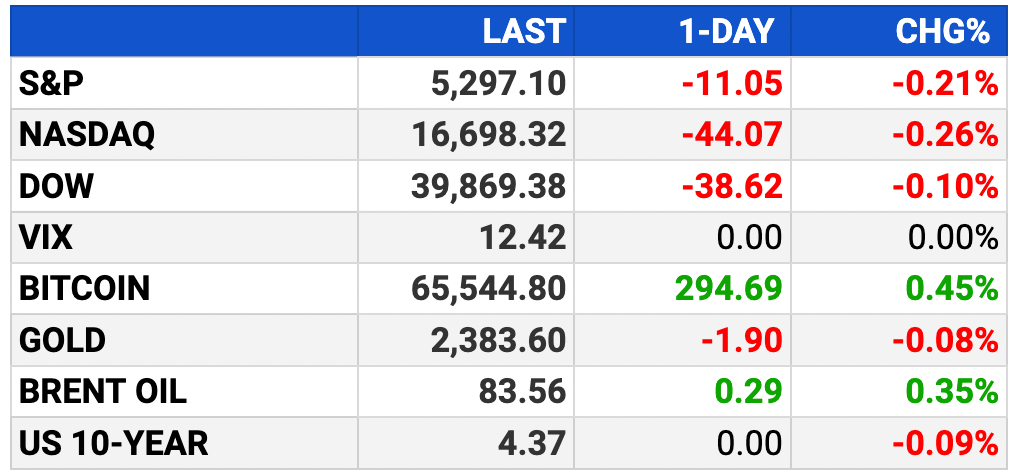

Market Recap:

Dow briefly hit 40,000, S&P fell 0.21%, Nasdaq dropped 0.26%

Both indexes hit records during the session.

Walmart led gains, up nearly 7% on strong Q1 results.

Rally fueled by rate cut hopes and AI enthusiasm; first Fed cut expected in September.

Tech stocks like Amazon (+20%), Meta, and Nvidia are up sharply YTD.

EARNINGS

Full earnings calendar here

HEADLINES

The Dow's climb to a record 40,000 points (more)

Biden signs sweeping aviation safety, reform bill into law (more)

House passes TICKET Act in push for event pricing transparency

(more)

US labor market fairly tight, broader economy losing steam (more)

Commercial real-estate investors run for the exits (more)

IMF says US should keep open trade, work with China to resolve disputes (more)

China consumption slows as retail sales and investment data disappoint (more)

China announces sweeping steps to stabilise property sector (more)

After Adobe collapse, Figma deal allows employees to sell shares at $12.5B valuation (more)

Wayfair to open its first large store, as physical locations make a comeback (more)

GameStop and AMC extend slump as meme-fueled rally unravels (more)

Renaissance Technologies piled Into GameStop, AMC ahead of rally (more)

Affluent consumers are creating a ‘bubble’ at Walmart, warns retailer’s former CEO (more)

Reality TV stars charged in UK crackdown on 'finfluencers' (more)

Green Bitcoin Miner Disrupts Industry Forever

This $1 Crypto Stock stands to benefit most from substantial regulatory changes.

It’s using 100% renewable energy and is producing bitcoin CHEAPER* than industry whales.

The secret sauce?

Subscribe to Bullseye Trade to learn more.

DEALFLOW

M+A | Investments

Johnson & Johnson to acquire Proteologix for $850M (more)

Snowflake in talks to buy Reka AI for $1 billion (more)

Sabadell rejected BBVA bid over capital impact, costs savings (more)

GSK to sell remaining $1.6B stake in Haleon (more)

Nippon Life exploring more deals after Corebridge (more)

Avathon Capital acquired Summit Professional Education, a provider of continuing education courses for physical therapists (more)

Quantic Electronics, an electronic component company, acquired M Wave Design, supplier of ferrite-based RF and microwave components for aerospace, quantum computing applications (more)

Handdii Holdings, a digital property claims company, received an investment from Johns Lyng Group (more)

VC

Vercel, a frontend cloud platform, raised $250M in Series E funding, at a valuation of $3.25B (more)

Sigma, a provider of a cloud analytics solution built natively for cloud scale, raised $200M in Series D funding (more)

CinDome Pharma, a company that advancing a safe, chronic therapy for gastroparesis, raised $40M in Series B extension funding (more)

Agora, a provider of real estate investment management solutions, raised $34M in Series B funding (more)

Voxel51, a visual AI company, raised $30M Series B funding (more)

Fay, a company connecting people with registered dietitian nutritionists, raised $25M in funding (more)

Aeropay, a provider of Pay-By-Bank solutions for businesses, raised $20M in Series B funding (more)

Watershed Health, a company driving patient care coordination across the healthcare ecosystem, raised $13.6M in funding (more)

Gamma, a provider of an AI powered presentation platform, raised $12M in Series A funding (more)

Honey Homes, a membership service delivering complete home upkeep and maintenance, raised $9.25M in Series A-1 funding (more)

Bedrock Materials, a battery technology startup launched out of Stanford University in 2023, raised $9M in Seed funding (more)

Phenomix Sciences, a biotech company bringing data intelligence to the treatment of obesity, raised $7.8M in funding (more)

Laws of Motion, a provider of AI sizing technology for eCommerce brands and retailers, raised $5M in seed funding (more)

Sine Digital, an independent performance marketing agency, raised $2.5M in Seed funding (more)

c/side, a cybersecurity company that secures vulnerable browser-side third-party scripts, raised $1.7M in Pre-Seed funding (more)

CRYPTO

BULLISH BITES

⛲️ Iconic: The Mirage in Las Vegas is closing after 34 years.

🚨 Crypto alert: Trigger event to send this Altcoin soaring... *

💻 Rivalry: The Mac vs. PC war is back on.

🎥 Watch: Palmer Luckey wants to be Silicon Valley's war king.

⏱ Masterpiece: The most complicated watch in the world.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.