☕️ Good morning.

The Fast Five → S&P 500 inches closer to all-time high, Apple resumes watch sales after appeals court lifts ban, the late-night email sent to Tim Cook that started Apple watch saga, Maersk reroutes dozens of vessels via Suez Canal, and SPAC mania’s ugly end yields $46B in investor losses…

Your 5-minute briefing for Thursday:

BEFORE THE OPEN

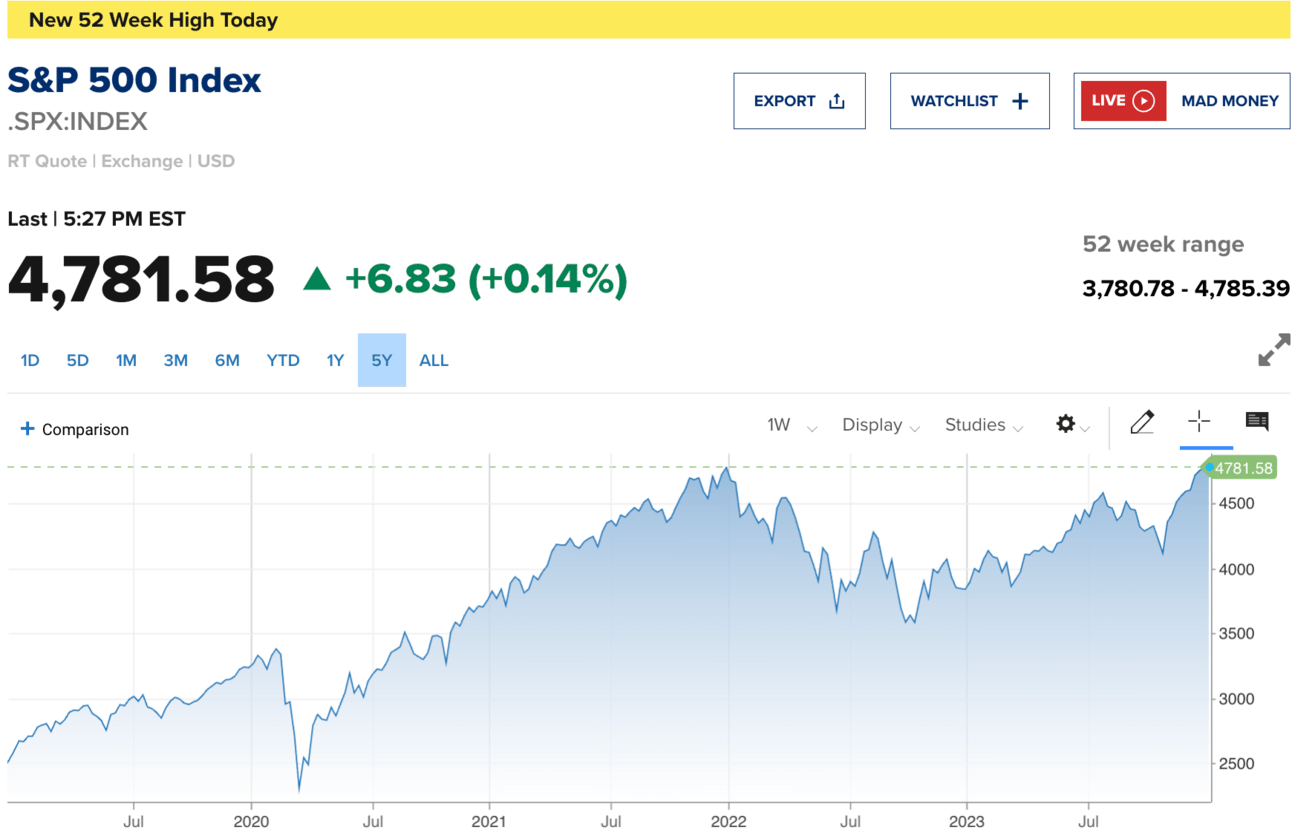

As of market close 12/27/2023.

MARKETS:

Stocks close higher with S&P 500 edging closer to record levels.

Dow reaches a new closing high.

S&P 500 nears its January 2022 closing record, enjoying an eight-week winning streak.

2023 marks strong gains: Dow up 13%, S&P 500 up 24%, and Nasdaq up 44%, its best year since 2003.

"Santa rally" in effect, historically averaging a 1.3% gain during this period.

Caution on over-optimism and potential disappointment if Fed delays rate cuts.

Market frothiness seen, 90% of S&P 500 stocks above 50-day moving average.

Overexcitement in bullish sentiment data raises concerns of unexpected setbacks.

EARNINGS

The earnings calendar is bare between Christmas and New Year's, picking back up the first week of January with Walgreens Boots Alliance (WBA) among the handful of names reporting.

In the following week (January 8-12), major banks will take the spotlight as the fourth-quarter earnings season begins. Stay tuned for our earnings outlook in next week's briefing.

Full earnings calendar here

HEADLINES

Economists say recession unlikely in 2024, according to survey (more)

SPAC mania’s ugly end yields $46 billion of investor losses (more)

US bond bulls look to 2024 Fed pivot to sustain searing rally (more)

Wall St wavers heading into year end due to lack of catalysts (more)

US short-term financing rate spikes as dealers close books for 2023 (more)

Two U.S. Senators call for Tesla recalls after Reuters investigation (more)

Oil drops almost 2% as investors watch Red Sea developments (more)

London gold price benchmark breaks all-time high (more)

Maersk schedules dozens of vessels to travel via Suez Canal (more)

Apple resumes sale of watches after appeals court lifts US ban (more)

Chinese carmaker overtakes Tesla as world’s most popular EV maker (more)

Tesla deliveries to hit record, but fall short of Musk's aspirations (more)

New York Times sues Microsoft, ChatGPT maker OpenAI over copyright infringement (more)

Online retailer Zulily is shutting down (more)

Generative AI’s breakout year produced hefty profits for Nvidia, lofty experiments for others (more)

Bitcoin’s 2023 rally drove some of the stock market’s biggest gains this year (more)

TOGETHER WITH IBD’s MARKETSMITH

The most powerful platform available.

Some call it the ‘affordable’ Bloomberg Terminal. Why?

Because with IBD’s MarketSmith, you'll have access to the same resources and insights as a professional stock market analyst, but at a fraction of the cost. MarketSmith also allows you to streamline your research by consolidating all of the information you need into a single window.

Get smarter trade ideas, analyze them quickly and see when to buy and sell, all in one platform.

🔥 MarketBriefing Exclusive → Get 6-Weeks now for just $49.95 (that’s HALF-OFF the regular price for MB readers!) — so if you’ve ever wanted to give MarketSmith a try, now’s your chance! (limited-time offer)

DEALFLOW

M & A | INVESTMENTS

Mavericks’ $3.5B sale to Adelson wins NBA approval (more)

Williams to buy natural gas storage assets for $1.95B (more)

Pavlov Media, a nationwide telecommunications company, acquired Ohibroadband service provider iZone Broadband, and Inspire Wi-Fi, a wireless provider for leasing offices, clubhouses and amenity areas (more)

Avnan Capital purchases Allied Components (more)

Williams buys Gulf Coast Natural Gas Portfolio (more)

Eli Lilly completes acquisition of POINT Biopharma (more)

Bruker acquires ELITech from PAI Partners (more)

Was this briefing forwarded to you? Sign Up Here

CRYPTO

Ether rallies 6% in catch-up trade as investors position for January (more)

MicroStrategy buys bitcoin worth $615.7 mln ahead of SEC's spot ETF decision (more)

Crypto hedge funds gear up for ‘token mania’ after 2023 rebound (more)

'Smart money' is record long on BTC ahead of expected Bitcoin ETF (more)

BULLISH BITES

⚖️ Balancing act: These 5 charts show how life got pricier, but also cheaper, in 2023.

🦾 Robo-labor: BotBuilt wants to lower the cost of homebuilding with robots.

👎 Haters: 49% of Americans dislike tech billionaires, but still want to be like them—here’s why…

💸 It adds up: Beware AI’s hidden costs before they bankrupt innovation.

🔥 Exclusive: Get smarter trade ideas, analyze them quickly and see when to buy and sell — all in one platform. IBD’s MarketSmith give you access to the same resources and insights as a professional stock market analyst, but at a fraction of the cost. Try 6-Weeks now for just $49.95 (limited time)

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

Disclaimer: MarketBriefing is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the MarketBriefing team2/26