Good morning.

The Fast Five → DOJ mulls Google breakup push, Starbucks orders a new CEO at Chipotle, US producer inflation slows, today’s CPI expected to hold steady, and UAW accuses Trump, Musk of trying to intimidate workers…

🚀 Early Investors Alert: Key Defense Stock Could Soar »

- a message from Simmy Adelman, BTM

Yesterday’s Poll: Should a president influence Fed policy?

🟩🟩🟩🟩🟩🟩 NO (71%)

🟨🟨⬜️⬜️⬜️⬜️ YES (29%)

Your comments:

NO: “FED MUST REMAIN FREE FROM POLITICAL INTERFERENCE!”

YES: “President should have something to say about Fed policy.”

NO: “One more step towards the end of democracy.”

NO: “A president shouldn’t have the time to study markets enough to make an informed decision. Therefore any decision they make would be political.”

Calendar: (all times ET) - Full calendar here

Today: Consumer price index (CPI), 8:30 AM

Tomorrow:

Initial jobless claims, 8:30 AM

US retail sales, 8:30 AM

Business inventories, 10:00 AM

Your 5-minute briefing for Wednesday, August 14:

US Investor % Bullish Sentiment:

↓40.54% for Wk of August 08 2024

Last week: 44.88%. Updates every Friday.

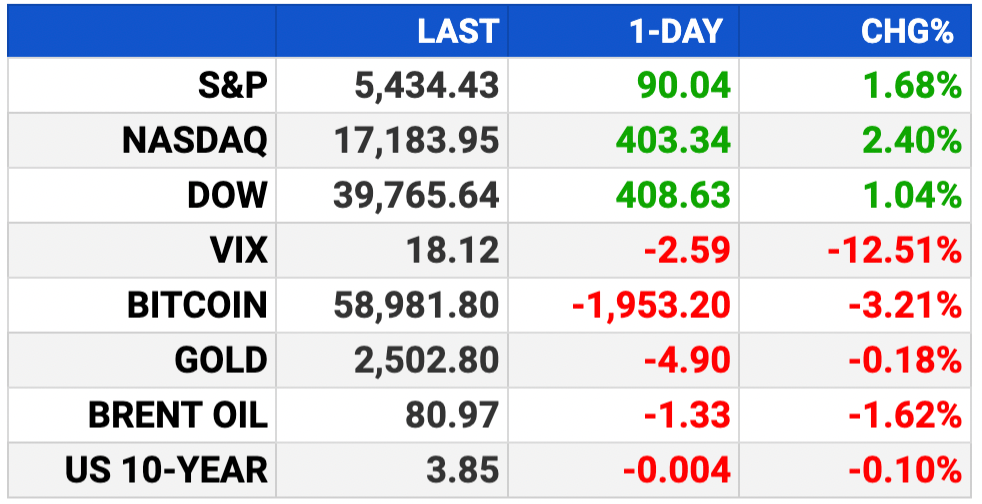

Market Wrap:

Stock futures flat after Tuesday’s rally.

Tuesday: Dow up 400+, S&P +1.7%, Nasdaq +2.4%.

Averages above pre-sell-off levels, but rapid rebound worries some.

Cooler PPI inflation; CPI report next could impact trading.

Concerns remain over a softening labor market.

EARNINGS

Here’s what we’re watching this week:

Cisco (CSCO) - analysts predict a 21.3% drop in earnings to $.85 per share on $13.5B revenue (-6.3% YoY)

Walmart (WMT) - earnings of $.64 per share (+14.3% YoY) on $168.5B revenue (+4.3% YoY)

Full earnings calendar here.

TOGETHER WITH BEHIND THE MARKETS

As Tensions Rise

Between China and Taiwan...

So does the potential of this conflict spreading to the United States.

The scary part: The US Military has already run a series of highly classified war games...

And in every possible scenario we lose.

That's why the US military is desperate to upgrade our weapons for 21st century warfare.

Which opens up an incredible opportunity for early investors.

One tiny defense firm just won a groundbreaking US military contract...

That could hand early investors gains of up to 35,960%.

Simmy Adelman, Publisher

Behind the Markets

- sponsored message -

HEADLINES

US producer inflation slows as pricing power diminishes (more)

CPI expected to hold steady in July as investors eye rate cuts (more)

Trump, Harris duel for voters with tax proposals (more)

Goldman, JPMorgan say markets pricing in higher recession odds (more)

Oil rises after industry report points to US stockpile drawdown (more)

Asia markets continue winning run as US PPI rises less than expected (more)

UAW accuses Trump, Musk of trying to intimidate workers in labor complaints (more)

Google launches first AI-powered Android update and new Pixel 9 phones (more)

Nvidia’s rebound added over $420M to its market value in four days (more)

Elliott readies Southwest proxy fight with up to 10 directors (more)

Intel sells stake in chip designer Arm Holdings (more)

DEALFLOW

M+A | Investments

Japan's Meiji Yasuda Life to buy American Heritage Life for $2 bln (more)

Allstate to sell its employer voluntary benefits business to StanCorp Financial in $2 bln deal (more)

Tilray to buy four craft breweries from Molson Coors (more)

Blackstone weighs sale of $2.6B events group Clarion (more)

Carlyle to buy Baxter's kidney-care spinoff Vantive for $3.8B (more)

Collective Audience, Inc., an innovator of performance advertising and media, acquired MarTech and AdTech company BeOp (more)

Experian, a global data and technology company, acquired NeuroID, a company specializing in behavioral analytics (more)

Rural Healthcare Group, a primary care provider, acquires Steward Medical Group and Steward Health Care Network (more)

NewBold Corporation, a provider of managed technology services to the quick service industries, received an investment from Fort Point Capital (more)

Shinkong Synthetic Fibers Corporation, a global leader in polyester production, has invested $10M in Ambercycle's first commercial facility (more)

VC

Sepio, a physical layer-based asset risk management solution, received an investment extending its Series B funding (more)

PayZen, a fintech company tackling healthcare affordability via AI-powered solutions, raised $232M in Series B funding (more)

Voltera, an operator of charging infrastructure for zero-emission vehicle fleets, secured a $100M debt facility (more)

Guidewheel, an AI platform that enabling factories to reach sustainable peak performance, raised $31M in Series B funding (more)

Setpoint, an infrastructure provider for the credit industry, raised $31M in Series B funding (more)

ITpipes, a provider of pipeline inspection software, raised $20M in funding (more)

MD Ally, a leader in 911 diversion, care, and navigation solutions, closed a $14M Series A funding round (more)

Pelage Pharmaceutical, a clinical-stage regenerative medicine company focused on hair loss, raised $14M in Series A-1 funding (more)

ArborXR, an enterprise-grade extended reality mobile device for enterprise companies and solutions providers, raised $12M in funding (more)

Livly, a provider of technology-driven residential management platforms, raised $10M in funding (more)

Ragie, a platform enabling developers to build AI applications connected to their own data, raised $5.5M in funding (more)

Tedu, an EdTech company, raised $2M in Seed-1M in funding (more)

CRYPTO

BULLISH BITES

💼 Inside Look: What Kamala Harris would mean for business.

📲 Reveal: Everything Google announced at the Pixel 9 launch event.

🤖 Futuristic: We’re entering an AI price-fixing dystopia.

🎡 No Lines: US theme parks are emptier as costs surge and travelers go global.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.