Good morning.

The Fast Five → Biden hikes tariffs on an array of Chinese imports, China vows to take ‘all necessary actions’ in response to tariffs, the meme stock revival continues, DOJ finds Boeing breached prosecution deal, and Alphabet unveils beefed-up AI search and chatbot…

Have a wild meme stock story? Hit reply and tell us about it.

Calendar: (all times ET)

Today: | Consumer price index (CPI), 8:30a |

THU, 5/16: | Initial jobless claims, 8:30a |

Your 5-minute briefing for Wednesday, May 15:

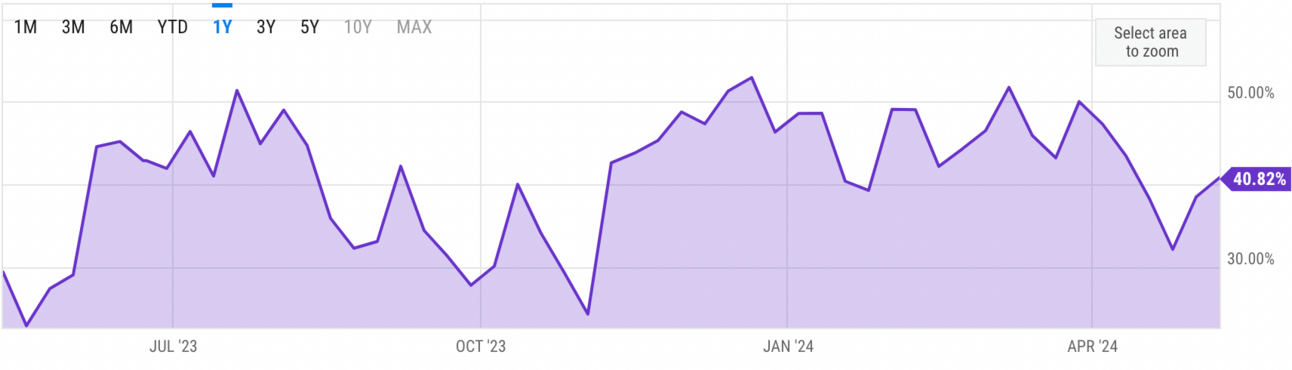

US Investor % Bullish Sentiment:

40.82% for Wk of May 09 2024 (Last week: 38.49%)

Market Recap:

Stock futures flat as Wall Street awaits April CPI.

Nasdaq +0.75% to record close; S&P 500 +0.48%, Dow +0.32%.

April CPI expected: +0.4% monthly, +3.4% yearly.

March PPI +0.5%, delaying Fed rate cuts.

Easing in housing, auto insurance may help.

Retail sales, Empire State manufacturing, housing index due.

Cisco Systems earnings after the bell.

EARNINGS

What we’re watching this week:

Today: Monday.com (MNDY)

Cisco Systems (CSCO) - earnings of $.77 (-23% YoY) on $11.6B (-20.5% YoY)

Thursday: Deere (DE)

Walmart (WMT) - earnings of $.53 on $159.4B (+4.7% YoY)

Full earnings calendar here

HEADLINES

Powell maintains wait-and-see posture on inflation, rates (more)

S&P gets close to all-time high before key CPI (more)

Traders pare bets on Sept start to Fed rate cuts (more)

China vows to take ‘all necessary actions’ in response to tariffs (more)

Asian stocks to follow US rally with focus on CPI (more)

Credit card delinquencies are increasing (more)

Boeing breached prosecution deal, Justice Dept finds (more)

Alphabet unveils beefed-up AI search and chatbot as competition heats up (more)

GameStop’s stock surge continues, punishing short sellers (more)

OpenAI co-founder and Chief Scientist Ilya Sutskever is leaving the company (more)

TikTok creators sue US govt, say divestiture law violates First Amendment (more)

Sony rethinking its bid for Paramount (more)

Anglo American gives BHP the blueprint for a takeover (more)

De Beers spinoff comes at a troubled time for diamond market (more)

TOGETHER WITH THE RUNDOWN AI

Keep up with AI

How do you keep up with the insane pace of AI? Join The Rundown — the world’s largest AI newsletter that keeps you up-to-date with everything happening in AI, and why it actually matters in just a 5-minute read per day.

DEALFLOW

M+A | Investments

Verizon wants to buy back Los Angeles stake from US Cellular (more)

Repsol in talks to sell a slice of its renewable business (more)

KKR to take UK's IQGeo private in $396M deal (more)

Shore Capital-backed Sweetmore acquires Sweet Eddie’s (more)

GitKraken, a developer tooling company, acquired CodeSee, a based code health innovator (more)

Goldman Sachs’ Petershill invests in Pennybacker (more)

FalconPoint makes inaugural investment with Jennmar (more)

VC

Harness, a modern software delivery platform company, raised $150M in financing (more)

SmarterDx, a company specializing in clinical AI for revenue integrity and care quality, raised $50M in Series B funding (more)

Steno, a provider of legal support and court reporting services powered by AI, raised $46M in additional funding (more)

Brixton Biosciences, a life sciences company developing novel therapies for chronic pain, raised $33M in Series B funding (more)

Gorgias, a provider of a customer experience (CX) platform, raised $29M in funding (more)

Sona, a London, an intelligent workforce management platform for frontline enterprises, raised $27.5M in Series A funding (more)

Artisan AI, a startup building AI employees and software for enterprise companies, raised $7.3M in Seed funding (more)

Switchboard Health, creator of a high-value specialty care network and software platform, raised $6.5M in seed funding (more)

Monitaur, a model governance software company, raised $6M in Series A funding (more)

Plenty, provider of a wealth-building platform that helps couples invest and plan for their future, raised $5M in funding (more)

Roam, provider of a platform for assumable mortgages, raised $3M in additional funding (more)

CRYPTO

Bitcoin-proxy MicroStrategy added to key MSCI World Stock Index (more)

Vitalik's Ethereum wallet proposal, scribbled in 22 minutes, gets positive reviews (more)

Galaxy’s Novogratz sees Bitcoin stuck in $55K to $75K range for now (more)

State of Wisconsin buys nearly $100M worth of BlackRock spot Bitcoin ETF (more)

BULLISH BITES

🤖 Google I/O 2024: Here’s everything Google just announced.

😺 Roaring Kitty: Who is he and why is he causing a GameStop stock surge?

🚀 Soaring demand: This weight loss company can't make enough product. *

📉 Teen MLM: How the ‘Harvard of trading’ ruined thousands of young people’s lives.

💣 Biz killer? Web publishers brace for carnage as Google adds AI answers.

Are You Prepared for the Death of the Dollar?

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.