Good morning.

The Fast Five → China unleashes stimulus blitz in push to hit growth goal, Boeing makes ‘final’ offer to striking machinists, Tesla's stock is leading S&P 500 gainers, Fed officials leave door open to another large cut, and Trump threatens ’200% tariff’ if John Deere moves production to Mexico…

📈 Nvidia is Pivoting to Solve Big Tech’s $1 Trillion Problem » *

A message from Weiss Research

Calendar: (all times ET) - Full calendar here

Today: Consumer confidence, 10:00 am

Tomorrow: New home sales, 10:00 am

Your 5-minute briefing for Tuesday, September 24:

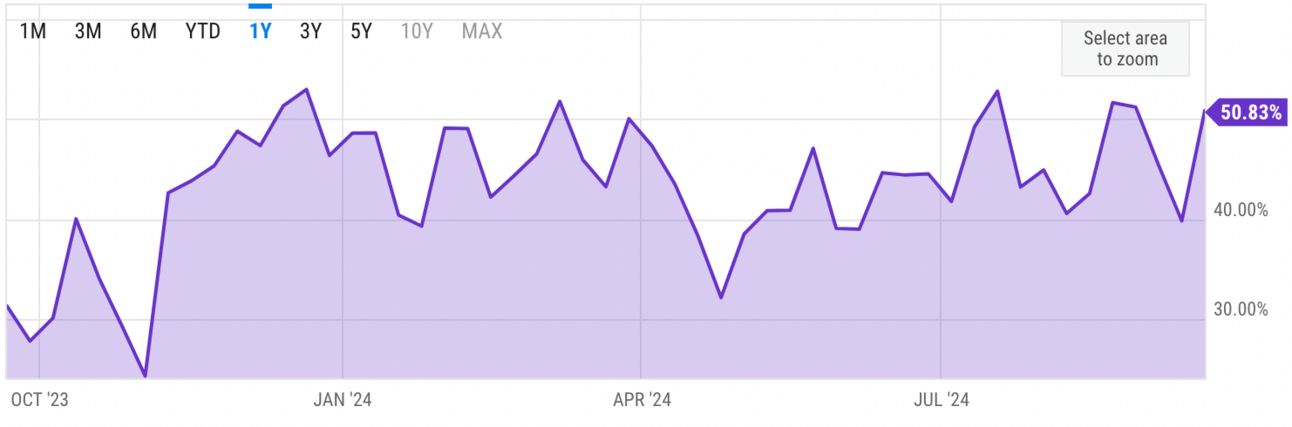

US Investor % Bullish Sentiment:

↑ 50.83% for Week of September 19 2024

Last week: 39.80%. Updates every Friday.

Market Wrap:

S&P hit new high, up 0.28%. Dow +61 points. Both closed at records.

Nasdaq gained 0.14%.

Stocks rallied after Fed's 50 bps rate cut.

US manufacturing hits 15-month low in August.

Jobless claims data on Thursday could offer more economic insight.

Concerns about labor market trends and volatility remain.

EARNINGS

Here are the earnings we’re watching this week.

Today: KB Home (KBH)

Wednesday: Jefferies (JEF)

Micron Technology (MU) - earnings of $1.13 per share (vs a per-share loss of $1.07 in the year-ago period). Revenue of $7.6B expected (+90% YoY)

Costco Wholesale (COST) - earnings of $5.08 per share (+4.5% YoY) on $79.9B revenue (+1.3%)

Friday: [none watched]

See full earnings calendar here.

HEADLINES

Stocks climb, euro falls; Fed officials say large rate cut was warranted (more)

Fed officials leave door open to another large interest-rate cut (more)

Money markets shy away from longer-term T-bills despite rate cut (more)

US companies raising billions in debt markets after rate cut (more)

KKR, Blackstone execs tout Japan as next big opportunity (more)

Trump threatens ’200% tariff’ if John Deere moves production to Mexico (more)

Nippon Steel's Mori asks USW leadership to 'come to the table' (more)

Tesla's stock is leading S&P 500 gainers on optimism for delivery report (more)

Trump Media tumbles to new lows after insider selling restrictions expire (more)

Southwest Airlines tells staff ‘difficult decisions’ ahead (more)

GM’s EV sales momentum finally building as new lineup fills out (more)

Visa faces DOJ antitrust case on debit cards (more)

A MESSAGE FROM WEISS RESEARCH

Nvidia's Quiet Trillion-Dollar Pivot

Nvidia and its powerful chips are the face of artificial intelligence.

But while everyone’s patting Nvidia on the back for record earnings…

It’s quietly moved on to the next phase of AI it plans to conquer…

Nvidia recently unveiled essential blueprints for this crucial $1 trillion pivot.

Click here now and find out about the three companies Nvidia absolutely needs to succeed in this vital new AI frontier.

- sponsored message -

DEALFLOW

M+A | Investments

VC

GC Therapeutics, a biopharmaceutical company advancing cell therapy-based medicines, raised $65M in Series A funding (more)

Pyka, an electric aviation tech leader in large-scale autonomous electric aircraft, raised $40M in Series B funding (more)

MetOx Int'l, a developer and manufacturer of high-temperature superconducting wire, raised $25M in Series B extension funding (more)

David Energy, a gridtech company, raised $23M in funding (more)

HavocAI, a company specializing in autonomous uncrewed surface vessel technology, raised $11M in Seed funding (more)

Permissionless Labs, the primary contributor of Pipe Network, a permissionless content delivery network on Solana, raised $10M in Series A funding (more)

arqu, a tech-enabled wholesale insurance brokerage company, raised $10M in Series A funding (more)

CRYPTO

Drop in Bitcoin dominance and bullish altcoin market structure have traders predicting altseason (more)

BlackRock Bitcoin ETF options to set stage for GameStop-like 'Gamma Squeeze' rally, Bitwise predicts (more)

Crypto’s correlation with US stocks nears record in Fed fallout (more)

US SEC, Coinbase clash in court over crypto rulemaking (more)

BULLISH BITES

🚀 Next Big Wave: A massive $1 Trillion AI superproject is underway *

🐂 Bullish: John Rogers on the art of security selection.

👟 Pursuits: How Foot Locker is waging a comeback after its breakup with Nike.

🛒 Attn Kmart shoppers: The last full-size Kmart in the United States is closing.

🤦🏻♂️ Yikes: Sam Altman catapults past founder mode into ‘God mode’ with latest AI post.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.