Good morning.

The Fast Five → Yellen launches contentious economic meetings with China, Ford postpones rollout of new EVs as demand wanes, bipartisan $78B tax deal hits GOP roadblock, silver prices settle near a three-year high, and Alphabet reportedly weighing offer for HubSpot (a strange pairing)…

Calendar: (all times ET)

Today: | Unemployment rate, 8:30am |

Your 5-minute briefing for Friday, April 5:

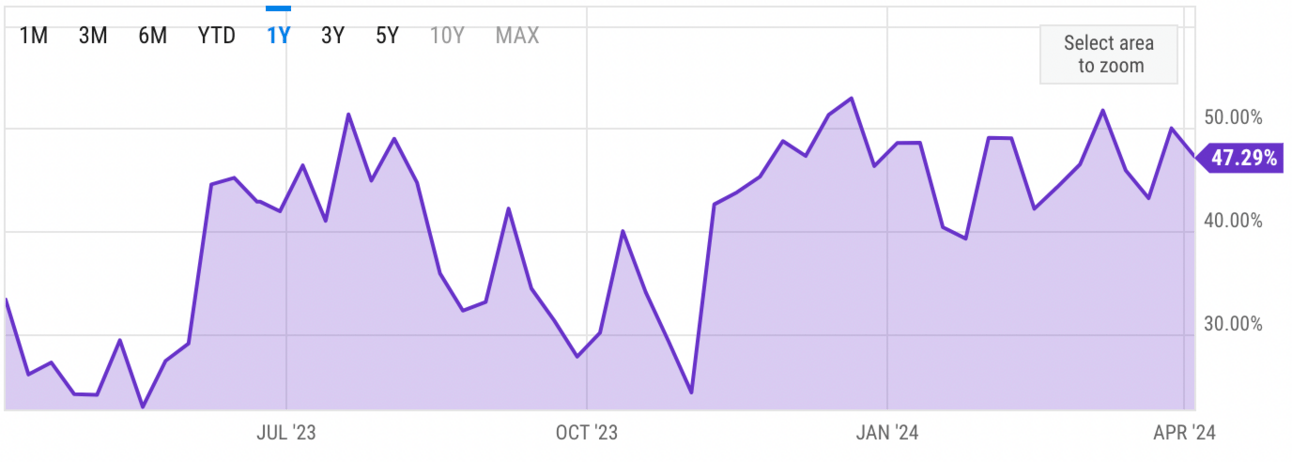

US Investor % Bullish Sentiment:

47.29% for Wk of Apr 04 2024 (Last week: 50.00%)

Market Recap:

Dow futures flat after worst day in a year, S&P 500 and Nasdaq futures stable.

Wall Street selloff continues: Dow down 530 points, S&P 500 and Nasdaq drop.

Dow leads weekly losses, set for worst performance since March 2023.

Today: Market awaits crucial labor data - Nonfarm payrolls expected to grow by 200,000.

EARNINGS

Next week’s watchlist will post on Monday.

Full earnings calendar here

HEADLINES

US raises commercial and market access issues with China in meeting (more)

Bipartisan $78B tax deal hits GOP roadblock in US Senate (more)

Silver prices settle near a three-year high (more)

Oil prices bound for second weekly gain on geopolitical tension, supply concerns (more)

Gov’t pensions have investments in TikTok owner ByteDance (more)

Meta pushes back on US FTC's bid to amend 2020 privacy settlement (more)

KKR's Sheldon says market in a 'Golden Age of credit allocation' (more)

Fed Central Bank tool use grows as cash stockpiling continues (more)

Alphabet and HubSpot deal rumors fly (a strange pairing) (more)

Unions’ picket power now extends to US boardrooms (more)

Poor resale values of EVs threaten adoption (more)

Apple lays off over 600 California employees after shuttering car project (more)

Samsung expects first-quarter profit to soar 931% as memory chip prices rebound (more)

Twilio board shakeup prompts renewed activist scrutiny (more)

PRESENTED BY TRADINGVIEW

Where the world does markets.

👋 Come see what you’re missing! Join 50 million traders and investors taking the future into their own hands.

Use TradingView for FREE today and experience the supercharged, super-charting platform and social network for traders and investors…

- please support our sponsors -

DEALFLOW

M+A | Investments

Alphabet reportedly weighing offer for HubSpot (more)

L’Oreal eyes stake in €3 Billion perfume brand Amouage (more)

US bidder eyes secondary London listing in battle for DS Smith (more)

Opswat, a company specializing in critical infrastructure protection cybersecurity solutions, acquired CIP Cyber, an online learning community to protect critical infrastructure (more)

Lexitas, a provider of tech-enabled litigation services, acquired Kopy Kat, a company specializing in the record retrieval and litigation support industry (more)

gWorks, a provider of a software solution designed specifically for small-medium sized local governments, acquired Freedom Systems, software company serving clients in PA (more)

CareerArc, a provider of social recruiting software and services, acquired Lumina, a provider of a SaaS platform for generating visual job postings at scale (more)

SnapCare, a healthcare workforce solutions provider, acquired Medecipher, Inc., a cloud-based predictive analytics staffing decision support tool (more)

Fleet Team, a fleet management and consulting company, acquired Forklift Training Systems, a compliant safety training company (more)

X2Engine, an enterprise software company providing open-source CRM solutions, acquired Identifid, a transaction security company (more)

OCLC, a nonprofit global library organization, acquired cloudLibrary, a platform that offers access to a wide variety of digital content through libraries (more)

LightEdge, a provider of secure cloud and colocation solutions, acquires Connectria, a provider of multi-cloud infrastructure and managed hosting solutions (more)

CData Software, a provider of data connectivity solutions, acquired Data Virtuality, a provider of data integration and management solutions (more)

Mill Point-backed ServicePoint buys Smart Source (more)

Shield AI acquires Sentient Vision Systems (more)

Henkel buys Seal For Life (more)

SnapCare acquires Medecipher (more)

PE-backed Apotex purchases Searchlight Pharma (more)

VC

Lambda, a GPU cloud company powered by NVIDIA GPUs, secured a special purpose GPU financing vehicle of up to $500M (more)

Diagonal Therapeutics, a biotech company developing new approach to discovering agonist antibodies, raised $128M in funding (more)

Aerospike, a provider of real-time vector and graph databases, raised $109M in growth funding (more)

SiMa.ai, a software-centric, embedded edge machine learning system-on-chip company, raised $70M in funding (more)

Biolinq, a healthcare technology company, raised $58M in funding (more)

Coalesce.io, a data transformation company, raised $50M in Series B funding (more)

Ion Clean Energy, a carbon dioxide capture technologies provider, raised $45M in funding (more)

Ellipsis Labs, a company that develops the on-chain Phoenix exchange, raised $20M in Series A funding (more)

Manifold, a provider of an AI-powered clinical research platform, raised $15M in Series A funding (more)

Full Glass Wine Co., a brand acquisition/management firm focused on DTC wine companies, closed a $14M Series A funding round (more)

Lirvana Labs, a learning companion app for preschool to elementary grade, raised $5.3M in early-stage financing (more)

Ivo, a provider of a generative AI-powered contract review solution, raised $4.8M in funding (more)

Hello Alice, a fintech platform connecting small businesses to capital, closed a Series C funding round, bringing valuation to $130M (more)

Nucleai, a spatial AI biomarker company, raised $14M in funding (more)

CRYPTO

Powered by MILKROAD - Get smarter about crypto in 5 min.

BULLISH BITES

🤖 Inside look: YC’s latest Demo Day shows fascinating wagers on healthcare, chip design, AI and more.

🖥 Breakthrough: Microsoft and Quantinuum say they’ve ushered in the next era of quantum computing.

🌜 All relative: The White House tells NASA to create a new time zone for the Moon.

⌚️ En vogue: Nice watch—love the dent! Why stylish guys want beat-up Rolexes and Cartiers.

🚨 Only 48 hours left… Experience MarketSurge for No-Cost thru Sunday - No Credit Card Required. Don’t miss the only chance this year to explore premium market insights and tools for free — last chance »

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here »

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

*from our sponsors

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.