Good morning.

The Fast Five → Amazon reaches $2 trillion market cap - also launching new discount section with direct shipping from China, top banks sail through Fed's 'stress tests', Japan issues warning against sharp falling yen, and consumers are revolting against high prices…

Calendar: (all times ET)

Today: | Initial jobless claims, 8:30a |

FRI 6/28: | PCE index, 8:30a |

Your 5-minute briefing for Thursday, June 27:

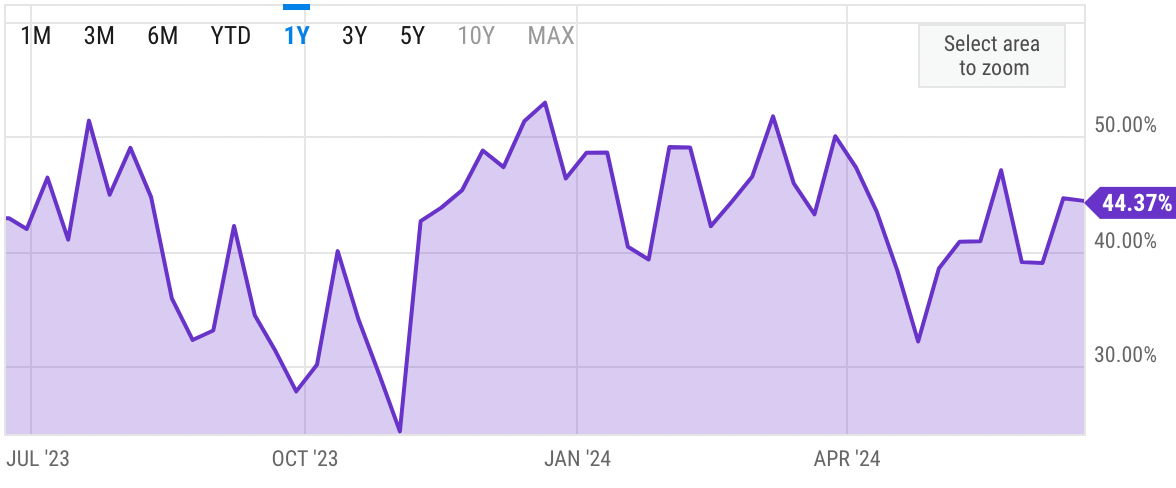

US Investor % Bullish Sentiment:

↓ 44.37% for Wk of June 20 2024 (Last week: 44.59%)

Market Recap:

S&P 500 +0.16%, Dow +0.04%, Nasdaq +0.49%.

Nvidia up 0.3% after 7% climb Tuesday; concerns about market reliance on Nvidia's surge.

Amazon jumped 3.9%, hitting $2 trillion market value.

Big tech dominates; rest of market sluggish.

Investors await May's PCE inflation data Friday.

FedEx +15.5% on Q4 results; Rivian up 23.2% on VW investment.

EARNINGS

Here’s what we’re watching this week:

Nike (NKE) - earnings of $0.84 per share (+27.3% YoY) on $12.9B revenue (+0.2% YoY)

Full earnings calendar here.

| Sponsored |

| Maximize 2024: Uncover "9 Stocks Poised for Growth |

| As we step into 2024, seize strategic opportunities in the market. Discover "9 Stocks Set to Soar," handpicked for their potential. Act Now: Before diving into our report, consider the opportunities 2024 holds. The time is ripe.Go HERE to Get Their Names And Ticker Symbols |

| By clicking the link you are subscribing to the Summa Money Newsletter and may receive up to 2 additional free bonus subscriptions. Unsubscribing is easy |

| Privacy Policy/Disclosures |

HEADLINES

Biden awards up to $75M in CHIPS Act grant to Entegris (more)

New home sales slump; supply at more than 16-year high (more)

Consumers are revolting against high prices (more)

High-end earners are worried about making ends meet (more)

Oil falls after jump in US inventories raises demand concerns (more)

Japan issues fresh warning against sharp yen falls (more)

Boeing resuming widebody airplane deliveries to China (more)

Amazon to launch discount section with direct shipping from China (more)

Southwest Airlines cuts revenue forecast as booking patterns change (more)

Jefferies profit climbs as investment-banking momentum builds (more)

Wealth advisors are about to get an OpenAI-powered assistant to do their grunt work (more)

Wealthy nation creditor club sees tide shifting as debt defaults peter out (more)

Surging returns lure private equity giants to India (more)

A message from Dylan Jovine, Behind The Markets

"Your Second Chance to Profit from A.I."

If you missed out on Nvidia, don't worry.

A 244-year-old pattern is about to trigger a $25.6 trillion AI surge...

And send three overlooked stocks soaring 1,000%+

- please support our sponsor -

DEALFLOW

M+A | Investments

FedEx explores divestment of freight business (more)

Bosch weighs offer for appliance maker Whirlpool (more)

Strategic Sports sees $3 Billion deal easing PGA Tour turmoil (more)

Blackstone snaps up UK hotel operator Village Hotels (more)

Nubank acquires AI-for-banks startup Hyperplane (more)

China Merchants buys 40% of PCCW fiber unit for $870M (more)

Crossbeam, an ecosystem-led growth platform, to merge with Reveal, a nearbound revenue platform, in an all-stock transaction (more)

ShakeStir LLC, a company specializing in creating and delivering cocktail kits at scale, acquired Thirstie, Inc., a provider of branded e-commerce solutions for liquor brands (more)

Wisk Aero, an advanced air mobility company, acquired Verocel, a software verification and validation company (more)

Cobalt Service Partners, a commercial solutions platform, acquired Digi Security Systems, a commercial security integrator (more)

Qure.ai, an AI-augmented detection for TB, lung cancer and stroke, gets investment from Merck Global Health Innovation Fund (more)

CipherHealth, Inc., a company specializing in patient-centered communication solutions, received an investment from Atalaya Capital Management (more)

LanzaJet, a sustainable fuels technology company and sustainable fuels producer, received an investment from MUFG (more)

VC

Gates’ climate VC firm turns sights to the developing world (more)

Function, a provider of a platform that manages lifelong health, closed a Series A funding (more)

Formation Bio, a tech-driven and AI-native pharma company, raised $372M in Series D funding (more)

CData Software, a provider of data connectivity solutions, received approx. $350M in Growth funding (more)

Foodsmart, a telenutrition company and provider of a food benefits management platform, raised $200M in funding (more)

Arrow, a healthcare technology company, announced its official launch bolstered by $110M in Series A funding secured in 2022 (more)

BlueFlame AI, a gen AI platform for alternative investment managers, closed a $5M Series A funding round at a valuation of $50M (more)

UroMems, a company developing implantable mechatronics technology, raised $47M in Series C funding (more)

Form Health, a provider of science-based obesity care, raised $38M in Series B funding (more)

OneHouse, a universal data lakehouse company, raised $35M in Series B funding (more)

Adonis, a healthcare financial technology platform, raised $31M in Series B funding (more)

Sensi.AI, a company specializing in care intelligence, raised $31M in Series B funding (more)

Rainforest, a payment provider for software platforms, raised $20M in funding (more)

Ario, an AI assistant for parents, raised $16M in Seed funding (more)

iVerify, a company specializing in advanced mobile EDR solutions, raised $12M in Series A funding (more)

Travertine, a company enabling critical element extraction for mining and fertilizer operations, raised $8.5M in funding (more)

HydroX AI, a AI startup providing comprehensive LLM safety and security platform, raised $4M in Angel funding (more)

LunchTable, a brand amplification platform, raised $2.4M in funding (more)

RISR, a comprehensive business owner engagement platform for financial advisors, raised $1.5M in funding (more)

CRYPTO

US regulators could approve spot Ether ETFs for launch by July 4 (more)

Crypto giants notch wins in expensive quest to sway US politics – without mentioning crypto (more)

Bybit is now the world’s second-largest crypto exchange (more)

ZynCoin meme token patches things up with tobacco giant Philip Morris (more)

BULLISH BITES

🏠 Explainer: The weird housing market, in 5 charts.

🚀 Second Wave: 244-year-old pattern to trigger AI surge. *

🤷🏻♂️ Inside Look: Has Facebook stopped trying?

🎡 ‘Funflation’ Effect: Why Americans are spending so much on travel and entertainment this summer.

👜 Good Investment? The crazy economics of the world’s most coveted handbag.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.