Good morning.

The Fast Five → Trump backs off Greenland tariffs—citing ‘framework’ deal, stocks set for TACO Thursday, Trump says inflation was ‘defeated’, Intel’s stock jumps 11%, and Goldman raises year-end gold price forecast to $5,400/oz…

📌 A small government task force just finished a 20-year project — They probably didn't realize their findings would allow everyday citizens to stake a claim on a $500 trillion national treasure. Go here to see how to claim your piece before Washington changes its mind → (ad)

Calendar: Full Calendar »

Today:

Core CPE Price Index, 8:30A Unemployment Change, 8:30A

Tomorrow:

Flash Manufacturing PMI, 9:45A Flash Services PMI, 9:45A

Your 5-minute briefing for Thursday, Jan 22:

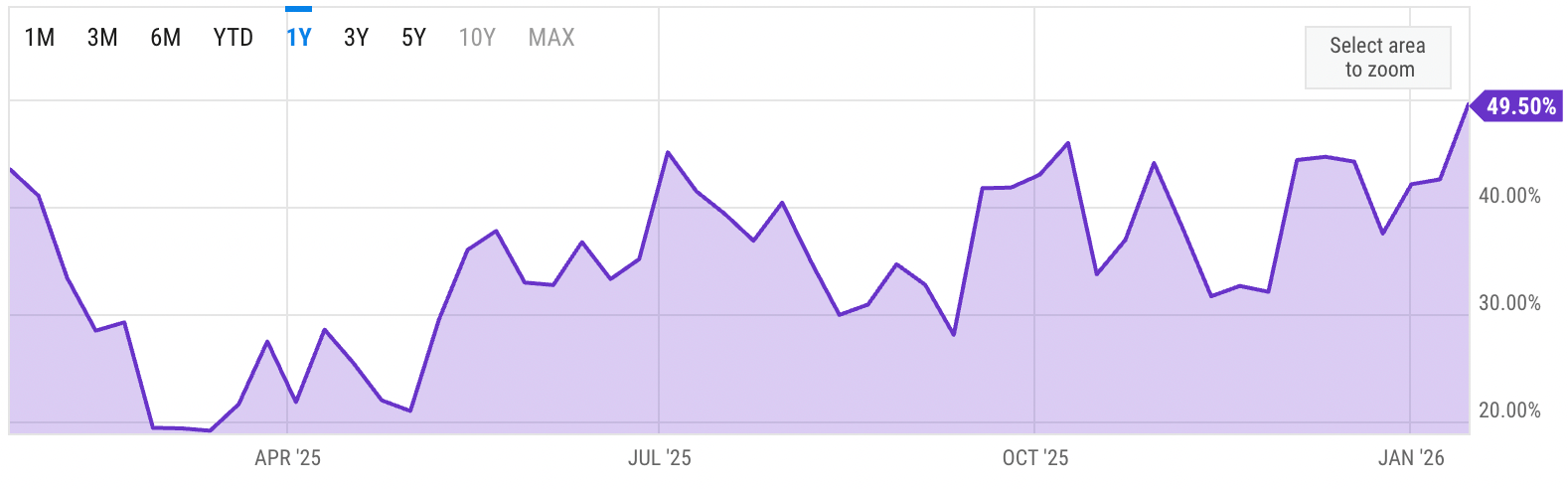

US Investor % Bullish Sentiment:

↑ 49.50% for Week of JAN 15 2026

Previous week: 42.49%

Market Wrap:

Futures up Dow +64, S&P +0.2%, Nasdaq 100 +0.3%

Trump pulled back Europe tariffs and pitched a Greenland deal framework

Wed. ripped S&P +1.2%, Dow +589, Nasdaq +1.2% to a record close

Thursday brings PCE inflation and weekly jobless claims

Earnings Thursday include P&G, Intel, GE Aerospace

Week still down Dow -0.6%, S&P -0.9%, Nasdaq -1.2%

EARNINGS

Here’s what we’re watching today:

Today: Capital One $COF ( ▲ 1.08% ), *McCormick $MKC ( ▼ 2.91% )

*GE Aerospace $GE ( ▲ 1.7% ) - $1.44 eps (+9% YoY) on $11.2B revenue (+13.4% YoY)

Intel $INTC ( ▲ 5.75% ) - $.08 eps (-38.5% YoY) on $13.4B revenue (-6.2% YoY)

A MESSAGE FROM BEHIND THE MARKETS

REVEALED: America Just Unlocked a $500 Trillion Asset

Everyone's talking about AI stocks but almost no one is talking about what AI actually runs on.

Nickel. Copper. Cobalt. Manganese.

America just secured exclusive rights to the largest untapped supply on Earth.

One company is already in position and this could be one of the most important AI infrastructure plays heading into 2026.

- a sponsored message from Behind The Markets -

HEADLINES

Dow, S&P, Nasdaq futures climb after Trump's Greenland whiplash (more)

EU freezes US trade deal approval over Greenland threats (more)

Trump says inflation was ‘defeated.’ Some economists disagree (more)

Trump touts progress on crypto regulation at Davos (more)

House seeks say over AI chip sales after Nvidia's China win (more)

Pending home sales drop sharply in Dec, dampening 2026 outlook (more)

Goldman Sachs raises 2026-end gold price forecast to $5,400/oz (more)

Quants in worst losses since October as crowded bets buckle (more)

Japan records a 5th straight yearly trade deficit (more)

Intel’s stock jumps 11% to highest since early 2022 ahead of earnings (more)

Schwab’s profit jumps on surge in brokerage activity (more)

Apple to revamp Siri as a built-in chatbot to fend off OpenAI (more)

Bezos’ Blue Origin launches satellite internet service to rival SpaceX (more)

DEALFLOW

M+A | Investments

EQT to acquire Coller Capital in $3.2B deal

Smithfield Foods acquires iconic Nathan's Famous

Next buys British footwear brand Russell & Bromley

Valor Fleet Services receives investment from Tailwind Capital

NetBrain Technologies receives majority investment from Blackstone Growth

NCC Group to sell Escode for $369.4M

Balena receives strategic growth investment from LoneTree Capital

VC

OpenEvidence, an AI platform for doctors, raised $250M in Series D funding

Duetti, a music-tech and financial services company for independent music creators, raised $200M in funding

Upscale AI, Inc., a developer of AI networking infrastructure, raised $200M in Series A funding

Preply, a language learning marketplace, raised $150M in Series D funding

Zanskar, an AI geothermal energy company, raised $115M in Series C funding

Zarminali Pediatrics, an outpatient pediatric destination for integrated primary care, raised $110M in Series A funding

Sage Geosystems, a pressure geothermal company, raised over $97M in Series B funding

Datarails, an AI-native financial platform, raised $70M in Series C funding

Jetson, a provider of home electrification solutions, raised $50M in Series A funding

Benepass, a benefits capital management platform, raised $40M in Series B funding

AnswersNow, a company specializing in virtual ABA therapy, raised $40M in Series B funding

Nasdaq Private Market, liquidity and investment solutions for the private markets, raised $37.6M in Series C financing

L-Nutra, a nutri-tech company advancing science-driven nutrition, raised additional $36.5M in its Series D funding

AheadComputing, a microarchitecture compute performance company, raised additional $30M in Seed2 funding

Atlas Invest, a company specializing in commercial real estate lending, raised a $25M facility

XBuild, an AI platform built for construction, raised $19M in Series A funding

Ultra, a developer of nicotine-free pouches, raised $11M in Series A funding

Furl, a security remediation startup, raised $10M in Seed funding

Renterra, a software platform for equipment rental businesses, raised $9M in Series A funding

AiStrike, a cybersecurity company developing AI-native, cyber defense, raised $7M in Seed funding

PraxisPro, an AI training platform for life sciences, raised $6M in Seed funding

CRYPTO

BULLISH BITES

Is 2026 the year the Davos consensus finally gets it right?

💰 Five reasons gold is surging toward $5,000 an ounce.

🤖 CEOs and workers see AI very differently.

🎮 The secretive V.I.P. programs that keep gamers spending.

DAILY SHARES

Have feedback or a suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.