Good morning.

The Fast Five → Trump tariffs reinstated by appeals court for now, Trump pressed Powell to lower rates in White House meeting, US-China talks ‘a bit stalled’, Eric Trump wants to see some big banks ‘go extinct’, and Anduril and Meta team up to transform XR for the US military…

📌 The Greatest "Income Play" of 2025? There’s a little-known company whose work Elon Musk says civilization would "crumble" without--and still trading under $20 a share. Get the full story » (ad)

Calendar: (all times ET) - Full Calendar

Today:

Personal income, 8:30A

PCE index, 8:30A

Consumer sentiment, 10:00A

Monday:

ISM manufacturing, 10:00A

Construction spending, 10:00A

Auto sales, TBA

Your 5-minute briefing for Friday, May 30:

US Investor % Bullish Sentiment:

↑ 37.70% for Week of MAY 22 2025

Previous week: 35.93%. Next chart posts Monday.

Market Wrap:

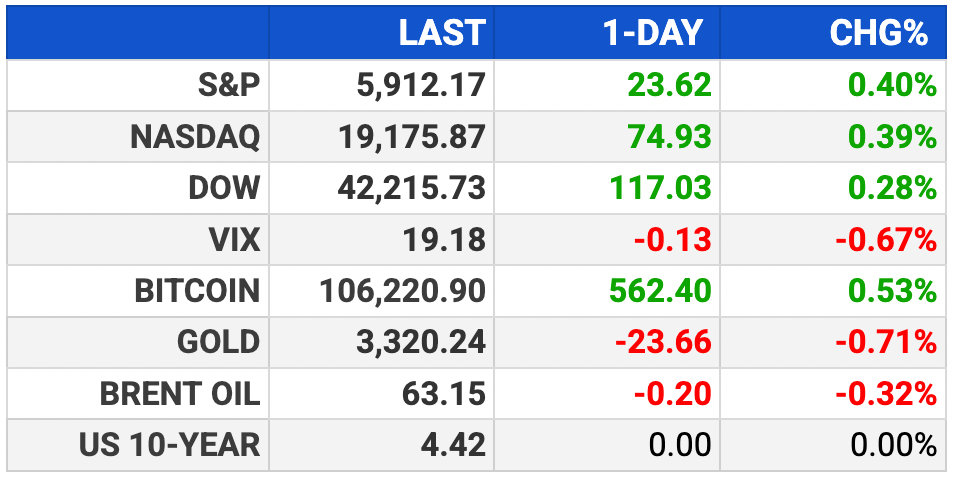

Futures dip: Dow -63 pts (-0.1%), S&P -0.2%, Nasdaq -0.3%

Thursday gains faded as trade headlines whipsawed markets

Gap -14% on weak Q2 outlook; Ulta +8%, Dell +2% post-earnings

Trump tariffs briefly halted, then reinstated—more uncertainty

May: S&P +6%; Nasdaq +10%; Dow +4%

Fed’s PCE inflation gauge due today, could move sentiment

EARNINGS

Nothing watched today. See full calendar here »

Top investors are buying this “unlisted” stock

When the team that co-founded Zillow and grew it into a $16B real estate leader starts a new company, investors notice. That’s why top firms like SoftBank invested in Pacaso.

Disrupting the real estate industry once again, Pacaso’s streamlined platform offers co-ownership of premier properties – revamping a $1.3T market.

By handing keys to 2,000+ happy homeowners, Pacaso has already made $110m+ in gross profits.

Now, after 41% gross profit growth last year, they recently reserved the Nasdaq ticker PCSO. But the real opportunity is now, at the unlisted stage.

Until May 29, you can join Pacaso as an investor for just $2.80/share.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

HEADLINES

Wall Street ends up with Nvidia, appeals court reinstates Trump tariffs (more)

US economy shrinks 0.2% on weaker spending, larger trade impact (more)

Pending home sales declined 6.3% in April (more)

Goldman’s Waldron says bond traders fear debt more than tariffs (more)

US-China talks ‘a bit stalled’ and need Trump and Xi to weigh in (more)

China's biotech boom leaves US playing catch-up (more)

Costco tops earnings and revenue estimates as sales jump 8% (more)

Tariffs will cost Gap up to $150 million (more)

Tesla targets June 12 launch of robotaxi service in Austin (more)

Abercrombie soars over 14% as strong demand drives first-quarter beat (more)

Tesla investors ask board to make Musk work full-time (more)

Anduril and Meta team up to transform XR for the US military (more)

Josh Brown says he’s not sure if Nike can ever turn it around (more)

More climate tech projects are dying on the vine (more)

Eric Trump would love to see some big banks ‘go extinct’ (more)

DEALFLOW

M+A | Investments

Grammarly secures $1 billion from General Catalyst

Northrop Grumman invests $50M in Firefly Aerospace

Advanced Micro Devices (AMD) acquired Enosemi

VC

ClickHouse, Inc., a real-time analytics and data warehousing company, raised $350M in Series C financing

David, a brand designing tools to increase muscle and decrease fat, raised $75M in Series A funding

Empathy, a loss support and legacy planning technology company, raised $72M in Series C funding

Wander, a company combining luxury hotel experiences with private vacation homes, raised $50M in Series B funding

Vivodyne, a company developing drug testing on lab-grown 3D human tissues, raised $40M in Series A funding

Rillet, an AI-native ERP platform, raised $25M in Series A funding

Acclaro Medical, a medical tech company, raised $23M in Series B funding

Sequence, a fintech startup, raised $7.5M in funding

Atomic Canyon, a developer of AI-powered search and generative AI tools for the nuclear power industry, raised $7M in funding

FarmQA, a digital agronomy platform, raised $4M in Seed funding

Naoris Protocol, a quantum-resistant blockchain and cybersecurity mesh architecture company, raised $3M in strategic funding

REplace, an AI-powered platform streamlining renewable energy and data center development, raised $2.1M in funding

DreamPark, a creator of a downloadable mixed reality (XR) theme park, raised $1.1M in Seed funding

Accelus, a medical tech company, raised an undisclosed amount in growth equity funding

Veyond Metaverse, a provider of a 5D XR real-time communication technology, raised an undisclosed amount in strategic funding

CRYPTO

BULLISH BITES

📈 America’s wealthiest are betting on this one stock. *

🛠 Trump’s steel deal.

🩸 Behind the Curtain: A white-collar bloodbath.

🫠 Google as you know it is slowly dying.

🎙 How a Steve Madden podcast interview went viral — and paid off.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.