Good morning.

The Fast Five → Trump hits Canada, Mexico with 25% tariffs tomorrow, the US economy just had another robust year, Apple forecast cheers investors as Microsoft outlook slumps, US sues to block tech deal, and Blackstone still bullish on AI data centers despite DeepSeek…

Marc Chaikin, a 50-year Wall Street insider who's been following the AI investment trend since early 2023, is urging Americans to make a very different move with their money. *

Calendar: (all times ET) - Full Calendar

Today:

PCE index, 8:30A

Monday:

Construction spending, 10:00A

Your 5-minute briefing for Friday, January 31:

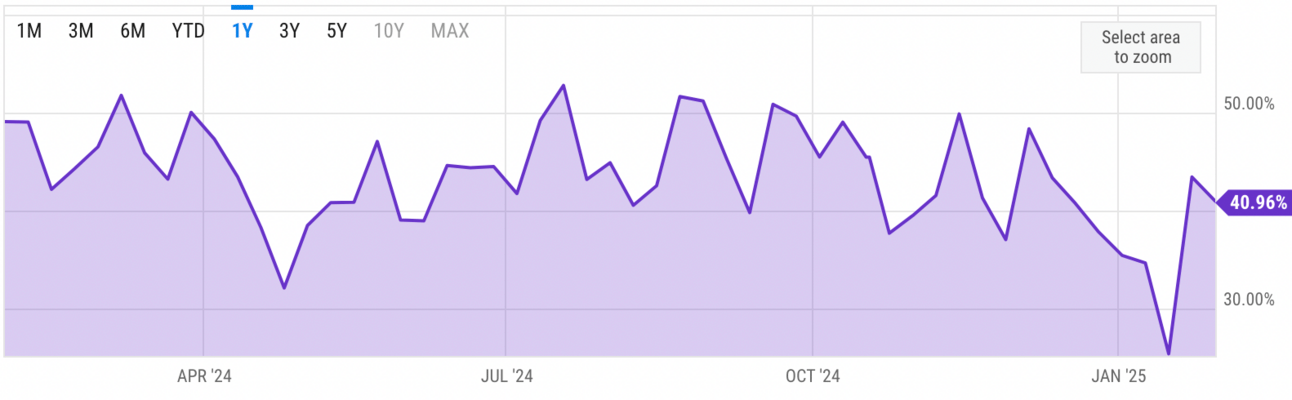

US Investor % Bullish Sentiment:

↓ 40.96% for Week of January 30 2025

Previous week: 43.43%. Updates every Friday.

📉 NVDA Suffers Biggest Market Loss in History – buy or sell?

- from Chaikin Analytics

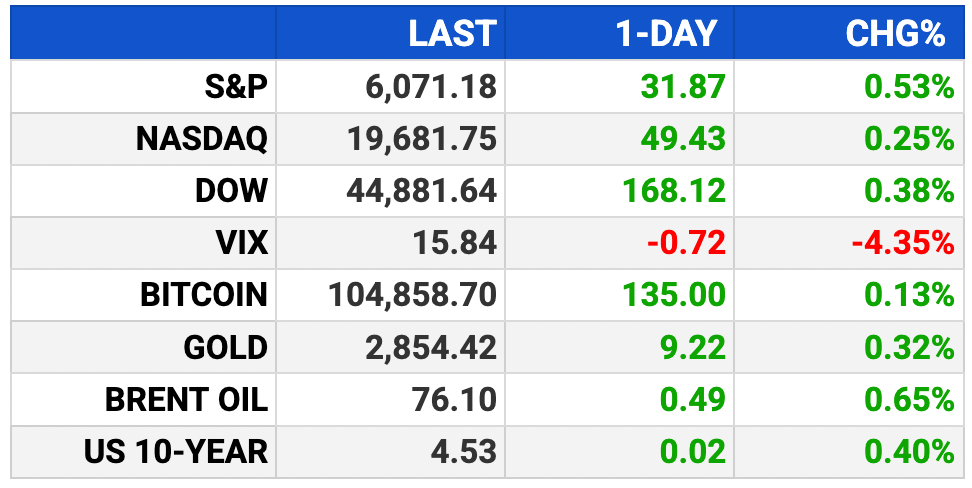

Market Wrap:

Futures edge up as investors digest Apple’s earnings, await key inflation data

Apple +3% post-earnings, Intel/KLA +3%, Deckers -16% on weak guidance

Dow set for a weekly gain, S&P 500 and Nasdaq eye losses

January wraps strong: Dow +5.5%, S&P 500 +3.2%, Nasdaq +1.9%

PCE inflation, jobs data, and Exxon/Chevron earnings ahead

EARNINGS

No earnings watched today. Full calendar here »

HEADLINES

Dow Jones makes a late break on Thursday (more)

Oil advances as Trump’s tariff threats unsettle global market (more)

ECB cuts rates and governors expect more amid weak growth (more)

US sues to block tech deal in first antitrust action of Trump term (more)

Blackstone still bullish on AI data centers despite DeepSeek (more)

DeepSeek will hardly dent Mag Seven stocks, survey shows (more)

Saudi seeks foreign capital to build global, competitive industries (more)

IBM rallies 13%, notches best day since 2000 on strong earnings (more)

Apple forecast cheers investors after mixed holiday results (more)

Microsoft stock slumps more than 6% on disappointing revenue outlook (more)

UPS stock sinks after announcing cut to Amazon deliveries (more)

Intel won’t bring its Falcon Shores AI chip to market (more)

TOGETHER WITH BILL.COM

Simplify with BILL. Get a BrüMate Backpack Cooler.

We love our customers—and the feeling is mutual! Demo BILL Spend & Expense and get $200 to spend with BrüMate.

“BILL gives me the capability to create as many virtual cards as I want. It makes budgeting easy. I use a different card for marketing, office expenses, etc and can set budget for each. All free, no hidden fees. Makes expense tracking extremely simple.” – Dylan Jacob, Founder @ BruMate

BILL gets you:

Customizable spending limits

Real-time tracking

Scalable credit lines

Take a demo and claim $200 to spend with BrüMate.1

1Terms and Conditions apply. See offer page for details. Card issued by Cross River Bank, Member FDIC, and is not a deposit product.

DEALFLOW

M+A | Investments

Nationwide to acquire Allstate's stop-loss insurance business in $1.25B deal (more)

EQT-backed Zayo in lead to buy Crown Castle assets in deal above $8 bln (more)

DataBank, a provider of enterprise edge colocation, interconnection, and managed services, received a $250M equity investment from TJC (more)

Suki, a company developing AI tech for healthcare, received an investment from Zoom Ventures (more)

VC

Rad AI, a healthcare AI company, raised $60M in Series C funding, at $525M valuation (more)

Seraphic Security, an enterprise browser security company, raised $29M in Series A funding (more)

Kode Health, an on-demand medical coding platform, raised $27M in Series B funding (more)

Paxton, an AI platform for the legal industry, raised $22M in Series A funding (more)

Anchor, an autonomous billing and collections platform, raised $30M in Series A funding (more)

Omnitron Sensor, a company specializing MEMS fabrication IP for new sensors, raised $13M+ in Series A funding (more)

Waterlily, a startup using AI to predict long-term care needs up to decades before they happen, closed a $7M Seed funding (more)

Final Round AI, an AI-powered platform helping people find jobs, raised $6.88M in Seed funding round (more)

Medsender, an AI-powered workflow automation platform for healthcare providers, raised $5M in Series A funding (more)

Athenic AI, a company specializing in the data analysis and BI space, raised $4.3M in funding (more)

Freeze, proactive offensive security and attack surface protection solutions, raised $2.6M in Seed funding (more)

MSTRO, an AI platform that allows individuals to spark new ideas and elevate human potential, raised $1.5M in Seed funding (more)

CRYPTO

BULLISH BITES

🚨 Tech Selloff Update: Is this the great AI market crash? *

🙏 Sam Bankman-Fried’s parents explore seeking Trump pardon for son.

⚠️ Meta warns that it will fire leakers in leaked memo.

💰 From an office park in a Kansas City suburb, Peter Mallouk has built an $11 billion fortune on Goldman, TPG deals.

😎 GQ takes us on a tour of "weirdo" men's fashion at the 2025 Sundance Film Festival.

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.