Good morning.

The Fast Five → Trump U-turns on Powell and China, Bessent: China tariffs are not sustainable, exhausted traders get no relief from rebound, a dozen states sue Trump to block new tariffs, and Gold prices plunge in biggest one-day drop in years…

📌 Jeff Bezos quietly backing world-changing tech (not AI)

The Amazon founder is quietly advancing a radical technology that could change society forever and benefit early investors.

Take these three steps to prepare → *

Calendar: (all times ET) - Full Calendar

Today:

Initial jobless claims, 8:30A

Durable-goods orders, 8:30A

Tomorrow:

Consumer sentiment (final), 10:00A

Your 5-minute briefing for Thursday, April 24:

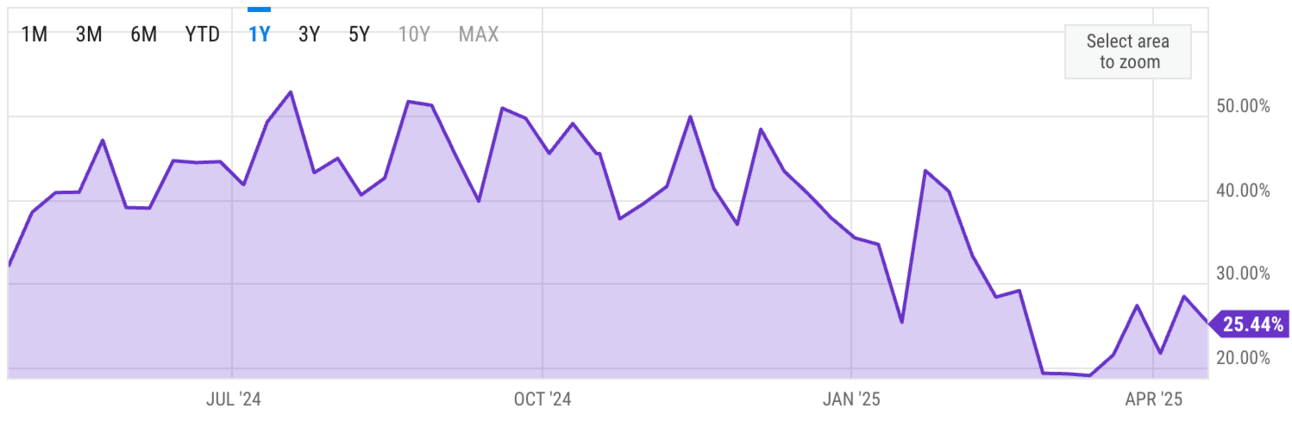

US Investor % Bullish Sentiment:

↓ 25.44% for Week of April 17 2025

Previous week: 28.52%. Updates every Friday.

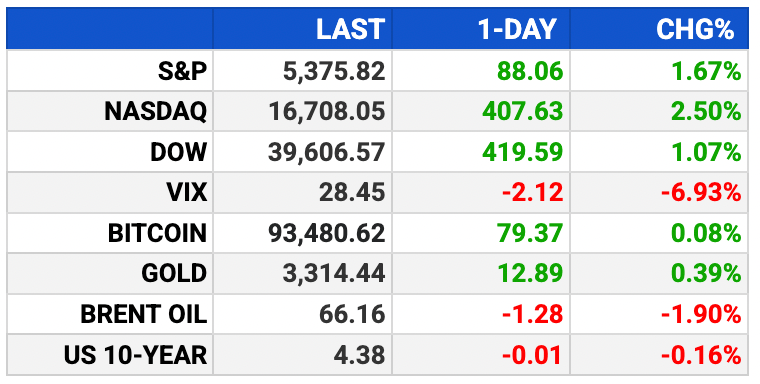

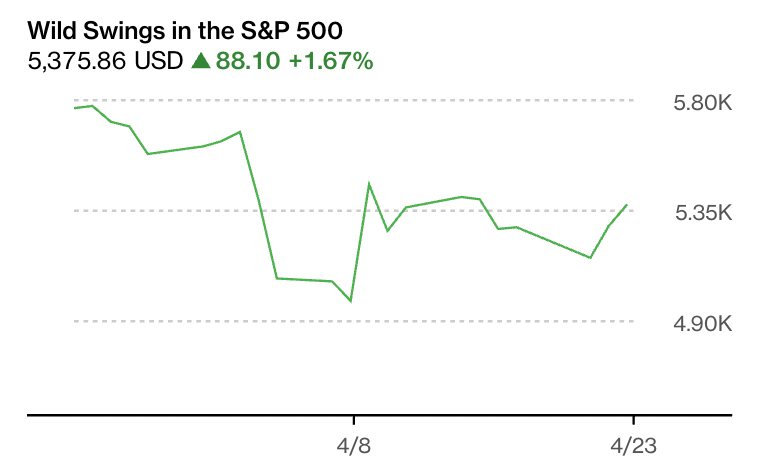

Market Wrap:

Dow +420 pts (+1.1%), S&P +1.7%, Nasdaq +2.5%.

Trump signals softer China stance; says 145% tariff will “come down.”

Bessent, WSJ point to possible 50–65% range, tied to a bilateral deal.

AAPL +2%, NVDA +3%, TSLA +5% on easing trade pressure.

Trump confirms Powell stays as Fed chair through 2026.

EARNINGS

Here’s what we’re watching this week:

Today: American Airlines $AAL ( ▲ 0.43% ), Intel $INTC ( ▼ 1.56% ), PepsiCo $PEP ( ▲ 1.96% ), Procter & Gamble $PG ( ▲ 2.55% ), Southwest $LUV ( ▼ 0.48% )

Alphabet $GOOGL ( ▼ 1.42% ) - earnings of $2.01 per share (+6.3% YoY) on $89.2B revenue (+10.7% YoY)

Our “#1 Tech Stock of 2025” (Not NVDA)

If you missed out on Amazon, Netflix, Apple...

Stay tuned, because Bloomberg says Jeff Bezos' new project could "achieve a $40 trillion valuation."

If you play this right, you could capture huge profits.

But according to Whitney Tilson, the former hedge fund manager who bought Amazon before it soared more than 8,000%, Netflix before it soared more than 11,000%, and Apple before the stock soared more than 65,000%...

You have to move quickly.

- a message from our research partner -

HEADLINES

Dow closes 400 points higher, but ends session well off the highs (more)

Credit a ‘short squeeze’ for the stock market’s big 2-day bounce (more)

Bessent says China tariffs are not sustainable (more)

Dozen states sue Trump in bid to block new tariffs (more)

Trump says 25% tariff on cars made in Canada could go up (more)

Trump: Millionaire tax would push wealthy to leave the US (more)

Gold prices plunge in biggest one-day drop in years (more)

Southwest to cut flights this year citing ‘macroeconomic uncertainty’ (more)

Chipotle’s sales miss points to weaker consumer sentiment (more)

IBM beats on earnings and revenue, maintains full-year guidance (more)

Nvidia supplier SK Hynix's Q1 profit more than doubles (more)

Musk's Neuralink could fetch $8.5B valuation (more)

DEALFLOW

M+A | Investments

Cantor Fitzgerald partners with Tether and SoftBank for $3.6B crypto venture

Columbia Banking System to acquire Pacific Premier Bancorp for $2 bln

Baker Tilly and Moss Adams announce $7 bln merger

WorkStep, a frontline employee engagement platform, acquired WorkHound, an employee feedback management platform

PSG, in combination with 2ndWave Software, acquired JAMS, a workload automation and job scheduling solution

Leap, a space logistics company, received an investment from Colorado ONE Fund

VC

Exowatt, a next-gen renewable energy company, closed its $70M Series A funding round

Instrumentl, a full-lifecycle grant solution for nonprofits and universities, raised $55M in funding

Alpaca, a self-clearing broker-dealer and brokerage infrastructure API provider, raised $52M in Series C funding

Cynomi, a cybersecurity company, raised $37M in Series B funding

Synthetic Design Lab, an antibody-drug conjugate company, raised $20M in funding

Scamnetic, a company protecting individuals and businesses from digital threats, raised $13M in Series A funding

VanishID, an agentic AI-powered digital executive protection company for enterprises, raised $10M in funding

HelloSky, a talent intelligence platform for the executive search industry, raised $5.5M in seed funding

Respondology, a social media comment moderation and intelligence company, raised an additional $5M in Series A-1 funding

Crowdpac, a political crowdfunding platform, raised $4M in funding

Coologics, a clinical-stage medical device company, raised $3M in Seed funding

CRYPTO

BULLISH BITES

📈 Where to invest $1,000 right now *

🤬 Scoop: Musk vs. Bessent dispute erupted into West Wing shouting match.

🤖 Draft executive order outlines plan to integrate AI into K-12 schools.

💰 Perplexity wants to buy Chrome if Google has to sell it.

😞 Inside the country’s saddest airport lounge.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.