Good morning.

The Fast Five → Tesla profit falls short again, India closes in on China, getting Biden’s war chest, Rivian to face trial in Tesla trade secrets theft case, and there’s a mutiny in the bond market…

📈 From E. Lasky, Weiss Advocate: This handful of small companies are crucial to AI’s next frontier »

Calendar: (all times ET)

Today: | New home sales, 10:00 AM |

THU, 7/25: | GDP, 8:30 AM |

FRI, 7/26: | PCE index, 8:30 AM |

Your 5-minute briefing for Wednesday, July 24:

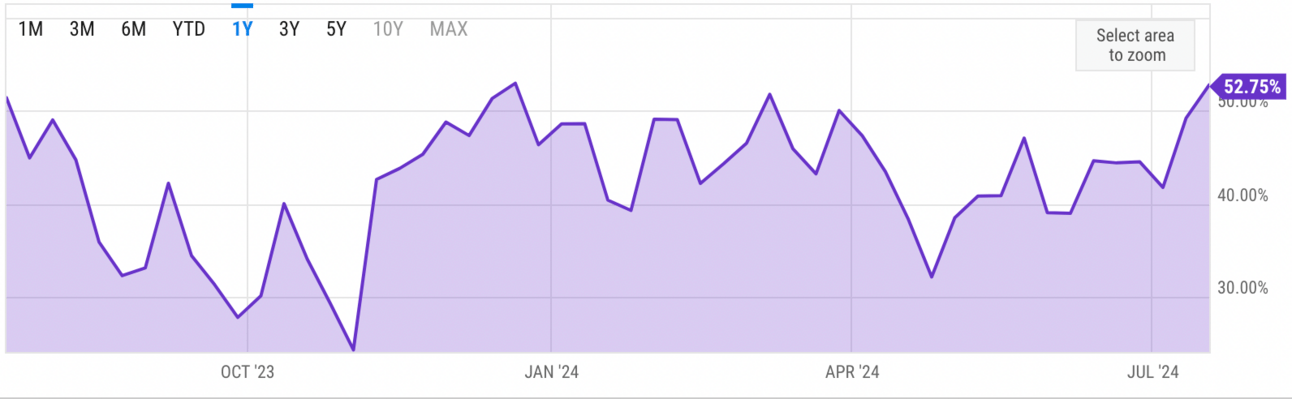

US Investor % Bullish Sentiment:

↑ 52.75% for Wk of July 18 2024 (Last week: 49.18%)

Chart updates every Friday.

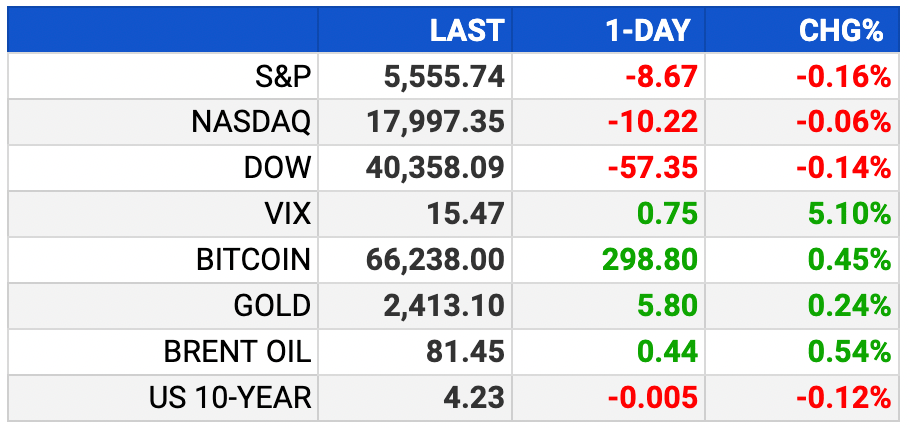

Market Recap:

Nasdaq futures -0.78%, S&P -0.51%, Dow -0.27%.

Alphabet shares -1.7%; YouTube ad revenue missed.

Tesla shares -6% on weak results, 7% drop in auto revenue YoY.

20% of S&P reported Q2 earnings; 80% beat expectations.

Rally driven by Fed rate cut expectations, soft landing hopes.

EARNINGS

Here’s what we’re watching this week:

Chipotle (CMG) - earnings of $.32 per share (+28% YoY) on $2.9B revenue (+16.3% YoY)

Friday: Bristol-Myers Squibb (BMY)

3M (MMM) - earnings of $1.68 per share (-22.6% YoY) on $5.9B revenue (-25.4% YoY)

Full earnings calendar here.

HEADLINES

Trump files complaint over Harris getting Biden’s $96M war chest (more)

10-year Treasury yield dips as investors closely monitor economic data (more)

Record house prices depress US home sales in June (more)

Dollar firms as commodities slide and carry unwinds (more)

Oil prices rise as crude, fuel inventories seen shrinking (more)

Asian stocks meander after US tech earns disappoint (more)

China's quant funds suffer deep losses amid crackdown (more)

Mutiny in the bond market as billionaires pick a debt fight (more)

Alphabet’s revenue boosted by cloud computing, search ads (more)

Boeing resumes deliveries of 737 Max airplanes to China (more)

GM slows EV plans again even as sales grow (more)

LVMH slumps 5% after second-quarter revenue miss (more)

Musk launches poll asking if Tesla should invest $5 bln in xAI (more)

Rivian to face trial in Tesla trade secrets theft case (more)

"How I 6X-ed My Wife's 401K in 1 Year"

At the peak of the dot-com boom, a former hedge fund manager put all $20,000 of his wife's 401k into shares of just ONE stock.

Everyone on Wall Street said he was crazy.

But a year later, that $20,000 in his wife's account was worth $120,000.

Today, he says: "If you thought the dot-com mania was intense, what's about to happen in the coming weeks could be even crazier and could open up a new window of opportunity for 500%-plus gains."

- sponsored message -

- We’re on a short break this week -

The Dealflow and Crypto sections

will resume on Monday 7/29.

BULLISH BITES

🇯🇵 Timing: Ex-banker behind $1.7 Trillion Japan rally says it’s just starting.

🚨 Rare Event: CNBC's ‘Prophet’ issues important Fed warning.

🤖 Futuristic: Mark Zuckerberg imagines content creators making AI clones of themselves

🤷🏻 Dilemma: Is Nvidia stock overvalued?

✈️ Unforgettable: How the ultra-wealthy travel in Paris.

What did you think about today's briefing?

Have a comment or suggestion?

💌Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.