Good morning.

The Fast Five → Investors to watch Powell’s tone as market teeters, Wall Street still sees two rate cuts this year, Deepseek sets stage for frenetic tech earnings season, Sam Altman: OpenAI will be ‘better than anyone is ready for’, and Musk’s X begins its push into financial services with Visa deal…

🚨 Wall Street Rumor: NVIDIA Crash is “Hint of What’s to Come"

- from Behind The Markets

Calendar: (all times ET) - Full Calendar

Today:

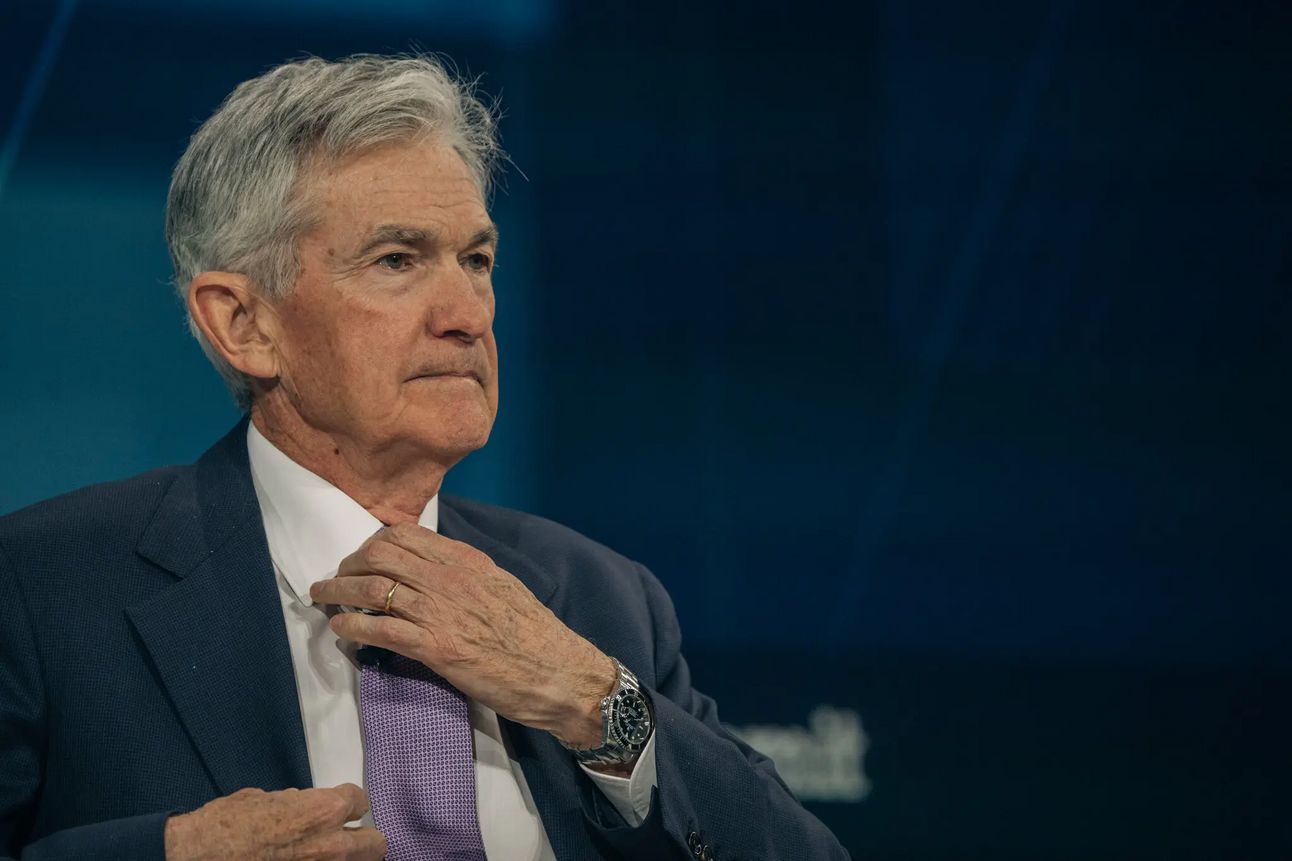

FOMC interest-rate decision, 2:00P

Fed Chair Powell press conference 2:30P

Tomorrow:

GDP, 8:30A

Initial jobless claims, 8:30A

Pending home sales, 10:00A

Your 5-minute briefing for Wednesday, January 29:

US Investor % Bullish Sentiment:

↑ 43.43% for Week of January 23 2025

Previous week: 25.43%. Updates every Friday.

🤔 Guess who's challenging the U.S. Dollar now?

- from Stansberry Research

Market Wrap:

Futures were flat ahead of the Fed's first 2025 rate decision.

S&P and Nasdaq rebounded Tue after AI sell-off; Nvidia jumped 9%.

Today: Fed expected to hold rates steady at 4.25%-4.50%.

Powell’s press conference key as Trump pressures for rate cuts.

Investors eye Fed tone on future policy moves.

EARNINGS

Here’s what we’re watching this week:

Meta (META) - earnings of $6.73 per share (+26.3% YoY) on $47B revenue (+17% YoY)

Apple (AAPL) - earnings of $2.43 per share (+11.5% YoY) on $124.8B revenue (+4.3% YoY)

HEADLINES

Wall Street still sees two rate cuts this year, but conviction is getting weaker (more)

Bets on bigger Treasuries rally are booming before Fed decision (more)

US businesses boosted equipment spending heading into 2025 (more)

Consumer stress is on the rise (more)

Gold prices rally on Trump’s rhetoric, haven demand (more)

DeepSeek triggered a wild, baseless rally for some Chinese stocks (more)

Sam Altman: OpenAI-Microsoft will be ‘better than anyone is ready for’ (more)

Billionaire Feinberg’s Cerberus taps Goldman to sell stake as he joins Trump (more)

Starbucks comeback gains momentum with sales slump easing (more)

Super Micro Computer stock is getting a fresh look from analysts (more)

Elon Musk’s X begins its push into financial services with Visa deal (more)

HSBC gives up on Wall Street, where Americans still rule (more)

Arnault says LVMH has woken up ‘Sleeping Beauty’ Tiffany (more)

NVIDIA just lost $600 billion of value in a day...

The single-biggest one day crash in U.S. stock market history. And Wall Street insiders are ringing the alarm bells.

Nassim Taleb - who predicted the 2008 financial crisis - claims this historic sell-off is just a "hint of what's to come."

Billionaire investor Ray Dalio says AI is in a massive "bubble" that resembles the build-up to the dotcom bust.

And 33-year Wall Street veteran Dylan Jovine says the recent AI crash is just the beginning...

Jovine has identified five massive cracks in the U.S. economy...

If he's right, we could soon see the stock market crash 50%...

Real estate could drop 40%...

And unemployment could triple.

That's why he has moved a seven-figure amount of his own money out of the stock market...

And into a safe-haven investment favored by billionaires like Warren Buffett, Elon Musk and Bill Ackman.

If Jovine is right, the next 90 days could be crucial for your financial future.

He's giving away his entire AI Bear Market Blueprint in his latest emergency briefing.

DEALFLOW

M+A | Investments

Alibaba's Tsai-backed firm buys 12% of Italian luxury sneaker maker Golden Goose (more)

Billionaire Castel to acquire Diageo’s unit and expand in Ghana (more)

Philips to sell emergency care unit to Bridgefield Capital (more)

SimpliGov, a provider of a government workflow automation platform, received an investment from JMI Equity (more)

VC

Helion, a fusion energy company, raised $425M in Series F funding, at $5.425B valuation (more)

Atalanta Therapeutics, a company developing RNA interference to treat neurological diseases, raised $75M in Series B funding (more)

Onebrief, a provider of software for operational planning and military staff workflows, raised $50M in Series A funding (more)

Eclypsium, an nfrastructure supply chain security company, raised $45M in Series C funding (more)

VideaHealth, a dental AI company, raised $40M in Series B funding (more)

Amplitude Vascular Systems, a medical device company, raised $36M in Series B Funding (more)

The Helper Bees, a technology aging platform, raised $35M in Series C funding (more)

Hone Health, an online clinic that provides preventative and proactive longevity care, raised $33M in Series A funding (more)

Qsic, an intelligent in-store audio platform, raised $25M in Series B funding (more)

Atomicwork, a company providing agentic service management for Enterprise IT, raised $25M in Series A funding (more)

Earth AI, a predictive explorer for clean energy metals, raised $20M in Series B funding (more)

Anivive Lifesciences, a software-driven pet health company, secured $20M in funding (more)

Nue, a revenue lifecycle platform, raised $20M in Series A funding (more)

Bonsai Robotics Inc., a developer of physical AI solutions for agriculture applications, raised $15M in Series A funding (more)

Hypori, a mobile access platform provider, raised $12M in Series B extension funding (more)

Tradeverifyd, an intelligence platform for supply chain risk management, raised $8M in Series A funding (more)

WiseLayer, an AI fintech company that makes AI-powered digital workers, raised $7.2M in funding (more)

Applied Labs, a company helping businesses deploy AI agents, raised $4.2M in Seed funding (more)

Frenos, an autonomous OT security assessment platform, raised $3.88M in Seed funding (more)

Aligned Marketplace, a primary care marketplace for self-insured employers, raised additional $3M in Seed funding (more)

CRYPTO

BULLISH BITES

🤖 DeepSeek and how it managed to sneak up on the some of the world's most sophisticated tech companies.

✈️ Boom’s XB-1 becomes first civil aircraft to go supersonic.

🗣 Why do people hate the sound of their own voice?

🏈 The Super Bowl’s most expensive tickets are selling for over $56,000.

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.