Good morning.

The Fast Five → Huang: 'China is going to win the AI race', SCOTUS questions Trump's authority on tariffs, Robinhood doubles revenue, Starbucks baristas prep 'biggest strike we've ever been on’, and Wall Street girds for life under Mamdani…

📌 Former Goldman VP Reveals Mysterious Gold Stock With Huge Upside Potential — He says the gains in this should be far greater than just bullion or mining stocks. Some folks had the chance to see 995% the last time we shared this exact gold stock. Most people know nothing about it (except the elite). See more details about his No. 1 gold stock right here » (ad)

Calendar: (*Shutdown may affect key data. All times ET) - Full Calendar »

Today:

None watched

Tomorrow:

Prelim Consumer Sentiment, 10A

Your 5-minute briefing for Thursday, Nov 6:

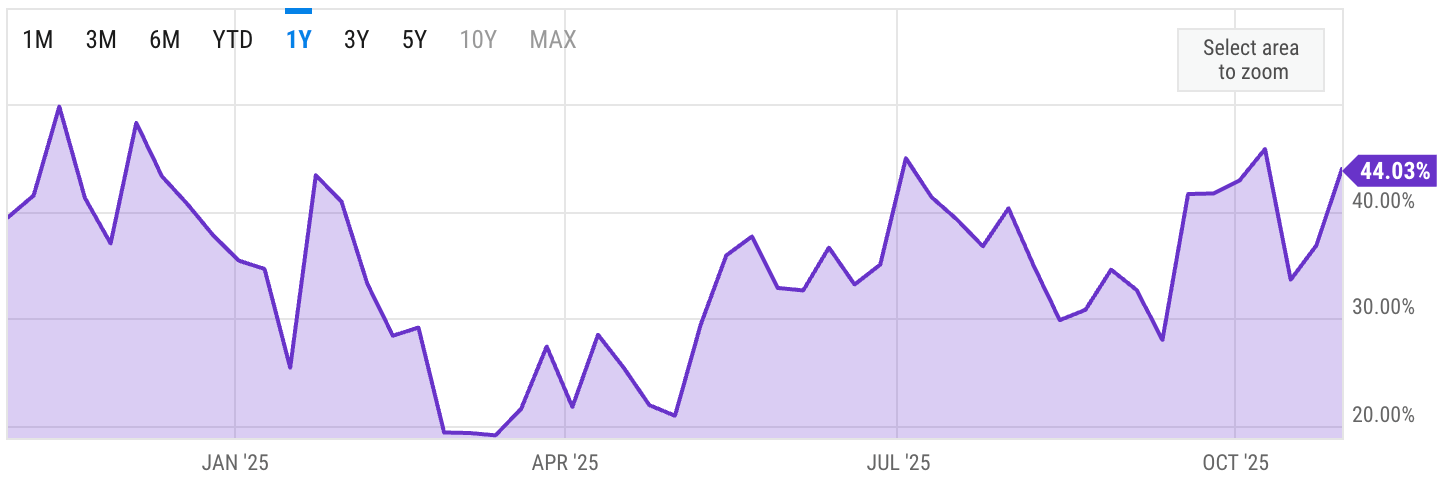

US Investor % Bullish Sentiment:

↑44.03% for Week of OCT 30 2025

Previous week: 36.86%

Market Wrap:

Futures flat: S&P/Nasdaq +0.1%, Dow +25.

Supreme Court skeptical of Trump tariffs; rollback could lift markets.

AI stocks rebound: AMD +2%, Broadcom +2%, Micron +9%, Oracle recovers.

AI bounce helps indexes stabilize after a soft start to the week.

Dynasty: “Still early in the AI super-cycle”; capex broadening beyond Mag7.

Earnings ahead: Expedia, Airbnb, Vistra report today.

EARNINGS

Here’s what we’re watching this week:

Today: Airbnb $ABNB ( ▲ 1.65% ), *Tapestry $TPR ( ▲ 3.15% ), *Warner Bros. Discovery $WBD ( ▲ 0.77% )

The Three Key Men Who Could Ignite The

Biggest Gold Bull Run in Over 50 Years

According to Dr. David Eifrig, a former Goldman Sachs VP, three powerful men inside the highest levels of the U.S. government are advancing a strange plan that could impact your wealth in a MAJOR way.

And in the process, it could spark the biggest gold frenzy in over half a century.

Dr. Eifrig urges you to move your money to his No. 1 gold stock immediately (1,000% upside potential). He warns if you wait any longer, you could get priced out.

HEADLINES

US markets stabilize after tech rout (more)

Supreme Court justices question Trump's authority on tariffs (more)

Fed's Miran: Cutting rates again would be 'a reasonable action' (more)

China sells $4 billion of dollar bonds as US tensions ease (more)

Execs from Mercuria, Rolex other Swiss firms meet Trump (more)

FAA to cut flights by 10% at 40 major airports due to gov’t shutdown (more)

US companies added 42,000 jobs in October (more)

Retailers are raising prices to meet tariffs, Amazon more than others (more)

Apple nears deal to pay Google roughly $1 bln a year for Siri AI model (more)

Robinhood doubles revenue beating third-quarter earnings expectations (more)

Rivian stock soars after revenue surges on EV rush (more)

Doordash tanks 20% as company misses earning (more)

McDonald’s is struggling to hold on to its low-income customers (more)

Is the AI Bubble About to Burst? (95.2% Accurate Forecast)

NVIDIA officially reports earnings November 19, but you can get a sneak peek right now.

Not just for NVIDIA, but for dozens of public companies.

On Polymarket, the world's largest prediction market (with verified 95.2% accuracy), you can see what top forecasters believe will happen.

Our new Earnings Markets let you:

See real-time odds of NVIDIA beating estimates

Predict what executives will say on earnings calls

Profit directly from being right, regardless of stock price movement

Trade simple Yes/No outcomes instead of complex options

Will Jensen stun Wall Street again?

Or is the AI trade finally cooling off?

Top forecasters are already positioning.

DEALFLOW

M+A | Investments

Zest AI receives investment from customers

VC

Armis, a cyber exposure management and security company, raised $435M in a pre-IPO funding round, which brought its valuation to $6.1B

Braveheart Bio, a biotech company developing novel therapeutics for hypertrophic cardiomyopathy, raised $185M in Series A funding

Neok Bio, a biotech company focused on the development of novel antibody drug conjugates for cancer patients, raised $75M in Series A funding

Procurement Sciences, an AI software company that focuses on how businesses find government contracts, closed $30M in Series B funding

DualBird, a data infrastructure startup, raised $25M in combined Seed and Series A funding

Cactus, an AI copilot built to power home service businesses, raised $7M in Seed funding

CommanderAI, a prospecting-first sales platform built for waste haulers, raised $5M in Seed funding

Mindsmith, an AI-native e-learning platform that combines AI with modern learning science, raised $4.1M in Seed funding

Rilevera, a startup that empowers engineering teams to manage cyber threat detection by automating workflows, raised $3M in Seed funding

GitLaw, a provider of AI legal services for businesses, raised $3M in Pre-Seed funding

Boostie, an automated talent marketing platform built for staffing agencies and corporate talent acquisition teams, raised $500k in Seed funding

CRYPTO

BULLISH BITES

🇺🇸 Election results' message: Americans want things cheaper.

🤝 Palantir’s ‘Meritocracy Fellowship’.

💍 Former Meta employees launch a smart ring that takes voice notes, controls music.

😎 It’s cool to have no followers now.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.