Good morning.

The Fast Five → Inside the final inflation report before the election, AMD launches AI chip to rival Nvidia, TD Bank pleads guilty in money laundering case, Trump Media shares up 100% from recent low, and Elon Musk reveals $30,000 Tesla Cybercab…

🚨 Invitation: Urgent 2024 Election Broadcast

An invitation from Porter Stansberry

Calendar: (all times ET) - Full calendar here

Today:

Producer price index (PPI), 8:30 am

Consumer sentiment, 10:00 amMonday:

Columbus Day holiday. Bond market closed.

Your 5-minute briefing for Friday, October 11:

US Investor % Bullish Sentiment:

↑ 49.01% for Week of October 10 2024

Last week: 45.45%. Updates every Friday.

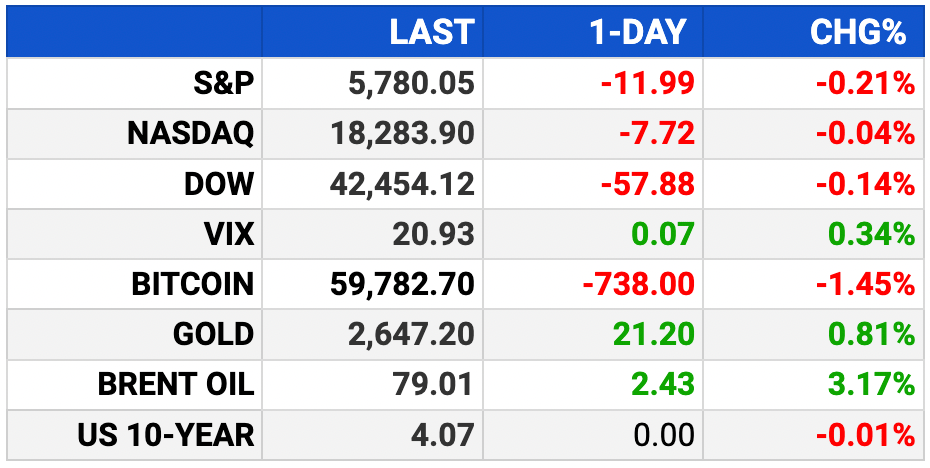

Market Wrap:

Stocks fell: S&P 500 -0.21%, Dow -0.14%, Nasdaq -0.05%.

CPI report showed inflation at 2.4%, hotter than expected.

Fed's Bostic suggested pausing rate cuts in November.

Fed funds futures suggest 85% chance of a 25 bps cut in Nov.

Universal Insurance +12%, Pfizer -3%, AMD -4% after launching AI chip.

EARNINGS

Earnings we’re watching this week:

JPMorgan Chase (JPM) - earnings of $4.01 per share (-7.4% YoY) on $41.7B revenue (+5.1% YoY)

See full earnings calendar here.

HEADLINES

Here’s the inflation breakdown for September 2024 — in one chart (more)

Wall St mixed as inflation data backs bets of 25 bps rate cut in November (more)

Mortgage rates surge for second-straight week after hitting two-year lows (more)

Oil prices jump 4% on US storm and Israel-Iran fears (more)

Asian stocks to sidestep Wall Street dip after CPI (more)

Elon Musk reveals $30K Tesla Cybercab and Robovan at robotaxi event (more)

TD Bank pleads guilty in money laundering case, will pay $3 bln in penalties (more)

Trump Media shares up 100% from recent low as DJT rally continues (more)

Tesla gambles on ‘black box’ AI tech for robotaxis (more)

Berkshire cuts stake in BofA to below 10% (more)

A BRIEFING FROM PORTER STANSBERRY

Now Live!

BREAKING POINT 2024

In the aftermath of November 5, the markets could be cleaved in two by an unseen financial force that’s brewing beneath the “politics” of the election.

Get on the right side of this coming divide here.

- A message from Porter Stansberry -

DEALFLOW

M+A | Investments

VC

Toca Football, Inc., a soccer experience company, raised approximately $100M in Series F funding (more)

Glooko, Inc., a global integrated digital health company, raised $100M in Series F financing (more)

Cytovale, a commercial-stage medical diagnostics company, raised $100M in Series D funding (more)

Farther, a tech-powered financial advisory firm, raised $72M in Series C funding (more)

Suki, a leader in AI technology for healthcare, raiserd $70 in Series D funding (more)

Braintrust, a platform enabling companies to evaluate and enhance the performance of AI products, raised $36M in Series A funding (more)

Relyance AI, an AI-powered data governance platform that provides visibility over enterprise-wide data, raised $32M in Series B funding (more)

Rivermark Medical, a company specializing in minimally invasive solutions for BPH, raised $30M in Series C funding (more)

Scope3, a collaborative sustainability platform decarbonizing media and advertising, raised $25M in funding (more)

Noetica AI, an AI-powered software platform for benchmarking deal terms, raised $22M in Series A funding (more)

Document Crunch, a construction document compliance platform, raised $21.5M in Series B funding (more)

Case Status, an AI-powered client engagement platform for law firms, raised $19.7M in Series B funding (more)

FlexFactor, a provider of decline recovery solutions for eCommerce brands, closed a $16.8M Series A funding round (more)

Centaur Labs, a company specializing in health data annotation, raised $16M+ in Series B funding (more)

Covu, a company specializing in AI-native services for insurance agencies, raised $12.5M in Series A funding (more)

RadiantGraph, a platform using artificial intelligence to drive consumer engagement for healthcare, raised $11M in Series A funding (more)

LEVY Health, an innovator in the field of reproductive health technology, raised $4.5M in funding (more)

MiLaboratories, a company specializing in computational biology innovation, raised an undisclosed amount in Series A funding (more)

CRYPTO

BULLISH BITES

⚠️ Warning: The election is about to rip markets in two *

🎯 Misleading: Fed’s 2% inflation target is ‘sacrosanct’ — and here.

📉 Impact: How stuck is the startup exit market? Pretty stuck, says Pitchbook.

🏛 Influence: The New Yorker dubs Silicon Valley the new lobbying monster.

😎 Trending: Wide, billowing pants are IN according to GQ.

What did you think about today's briefing?

hitHave a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.