Cheers! Happy holidays to you.

Note: Market Briefing will be paused December 25-26, and January 1, 2025 ✨

The Fast Five → Markets begin last trading week with holiday cheer, Honda shares jump 17%, Tesla, Meta and Broadcom weights shrink, Nordstrom family will take retailer private, and Biden to decide on US Steel acquisition after panel deadlocks…

Discover the $20 Stock Fueling the AI Boom

If you are looking for the perfect retirement stock... your search is over.

AMD, NVIDIA, META... none of these companies could exist without this firm.

And it could be yours for only about $20 a share.

Calendar: (all times ET) - Full calendar

Today:

Initial jobless claims, 8:30A

Existing home sales, 10:00A

Tomorrow:

Christmas holiday

Your 5-minute briefing for Tuesday, December 24:

US Investor % Bullish Sentiment:

↓ 40.71% for Week of December 19 2024

Previous week: 43.33%. Updates every Friday.

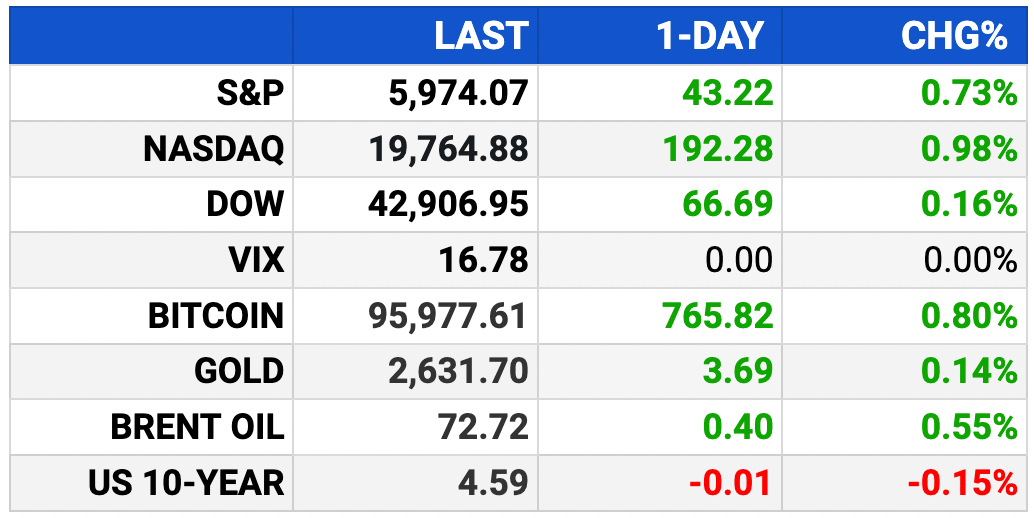

Market Wrap:

Stock futures steady: Dow flat, S&P unchanged, Nasdaq down 0.2%.

NYSE closes early today, markets shut Wednesday for Christmas.

Monday: S&P +0.7%, Nasdaq +1%, Dow +0.2%. Tech led gains: Nvidia +3.7%, Broadcom +5%, Meta +2%.

Weak data: Consumer confidence at 104.7, durable goods orders down 1.1% in November.

Santa Claus rally hopes linger, but S&P 500 near 6,000 may stall further gains.

EARNINGS

No noteworthy earnings reports scheduled for release this week. See full calendar »

HEADLINES

Wall Street ends higher on gains by most megacaps (more)

Consumer confidence drops as election boost fades (more)

Dollar firms as US rates outlook dominates (more)

Oil prices up in thin pre-Christmas trade (more)

Bumpy ride for US corporate bond spreads expected in 2025 (more)

Biden to decide on US Steel acquisition after panel deadlocks (more)

US launches probe into Chinese semiconductor industry (more)

Silicon Valley’s WH influence grows as Trump taps tech execs for roles (more)

Honda shares jump 17% as buyback eases concern over Nissan deal (more)

Nordstrom family will take retailer private in $6.25B deal (more)

VC partners are leaving big firms in droves (more)

The Container Store files for bankruptcy (more)

TOGETHER WITH DUBAPP

Lawmaker stock trades can now be copied automatically on Dub

On Dub, you don't pick stocks. You pick the people you want to copy, with portfolios based on hedge fund managers, investing experts, and even law makers.

Portfolios are automatically adjusted with quantitative investment strategies based on multiple factors around a long-term strategy, aiming to have high performance despite disclosure delays.

Dub is SEC-registered, member FINRA. All deposits are SIPC-insured.

Not investment advice. Full disclosures here

- Shortened briefing during holiday -

Dealflow, Crypto, and Bullish sections

will resume on January 2, 2025. Enjoy the holiday!

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.