Good morning.

The Fast Five → House passes bill to ban TikTok, TikTokers revolt, Tesla slapped with new bearish call, Fed’s inflation fight starting to feel like a forever war, and Stripe reveals passing $1 trillion in payment volume…

Calendar:

Today: Producer price index (PPI), 8:30am ET

Your 5-minute briefing for Thursday, March 14:

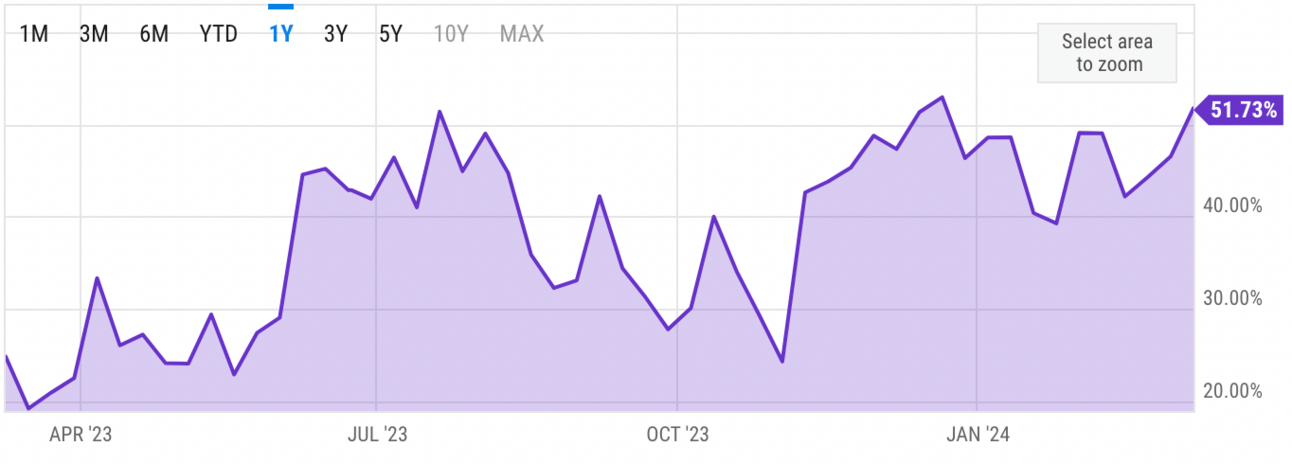

US Investor % Bullish Sentiment:

51.73% for Wk of Mar 07 2024 (Last week: 46.50%)

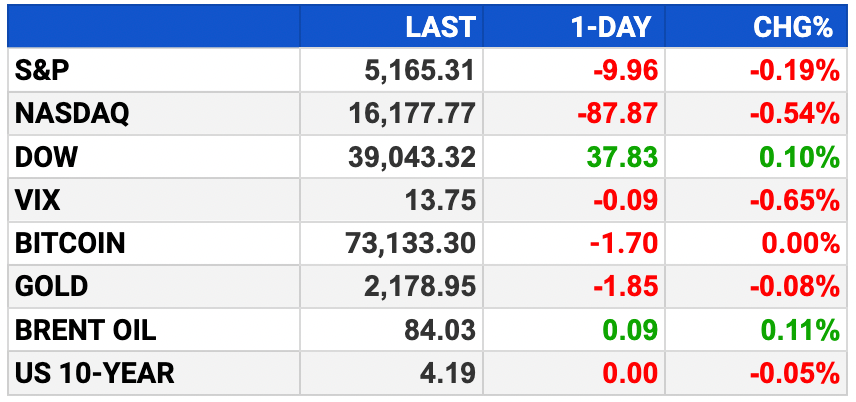

Market Recap:

Stock futures inch up Wed. night ahead of inflation data.

Dow up 0.1%, S&P 500 futures climb 0.1%, Nasdaq 100 rises 0.2%.

Robinhood gains 10%, Fisker tumbles 46% after hours.

Tech sector drag pulls S&P 500, Nasdaq down; Dow holds.

Eyes on Feb. producer price index before Fed meeting.

Tech sell-off continues; only Alphabet, Amazon rise.

Apple, Tesla slide; Chinese tech stocks uncertain.

Today brings jobless claims, retail sales reports pre-market.

EARNINGS

What we’re watching this week:

Today: Dick's Sporting Goods (DKS), Ulta Beauty (ULTA)

Adobe (ADBE) - earnings of $4.38 per share (+15.3% YoY) on $5.1B in revenue (+10.3%)

Full earnings calendar here

HEADLINES

Biden admin investigating Change Healthcare cyberattack as disruptions continue (more)

Yellen says US moving to ensure domestic EV maker success despite China's exports (more)

Stocks struggle near record before inflation data (more)

US grants $750M for hydrogen projects across 24 states (more)

Treasury yields rise as investors weigh inflation outlook (more)

Fed's inflation fight is starting to feel like a forever war (more)

Eli Lilly taps Amazon Pharmacy to help deliver Zepbound (more)

Analyst adjusts Nvidia stock price target ahead of conference (more)

Stripe reveals passing $1 trillion in payment volume in 2023 (more)

Tesla stock slapped with new bearish call (more)

Jamie Dimon backs Disney CEO Bob Iger in proxy fight with Nelson Peltz (more)

SpaceX cleared to attempt third Starship launch Thursday after getting FAA license (more)

Petco CEO is out, former Best Buy exec to step in as interim chief executive (more)

A MESSAGE FROM BEHIND THE MARKETS

- please support our sponsors -

DEALFLOW

M+A | Investments

Altria plans to sell more than $2 Billion of AB InBev shares (more)

JPMorgan leads $2 Billion in financing for Beverly Hills resort (more)

Paramount sells India TV stake to Reliance for $517M (more)

KKR leads $500M deal for HarbourView music royalties (more)

Accelirate, provider of AI-enabled automation services, acquired Revelation AI, a Platinum Salesforce Partner specializing in AI & Predictive Analytics (more)

Daasity, provider of a data and analytics platform built for omnichannel consumer brands, acquired Red Fox Analytics, a leader in data analytics for consumer packaged goods brands (more)

Stonepeak buys four onshore wind farms from Ørsted (more)

Peak Rock acquires California Custom Fruits & Flavors (more)

Halle Capital-backed True purchases Sundance (more)

TZP-backed Soccer Post buys Soccer Pro (more)

Falfurriras-backed Executive Platforms merges with Board.org (more)

Riverside invests in Cabinet Depot (more)

VC

Zephyr AI, Inc., a healthcare tech company developing explainable AI solutions for medicine, closed a $111M Series A funding (more)

Fermat, a startup that allows retailers to create a shopping experience for each customer journey, raised $17M in Series A funding (more)

Siolta Therapeutics, a clinical-stage biotech company, raised $12M in Series C funding (more)

Tierra Biosciences, a company providing a predictive AI-guided cell-free technology platform, raised $11.4M in Series A funding (more)

DBOS, a developer of a cloud-native operating system, raised $8.5M in Seed funding (more)

Murphy’s Naturals, an outdoor lifestyle company focused on creating natural products, raised $8M in Series B funding (more)

Big Sur AI, a provider of an AI platform for e-commerce, raised a $6.9M in seed funding (more)

Furno, a startup dedicated to decarbonizing the cement production industry, raised $6.5M in Seed funding (more)

Telo, an electric mobility company advancing EV mini-trucks, raised $5.4M in funding (more)

Nest Health, a value-based whole-family healthcare provider, raised over $4M in an extended Seed funding (more)

RapidCanvas, an AI platform built for business, raised $7.5M in Seed funding (more)

WealthFeed, a provider of organic growth platform for financial advisors, raised $2M in funding (more)

CRYPTO

BULLISH BITES

☠️ Poof: EV euphoria is dead.

👨🏻🦱 They're back: And more realistic than ever, toupees are the luxury world’s newest flex.

🔥 Among us: The A.I. doomsayers.

✈️ Rivalry: Airlines want to stop ‘travel hack’ JSX from luring rich flyers away.

📈 AI’s unbeatable advantage: The BBC is saying that AI, "could spark the next medical revolution." That's why early investors in this technology can make an absolute killing. Get all the details here »*

*from our sponsor

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.