A quick favor? Hit ‘reply’ and tell us your current top stock pick!

Why? we are changing our send domain which may cause some bumps in delivery. When you ‘reply’ it “tells” your email provider to keep briefings in your primary inbox (plus we’ll share the stock picks!) - thank you.

Good morning.

The Fast Five → Jerome Powell says the magic words, sales set to double for Nvidia, job market may be near tipping point, NASA snubs Boeing for SpaceX, and Telegram app CEO arrested in France…

American dodged a crisis: Discover Dr. Weiss’s 3 critical steps to safeguard your future before sweeping changes hit »

A message from Weiss Research

Calendar: (all times ET) - Full calendar here

Today: Durable-goods orders, 8:30A

Tomorrow: Consumer confidence, 10:00A

Your 5-minute briefing for Monday, August 26:

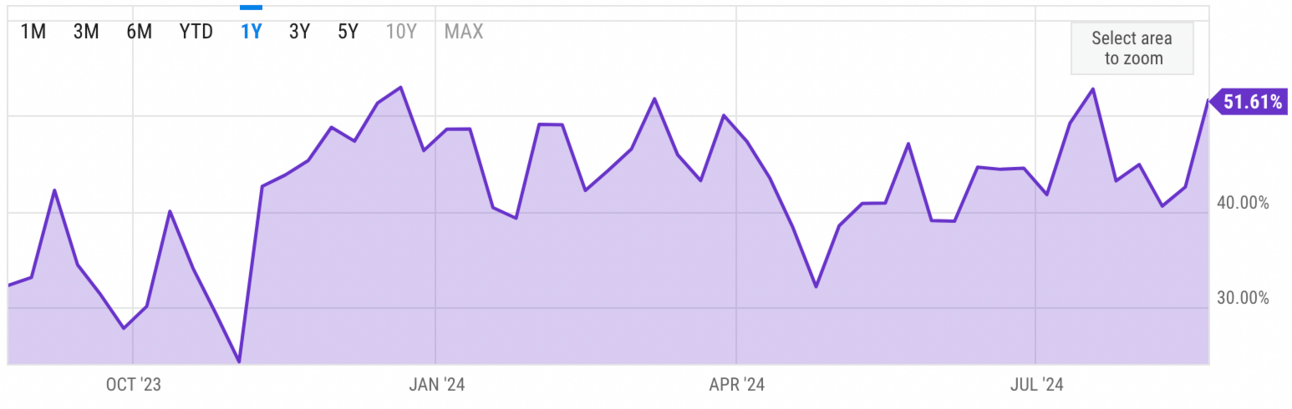

US Investor % Bullish Sentiment:

↑51.61% for Wk of August 22 2024

Last week: 42.54%. Updates every Friday.

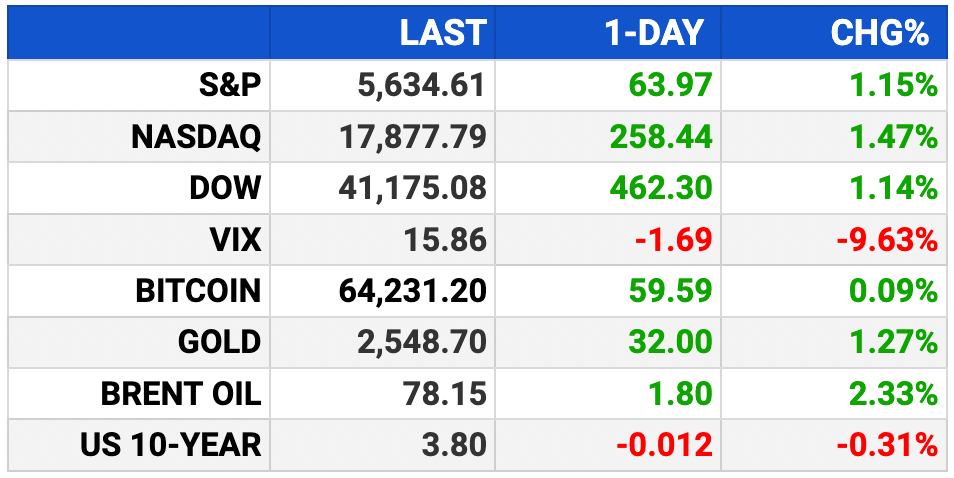

Market Wrap:

Stock futures slightly down: S&P and Nasdaq off 0.1%, Dow -16 points.

Last week’s gains fueled by Powell hinting at rate cuts.

Equities rebounded; S&P now within 1% of record high.

Rate cut timing/size uncertain, but Sept. cut expected.

EARNINGS

Here’s what we’re watching this week:

Tuesday: Nordstrom (JWN)

Nvidia (NVDA) - earnings of $.57 per share (lower than Q1 due to the 10-for-1 stock split) on $25.6B revenue, nearly double the $13.5B it reported in the year-ago period.

Salesforce (CRM) - earnings of $2.36 per share (+11.5% YoY) on $9.2B revenue (-3.8% YoY)

Ulta Beauty (ULTA) - earnings of $5.52 per share (-8.3% YoY) on $2.6B revenue (+4% YoY)

Full earnings calendar here.

HEADLINES

Powell’s pivot leaves traders debating rate cut size (more)

2 big tests ahead determine if last week's excitement was warranted (more)

US job market may be near tipping point (more)

Gold holds near record after Powell affirms rate cuts (more)

Oil climbs on Mideast escalation fears, rate cut expectations (more)

Asian stocks eye Fed bounce after Powell speech (more)

Bank of China President Liu Jin resigns (more)

China slams US for adding firms to export control list, vows action (more)

NASA snubs Boeing Starliner for SpaceX (more)

Restaurants fight back against the FTC crackdown on ‘junk fees’ (more)

UBS activism bankers depart for roles at BofA, Wells Fargo (more)

Telegram app CEO arrested in France (more)

A MESSAGE FROM OUR PARTNER

America dodged a crisis — could next time be worse?

$34 Trillion of debt, 20% dollar devaluation since 2020, $1 TRILLION spent every 100 days. If you thought things were already bad in the U.S., Dr. Martin Weiss reveals how the next crisis could lead to unprecedented government and financial control. But there's still time to act.

- sponsored message -

DEALFLOW

M+A | Investments

Bronfman's Paramount plans include partnerships with Amazon or Apple (more)

CVC, DSV submit dueling €14B bids for DB Schenker (more)

Meritage explores $2 bln sale of Columbia Distributing (more)

China Mobile buys stake in Huawei smartphone-spinoff Honor (more)

Takeover battle for Taiwan Bank heats up with CTBC offer (more)

Cloudbreak Health, video remote interpretation services for the healthcare industry, acquired Voyce, a tech-enabled language services provider (more)

Husqvarna Group, a manufacturer of products and solutions for managing forests, parks, and gardens, acquired InCeres, a digital platform in the professional light agriculture segment (more)

Forge Health, an outpatient mental health and substance use care provider, received a strategic investment from MFO Ventures (more)

YA Group, an int’l professional services organization providing consulting, received an investment from THL Partners (more)

VC

TickPick, an event ticket marketplace, raised $250M from Brighton Park Capital (more)

Openwater, a provider of a healthcare platform, raised $100M in total funding (more)

Sorella Labs, a crypto startup advancing tools to identify MEV activities and process Ethereum blocks, raised $7.5M in funding (more)

Deep Fission, a nuclear energy company, raised $4M in funding (more)

CRYPTO

BULLISH BITES

💰 Get your complimentary Wealth Protection Kit (3 Guides) » *

🏠 Pursuits: Marc Andreessen’s family plans to build a ‘visionary’ subdivision near the proposed California Forever utopia city.

🛻 Futurism: Cybertrucks are about to get full self-driving.

🐝 Good Company: “Layoff influencers” take the sting of shame out of losing a job.

💎 See It: Second-largest diamond ever found is discovered in Botswana.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.