Good morning.

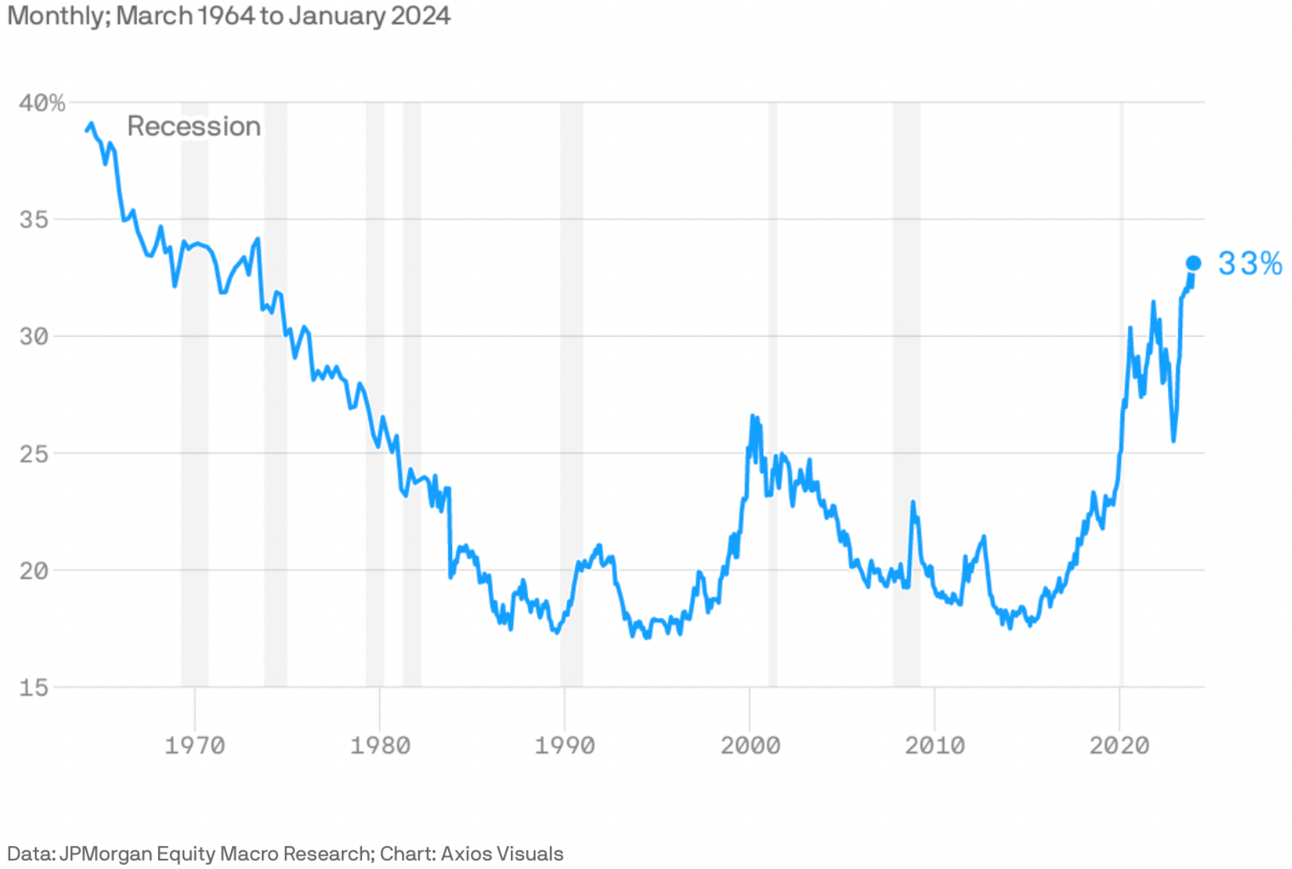

The Fast Five → S&P 500's top stocks haven't been this concentrated in 50 years, Powell tells ‘60 Minutes’ Fed wary of cutting rates too soon, Palantir stock jumps 19% on revenue beat, Tesla is losing the Magnificent Seven cage fight, and Tech industry starts the year with 32,000 job cut…

Your 5-minute briefing for Tuesday, February 6:

BEFORE THE OPEN

As of market close 2/5/2024.

Pre-Market:

Market Recap:

US stock futures near flatline post sell-off due to bond yields and rate cut uncertainty.

Dow futures down 0.1%, S&P 500 down 0.05%, Nasdaq 100 up 0.02%.

Palantir surges 19% on Q4 beat, NXP Semiconductors up 3.3%.

S&P 500, Dow pull back from highs, down 0.32% and 0.71%; Nasdaq down 0.2%.

10-year Treasury yield up 13 points to 4.16% after Fed Chair Powell's remarks.

Concerns about market sustainability raised by Bob Doll.

NY Fed's Q4 household debt report, central bank speakers, and earnings: Eli Lilly, Spirit, DuPont in AM; Amgen, Chipotle, Ford after bell.

EARNINGS

What we’re watching this week:

Today: Chipotle Mexican Grill (CMG), Ford Motor (F), KKR (KKR), MicroStategy (MSTR), Spotify Technology (SPOT)

Eli Lilly (LLY) - expected: $2.36 per share (+12.9% YoY) on $9.0B revenue (+22.9% YoY)

Wednesday: Roblox (RBLX)

Walt Disney (DIS) - expected: $1.04 per share (+5.1% YoY) on $23.8B revenue (+1.3% YoY)

Thursday: Affirm (AFRM), AstraZeneca (AZN), Spirit Airlines (SAVE)

Friday: PepsiCo (PEP)

Full earnings calendar here

HEADLINES

Powell tells ‘60 Minutes’ Fed is wary of cutting rates too soon (more)

Stock market in a ‘very dangerous’ position as jobs and wages run hot (more)

Goldman believes it's likely the 'Magnificent 7' beats the market again this year (more)

Fed says banks tightened credit standards in fourth quarter (more)

Bill Gross is betting on a steeper yield curve (more)

NYCB’s tense talks with watchdog led to moves that rocked market (more)

Oil market will face supply shortage by end of 2025, Occidental CEO says (more)

Mortgage rates jump back over 7% as stronger economic data rolls in (more)

Palantir stock jumps 19% on revenue beat (more)

Boeing finds more misdrilled holes on 737 in latest setback (more)

Snap cutting 10% of staff as social media copes with ad slump (more)

Tesla is losing the Magnificent Seven cage fight (more)

US regional lenders' commercial real estate exposure in spotlight after carnage (more)

AI chip demand forces Huawei to slow smartphone production (more)

Wegovy maker inks $16.5 billion deal to boost weight-loss drug supply (more)

NYC apartment buildings are on sale now for 50% off (more)

TOGETHER WITH WISERADVISOR

Compare advisors in your area— FREE

Connect with the best financial advisor for your needs from WiserAdvisor - a free, independent and unbiased matching service…

Trusted by over 100,00+ consumers since 1998

FREE initial 1 on 1 consultation

Get a custom match with 1-3 Advisors with NO match fee

Simply answer a few questions and get matched with 2-3 financial advisors in your area today…

~ please support our sponsors ~

DEALFLOW

M+A | Investments

Blackstone considers bid for skin-care company L’Occitane (more)

Byron Allen says he’s begun talks with Paramount on $14.3B buyout bid (more)

DocuSign falls on report Bain, Hellman & Friedman are losing interest (more)

Stellantis says no merger plans after Renault report (more)

CVC weighs sale of hotel booking app Good Choice (more)

Fosun considers sale of $800M stake in Ageas (more)

Novo Nordisk parent to buy Catalent for $16.5B to expand Wegovy supply (more)

Yandex owner to exit Russia in $5.2 billion deal (more)

Merck Animal Health buys Elanco’s Aqua business for $1.3B (more)

MedImpact Healthcare Systems, Inc., an independent health solutions and benefit management provider, acquired Elixir Solutions, a pharmacy benefits and services company (more)

Cantaloupe, Inc. (CTLP), a provider of end-to-end technology solutions for self-service commerce, acquired Cheq Lifestyle Technology, Inc., a provider of solutions that streamline venue operations (more)

Chainwire Merlin Chain, the native Bitcoin Layer2, announced a round of funding from 24 investors including OKX Ventures, ABCDE, Foresight Ventures and Arkstream Capital (more)

Furno Materials, a company that is building modular cement plants, received an investment from O’Shaughnessy Ventures (more)

Inovalon, a provider of cloud-based software solutions empowering data-driven healthcare, acquired VigiLanz, a SaaS-based clinical surveillance and patient safety software and data company (more)

JuneShine, a hard kombucha and ready-to-drink spirits brand, received an investment from InvestBev (more)

Trilantic-backed OLS acquires The Rock Place (more)

Thoma Bravo acquires Everbridge (more)

CBRE purchases J&J Worldwide (more)

Comfort Systems buys Summit Industrial Construction (more)

Aquiline partners with Health Prime (more)

Investcorp invests in Banner Ridge Partners (more)

VC

Procyrion, a medical device company, raised $57.7M in Series E funding, including the conversion of $10.0M of interim financing (more)

ProducePay, an agtech company, raised $38M in Series D funding (more)

Statuspro, a sports technology and gaming company, raised $20M in Series A funding (more)

Vektor Medical, a pioneer in non-invasive, AI-based arrhythmia analysis technology, announced a $16M Series A investment (more)

Nibiru Chain, a provider of a general-purpose layer 1 blockchain, raised $12M in funding (more)

Nauticus Robotics (KITT), a developer of subsea robots and software, raised $12M in funding (more)

Meme Kombat, a provider of Web3 igaming platform, raised nearly $8M in its fundraising campaign (more)

Candor Technology, Inc., a provider of automated underwriting technology and other tech solutions for the mortgage industry, closed a Series B equity funding round of undisclosed amount (more)

Rivia Health, a provider of a revenue cycle management solution for healthcare provider organizations, raised $3.25M in Seed funding (more)

Was this briefing forwarded to you? Sign Up Here

CRYPTO

BULLISH BITES

🎯 Strategy: B2B vs. B2C is not about who’s buying, but how you’re selling.

😱 Trending: Layoffs in the age of TikTok have employers doing damage control.

💡 Playbook: How to write your monthly investor update.

👀 Watching: Silicon Valley’s new start-ups: City-States.

💰 Find yours! Connect with the best financial advisor in your area from WiserAdvisor - a free, independent and unbiased matching service…. Try WiserAdvisor and get matched, free »

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

Disclaimer: MarketBriefing is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the MarketBriefing team. 2/6