Good morning.

The Fast Five → Powell gives the September rate cut signal, bank stocks rally to two-year high, Boeing taps aerospace veteran as new CEO, Ackman’s Pershing Square withdraws IPO amid low demand, and Nvidia surges on Microsoft’s magic words …

Calendar: (all times ET)

Today

Initial jobless claims, 8:30 AM

Tomorrow

Employment report, 8:30 AM

Your 5-minute briefing for Thursday, August 1:

(Note: we’ve made some changes to improve mobile viewing - let us know what you think)

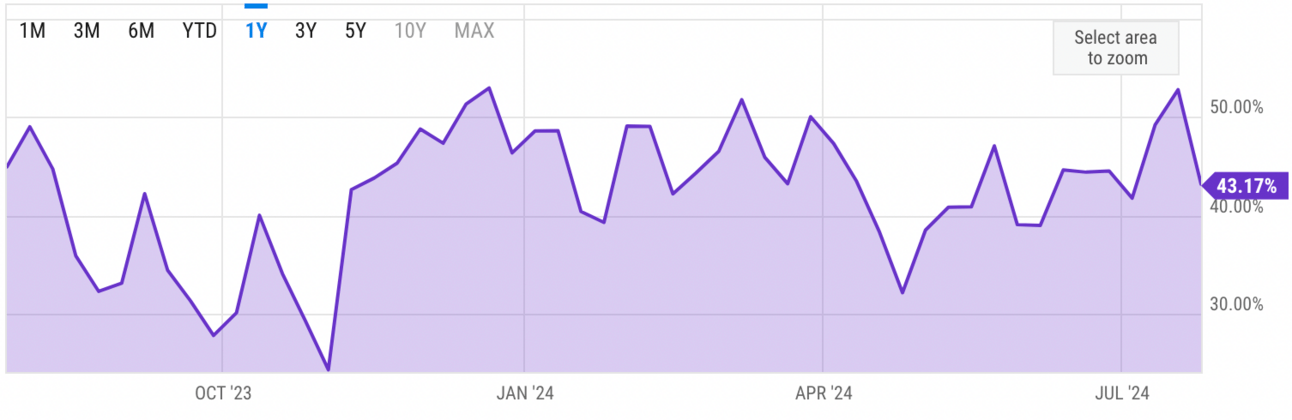

US Investor % Bullish Sentiment:

↓43.17% for Wk of July 25 2024

Last week: 52.75%. Updates every Friday.

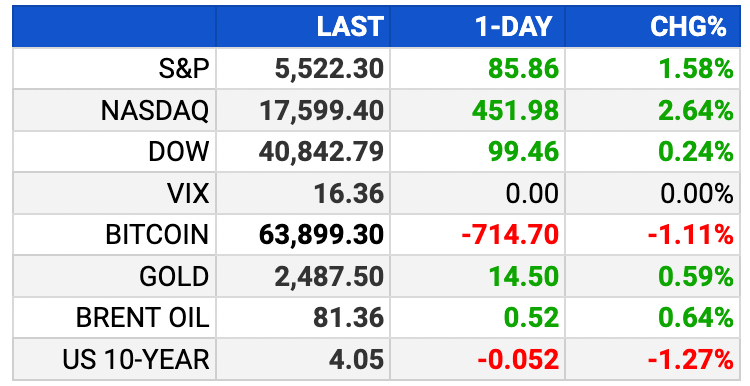

Market Wrap:

S&P 500 +1.58%, Nasdaq +2.64%, Dow +0.24%.

Meta Platforms up 7% on strong Q2 results.

Arm Holdings down 10% on weak guidance.

Fed Chair Powell hints at a September rate cut.

Tech stocks bounced: Nvidia +13%, Semiconductor ETF +8%.

July recap: Nasdaq -0.8%, S&P +1.1%, Dow +4.4%.

Earnings ahead: Apple, Amazon, Intel, Moderna.

EARNINGS

HEADLINES

Officials tempered their assessment of the labor market. They said inflation has eased over the past year but remains “somewhat elevated.”

Slowing wage gains restrain US labor costs in second quarter (more)

Traders rush back to oil options to hedge Mid-East political risk (more)

Wall St panel endorses T-bill supply scorned by republicans (more)

Japan raises interest rates for second time since 2007 (more)

Nvidia’s stock surges 13% as Microsoft says the magic words (more)

Meta shares pop on revenue and earnings beat (more)

Arm slides after sticking with tepid annual sales forecast (more)

Amazon set to join Big Tech's spending surge as AI race heats up (more)

Boeing taps new CEO, aerospace veteran Ortberg (more)

Bill Ackman’s Pershing Square withdraws IPO as demand for offering waned (more)

UAW union endorses Vice President Kamala Harris (more)

23andMe CEO files proposal to take company private as stock craters (more)

A Massive $1 Trillion AI Superproject is Underway

AI is growing exponentially. That means thousands of existing facilities are now obsolete.

New billion-dollar mega complexes are rising in their place.

And Nvidia, the hottest company in the world, is playing a vital role in their production.

But they’re not alone …

Nvidia needs a critical group of Silent Partners to help get the job done.

- sponsored message -

DEALFLOW

M+A | Investments

Robot software maker Covariant gets takeover inquiry from Amazon (more)

Italy’s Bending Spoons buys WeTransfer file-sharing pioneer (more)

CBIZ to acquire accounting firm Marcum in $2.3B deal (more)

ClickHouse, Inc., a company behind a popular real-time analytical database, acquired PeerDB, a provider of change data capture solutions for Postgres databases (more)

Dotmatics, a leader in R&D scientific software connecting science, data, and decision-making, acquired EasyPanel, a company specializing in flow cytometry panel design software (more)

Fiverr announced its acquisition of AutoDS, a subscription-based end-to-end solution for dropshippers (more)

Halcyon, a platform designed to defeating ransomware, received a strategic investment from Cisco Investments (more)

Winky Lux, a beauty brand known for its innovative products and commitment to clean, cruelty-free formulations, received a majority investment from CORE Industrial Partners (more)

VC

FleetPulse, an innovator in trailer telematics, received an additional funding of undisclosed amount (more)

Gloo, a tech platform dedicated to connecting the faith ecosystem and releasing its collective might, closed a $110M financing (more)

Spring Health, a mental health solution for employers and health plans, raised $100M in Series E funding with valuation of $3.3B (more)

Airna, a biotech company advancing RNA therapeutics for patients with diseases, closed a $60M financing round (more)

Rhombus, a leader in cloud-managed physical security, raised $45M in Series C funding (more)

Ema, a gen AI company creating the universal employee of the future, added $36M to its Series A funding totaling $50M (more)

Graphyte, a leader in the durable carbon removal industry, closed a $30M Series A funding round (more)

Applied Carbon, a tech company designing automated biochar production machines that convert crop waste into biochar, raised a $21.5M in Series A funding (more)

Checkly, a provider of synthetic monitoring powered by Monitoring as Code and Playwright, raised $20M in Series B funding (more)

Gigpro, an on-demand labor marketplace for the hospitality industry, closed a $16M Series A funding round (more)

Leaf, a unified farm data API and farm data processing platform, closed a $11.3M Series A funding (more)

Icebreaker, an open professional network, raised $5M in seed funding (more)

Matereal, a plastic replacements technology company, closed a $4.5M seed funding round (more)

FranShares, a platform for franchise investing, raised $4.1M in seed funding (more)

Endari, a cybersecurity company, raised $4M in seed funding. The backers were not disclosed (more)

Not Diamond, a product that gives developers the ability to route AI queries to the best-suited models, raised $2.3M in funding (more)

CRYPTO

BULLISH BITES

🔥 Next Move: He called Nvidia at $8. Here’s his next pick … *

😎 Watch Out: AMD is becoming an AI chip company, just like Nvidia.

👊 Next Level: California's DMV is attempting to fight fraud by uploading 42 million car titles to the blockchain.

🤡 Crazy: Google wins the gold medal for worst Olympic ad.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.