Good morning.

The Fast Five → A traders guide to markets in a shutdown, Amazon overhauls devices to take on Apple, Trump and Pfizer announce deal, Alphabet fuels biggest quarterly jump since 2005, and silver nears record in hockey stick rally…

📌 "The America you knew is dying in front of you" — That's the warning the former $200M hedge fund firm manager who predicted 2008 and 2020 just issued. He says if you're over 50, there's one urgent move you need to make to survive... or risk getting left behind. The rules are changing: Here's your financial lifeline » (ad)

Calendar: (all times ET) - Full Calendar

Today:

ADP Employment, 8:15A

ISM Manufacturing PMI, 10AM

ISM Manufacturing Prices, 10AM

Tomorrow:

Unemployment Claims, 8:30A

Your 5-minute briefing for Wednesday, Oct 1:

US Investor % Bullish Sentiment:

↑ 41.73% for Week of SEP 25 2025

Previous week: 41.67%

Market Wrap:

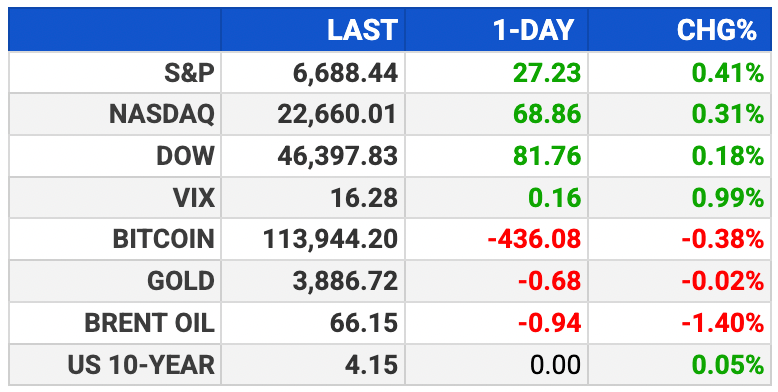

Futures lower: Dow -52 (0.1%), S&P -0.2%, Nasdaq -0.2%.

Shutdown likely at midnight without a funding deal.

SEC preps staff; Trump calls stoppage “probably likely.”

Risks higher this time: weak labor, sticky inflation, rich valuations.

Stocks still closed higher Tuesday; S&P gained 7.8% in Q3.

Nike +4% after strong earnings surprise.

EARNINGS

Here’s what we’re watching this week:

Today: Conagra $CAG ( ▼ 1.18% ), Levi $LEVI ( ▲ 2.83% )

A Strange Chasm is Coming to Wall Street...

It's already creating new wealth at the fastest pace in history.

CNBC calls it "the largest wealth creation spree in history." Yet 1 in 3 Americans now fear their financial situation is deteriorating.

There's only one way to survive, says the man who predicted 2008 and 2020, but sadly it's already too late for many.

- a message from Stansberry Research -

HEADLINES

Dow hits record as stocks cap high-flying quarter (more)

Trump threatens to fire 'a lot' of federal workers if shutdown proceeds (more)

Trump and Pfizer announce deal to lower drug prices (more)

Pfizer gets 3-year grace period from Trump pharma tariffs (more)

US consumer confidence weakens in Sept on labor market worries (more)

'Frozen' job market shows little sign of thawing (more)

Silver nears record in hockey stick rally, gold approaches $4,000 (more)

Fed agrees to shrink Morgan Stanley's 'stress capital buffer' (more)

Nvidia’s market cap tops $4.5 trillion after string of AI deals (more)

Alphabet's AI strength fuels biggest quarterly jump since 2005 (more)

Meta said to acquire chips startup Rivos to push AI effort (more)

Berkshire nears $10 billion deal for OxyChem (more)

Nike earnings, sales top forecasts amid turnaround efforts (more)

CoreWeave surges as $14B Meta deal signals 'limitless' demand (more)

Disney sent cease and desist letter to CharacterAI (more)

Ford CEO expects EV sales to be cut in half after end of tax credits (more)

Oil companies slash jobs by the thousands as prices fall, tariffs rise (more)

Spirit Airlines on track for a $475M bankruptcy lifeline (more)

DEALFLOW

M+A | Investments

Meta to acquire chip startup Rivos

Berkshire in talks to buy Occidental’s OxyChem unit

Prada gets EU approval for Versace acquisition

Electronic Arts buyout progresses

VC

Crystalys Therapeutics, a clinical-stage biopharma company, raised $205M in a Series A financing

Eve, an AI platform for plaintiff law firms, raised $103M in Series B funding at over a $1B valuation

Assort Health, a patient experience platform empowered by specialty-specific agentic AI, raised $76M in Series B funding

Vibe.co, an ad platform focusing on CTV performance marketing, closed $50M in Series B financing

SureCo, an ICHRA administrator, raised $23M in Series A funding

Alex, an AI agent company conducting video and phone interviews, raised $20M in funding

Datawizz, a platform that delivers efficient AI by replacing generic large models with specialized language models, raised $12.5M in Seed funding

AdPipe, an AI-powered video platform, raised $12M in Series A funding

Anything, an AI agent platform turning prompts into production-ready apps, raised $11M in Series A funding at a $100M valuation

Tie, an AI-powered identity platform for e-commerce brands, raised $10M in Series A funding

Supernova, a platform uniting design, code and product, raised $9.2M in Series A funding

Notable, a company specializing in pay-at-close financing for home sale prep, raised $6M in Series A funding

CRYPTO

BULLISH BITES

💊 Get ready for TrumpRx.

🥡 DoorDash’s Dot delivery bots might be coming to a bike lane near you.

👽 Tourists are flocking to a Chinese megacity that’s straight out of Sci-Fi.

☕️ Instructions for your high-end Italian espresso machine.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.