Good morning.

Happy New Year! 🎉

The Fast Five → Classified docs stolen from US Treasury by Chinese hackers, US announces $5.9 billion aid to Ukraine, BlackRock’s Bitcoin Fund became ‘greatest launch in ETF history’, Gold on track for best year in over a decade, and NYSE to close on Jan. 9 in honor of the late former President Jimmy Carter…

Unveiled: NVIDIA's "Secret Royalty" Program

"Civilization will crumble" without this company. - Elon Musk

This investment will give you the opportunity to collect what amounts to a "royalty" every time someone makes a computation...

Calendar: (all times ET) - Full calendar

Today:

no notable reports

Tomorrow:

New Years holiday

Your 5-minute briefing for Tuesday, December 31:

US Investor % Bullish Sentiment:

↓ 40.71% for Week of December 19 2024 *

Previous week: 43.33%. Updates every Friday. *Delayed update due to holiday

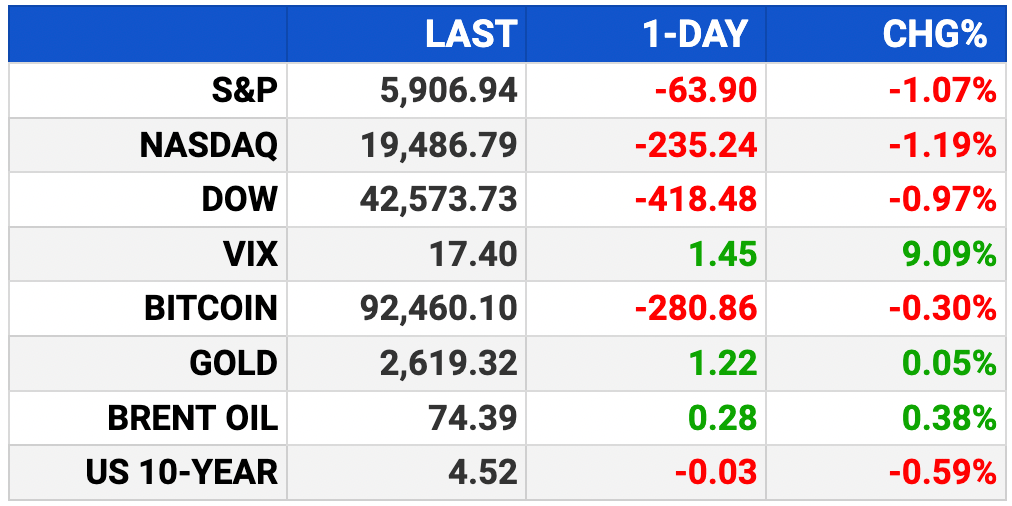

Market Wrap:

Futures dip as 2024 ends

S&P +23.8% YTD, Nasdaq +29.8%, Dow +13%, powered by AI and rate cuts.

Nvidia, Apple lead tech rally, pushing indexes to records.

Fed cut rates by 100 bps since September; slower cuts expected in 2025.

December sees profit-taking; Dow -5.2%, S&P -2.1%, Nasdaq +1.4%.

EARNINGS

No noteworthy earnings scheduled for release this week. See full calendar »

HEADLINES

NYSE to close on Jan. 9 in honor of the late former President Jimmy Carter

Wall Street ends sharply lower on penultimate trading day of a strong 2024 (more)

Treasury yields fall as final trading week of 2024 kicks off (more)

Value-seekers drove 2024’s retail trends and dead ends (more)

Dollar stands tall in 2024, propped up by cautious Fed, Trump trade (more)

Gold on track for best year in over a decade (more)

Oil rises on Chinese factory activity, but set to end year lower (more)

Natural-gas prices soar on frigid forecast (more)

US pending home sales hit 21-month high in November (more)

China Dec factory activity expands at slower pace as trade risks rise (more)

US announces $5.9B in military and budget aid to Ukraine (more)

US files complaint against fintech app Dave and its CEO (more)

Bill Ackman expects Trump to privatize Fannie Mae and Freddie Mac (more)

MicroStrategy falls as much as 6% after latest bitcoin purchase (more)

TOGETHER WITH UPMARKET

Access Hedge Funds and Pre-IPO Deals

Join UpMarket for free and start investing in hedge funds and pre-IPO companies today. No membership fees. No pressure to invest. Start building your diversified portfolio now.

- Shortened briefing during holiday -

Dealflow, Crypto, and Bullish sections

will resume on January 2, 2025. Happy New Year!

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.