Good morning.

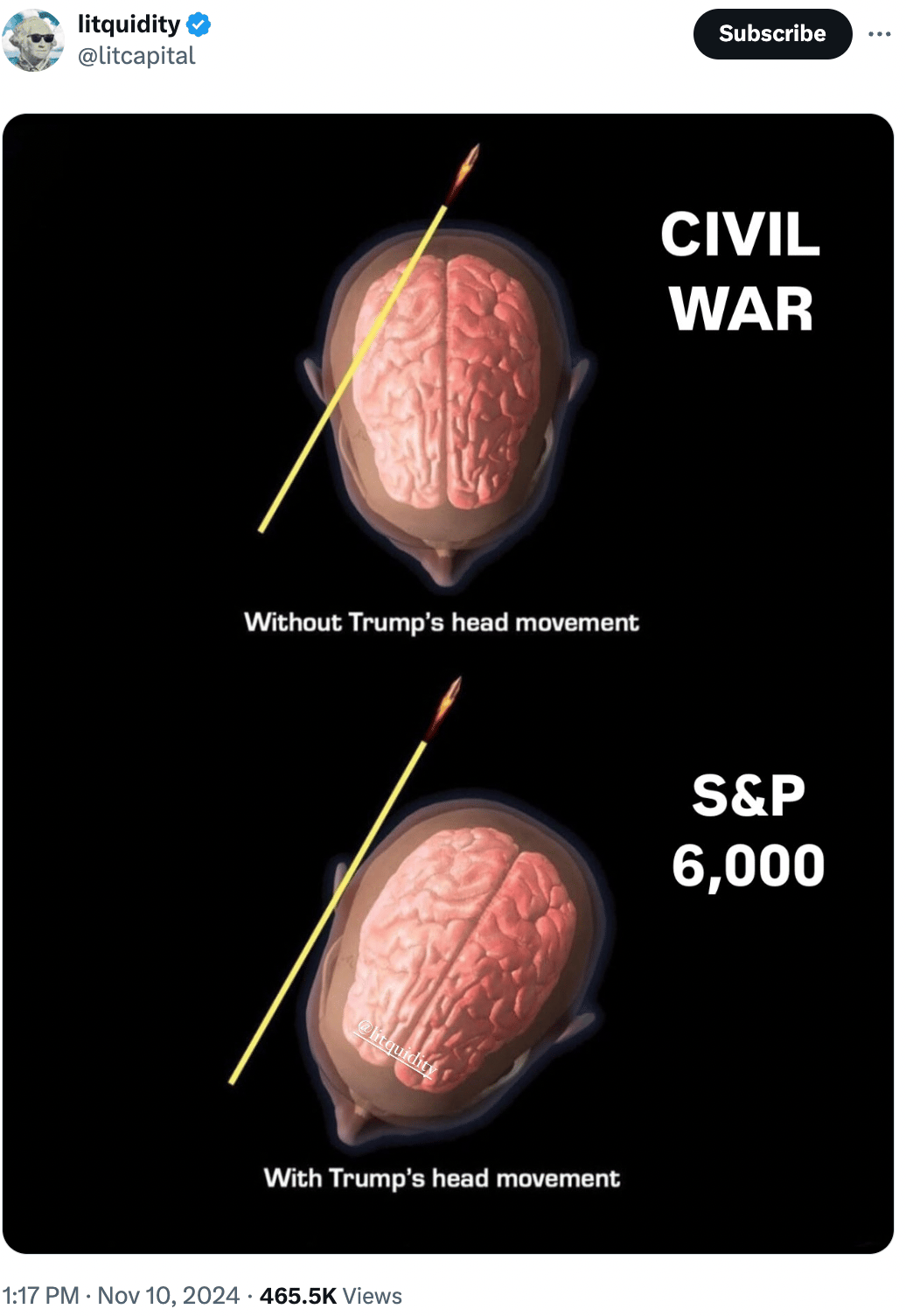

The Fast Five → Bitcoin closes in on $90,000 for the first time ever, Trump trade powers Dow 44,000, S&P 6,000, Wall Street looks forward to less regulation, Chipotle names new permanent CEO, and Tesla shares pop 9% as rally continues…

🚀 Bitcoin skyrockets on Trump’s election. Which coin is next?

From Weiss Research

Calendar: (all times ET) - Full calendar here

Today:

Consumer price index (CPI), 8:30 am

Tomorrow:

None

Your 5-minute briefing for Tuesday, November 12:

US Investor % Bullish Sentiment:

↑ 41.54% for Week of November 07 2024

Last week: 39.48%. Updates every Friday.

Market Wrap:

Futures flat as Wall Street assesses postelection rally

Dow tops 44,000; S&P above 6,000; Nasdaq hits 4th straight record. Bitcoin over $89K.

“Markets watching election-driven policies,” says Larry Tentarelli.

CPI data today, PPI inflation data later this week.

EARNINGS

Here’s what we’re watching this week.

Home Depot (HD) - earnings of $3.64 per share (-4.5% YoY), on revenue of $39.1B (-3.6% YoY)

Cisco (CSCO) - earnings of $.87 cents per share (-21.6% YoY) on $13.8B revenue (-6.1% YoY)

Thursday:

WALT DISNEY (DIS) - anticipate earnings of $1.10 per share on $22.4B revenue

Friday: Alibaba (BABA)

See full calendar here.

HEADLINES

Trump is the most pro-stock market president in history, Wharton’s Jeremy Siegel says (more)

Wall Street looking forward to less regulation and higher profits (more)

Bond market on risky path as traders regroup from wild week (more)

Gold dips as dollar rallies (more)

Oil prices hold their ground after falling on China stimulus (more)

Asian markets mostly decline, shrugging off Wall Street’s rally (more)

Blackstone CEO’s Trump bet pays off as His No. 2 plays powerful hedge (more)

Ex-Trump antitrust cop in touch with transition team about FTC job (more)

Tesla shares pop 9% as postelection rally continues (more)

Hedge funds shorting Tesla just lost more than $5 billion (more)

TSMC halts chip shipments to Chinese companies (more)

Amazon developing driver eyeglasses to shave seconds off deliveries (more)

Chipotle Mexican Grill names Scott Boatwright as permanent CEO (more)

TOGETHER WITH FOUR NINES GOLD

This Stock is Up 220% and Primed for the Next Breakout

Bank of America analysts predict gold will hit $3,000 by 2025 — and this hidden gold stock is set to benefit.

With gold's post-election dip, now could be a good opportunity to consider adding to your portfolio. Savvy investors understand the value of holding gold and gold stocks.

This stock has made impressive gains in recent years, and with insiders continuing to buy, it's one to keep on your watchlist.

P.S. The last gold stock we highlighted in this newsletter saw a strong rally, climbing over 60% just days after our feature. Be sure to keep this one on your watchlist!

This is a sponsored advertisement on behalf of Four Nines Gold. Past performance does not guarantee future results. Investing involves risk. View the full disclaimer here: https://shorturl.at/73AF8

DEALFLOW

M+A | Investments

Blackstone nears deal to buy American Industrial Partners stake (more)

Endeavor to sell OpenBet, IMG Arena for $450M to management-led group (more)

Morgan Stanley's PE arm to sell HVAC firm to Goldman Sachs Alternatives (more)

AlloVir (ALVR), a T cell immunotherapy company, merged with Kalaris Therapeutics, a clinical-stage biopharmaceutical company (more)

Malwarebytes, a real-time cyber protection solutions company, acquired AzireVPN, a privacy-focused VPN provider (more)

Centana Growth Partners, a growth equity firm specializing in the financial services ecosystem, acquired a majority stake in First Connect Insurance Services, an insurtech platform, formerly an indirect subsidiary of Hippo Holdings Inc. (more)

Serve Robotics (SERV), an autonomous robotic delivery company, acquired Vebu, an automation and robotics solutions for restaurant partners (more)

BigTime Software, a provider of time tracking, project management, resource management, invoicing, and payment solutions for professional services businesses, acquired WorkRails, a CPQ and workflow automation platform built specifically for professional services organizations (more)

Contego Investigative Services, a company specializing in delivering comprehensive investigative and fraud solutions, acquired Investigation Specialists, Inc., a surveillance provider (more)

ECI Software Solutions, cloud-based business management software and services, acquired Avid Ratings, a provider of customer experience solutions for the homebuilding industry (more)

HTEC, an end-to-end digital product development and engineering services company, acquired eesy-innovation, an embedded hardware and software engineering company (more)

Hale Capital Partners, a private growth equity firm, acquired a majority stake in Athenium, an innovative risk and quality management solutions for insurance, finance and government sectors (more)

Oyster, an employment solution to employ, pay, and care for distributed teams, received a $5M investment from ServiceNow Ventures (more)

Thoma Bravo signed an agreement to sell a significant minority stake in Qlik, a global leader in data integration and analytics, to a subsidiary of the Abu Dhabi Investment Authority (more)

VC

ZAP Surgical Systems, a non-invasive robotic brain surgery company, raised $78M in Series E funding (more)

UnifyApps, a Unified Enterprise AI Agent platform, closed a $20M Series A funding round (more)

Parker, an e-commerce financial platform, raised $20M in Series B funding (more)

BayBridgeDigital, a company specializing in digital transformation and Salesforce consulting, raised $6M in funding (more)

PuppyGraph, a graph query engine company, raised $5M in Seed funding (more)

Algorized, an AI-powered platform developing advanced people-sensing and positioning software, raised $4.3M in Seed funding (more)

Conflixis, Inc., a data and risk intelligence company, raised $4.2M in seed funding (more)

Talli, a digital payments platform for the legal industry, raised $4M in Seed funding (more)

SocialCrowd, a workforce performance company, raised $2.5M in Seed funding (more)

Craftt, a platform built on decentralized infrastructure for the modern workforce, raised $2M in Seed funding (more)

Nimbus Power Systems, a developer of fuel cell technologies for heavy-duty vehicles, raised an undisclosed amount in funding (more)

EpiBone, a regenerative medicine company, raised an undisclosed amount in funding (more)

CRYPTO

BULLISH BITES

📈 Don’t Miss: The centerpiece of Trump’s crypto’s masterplan » *

💼 New Recruit: Goldman Sachs veteran joins Melania Trump’s transition team.

📚 Crushed: How ChatGPT brought down an online education giant.

🧘🏻♀️ $1B Sales: Lululemon's $150 yoga pants become surprise hit in slowing China.

🎁 Gift Guide 2024: The best gadgets for new homeowners

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.