Good morning.

The Fast Five → Trump insists Powell cut rates now, US asks judge to break up Google, dollar hits three-year low, Musk caught in ‘code red’ moment at Tesla, and Trump hosts Walmart and Target CEOs for tariff meeting…

Calendar: (all times ET) - Full Calendar

Today:

none scheduled

Tomorrow:

New home sales, 10:00A

Fed Beige Book, 2:00P

Your 5-minute briefing for Tuesday, April 22:

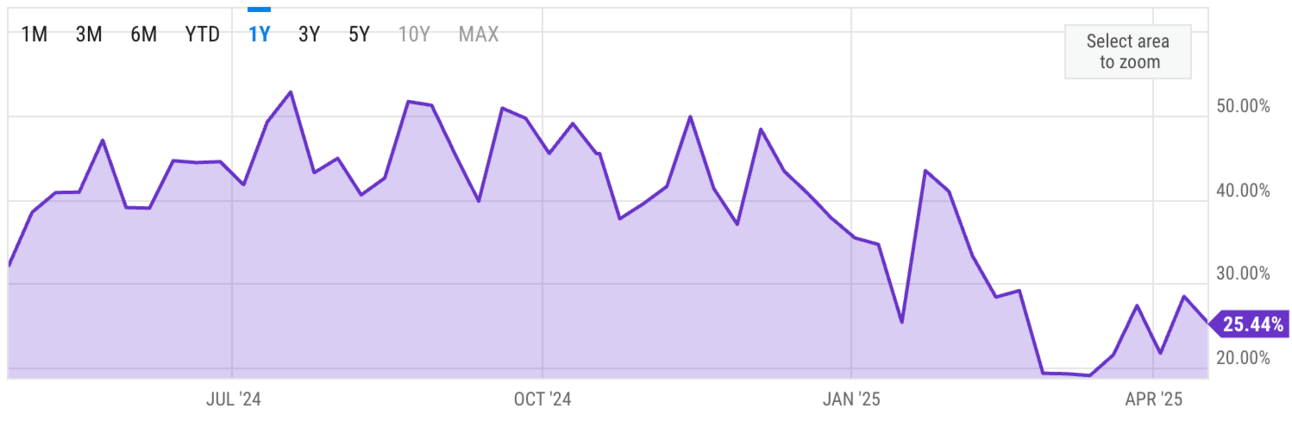

US Investor % Bullish Sentiment:

↓ 25.44% for Week of April 17 2025

Previous week: 28.52%. Updates every Friday.

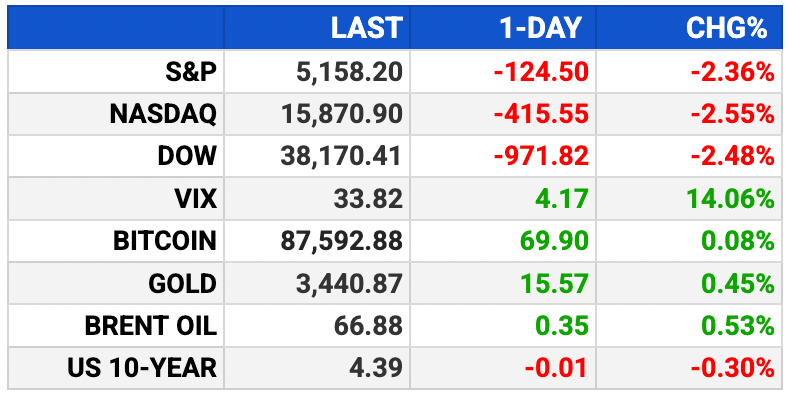

Market Wrap:

Futures: Dow +122 pts (+0.3%), S&P +0.4%, Nasdaq +0.4%.

Monday: Dow -970 pts, S&P/Nasdaq -2%+; indexes -9%+ since April 2.

Trump slams Powell as “major loser,” hints at firing; adds to market volatility.

Earnings Tues: LMT (AM), TSLA (PM).

Richmond Fed survey + key Fed speakers ahead.

EARNINGS

Here’s what we’re watching this week:

Today: Bank of America $BAC ( ▲ 0.21% ), Citigroup $C ( ▲ 1.85% )

Tesla $TSLA ( ▼ 0.08% ) - earnings per share of $.42 (-6.7% YoY), on $21.5B revenue (+1.1% YoY)

Wednesday: AT&T $T ( ▲ 0.48% ), Boeing $BA ( ▲ 3.47% )

Chipotle $CMG ( ▲ 0.19% ) - earnings of $.28 per share on same-store sales growth of 2.2%

Thursday: American Airlines $AAL ( ▲ 0.43% ), Intel $INTC ( ▼ 1.56% ), PepsiCo $PEP ( ▲ 1.96% ), Procter & Gamble $PG ( ▲ 2.55% ), Southwest $LUV ( ▼ 0.48% )

Alphabet $GOOGL ( ▼ 1.42% ) - earnings of $2.01 per share (+6.3% YoY) on $89.2B revenue (+10.7% YoY)

SIGNAL

A few sharp perspectives we found compelling:

- from our research partners -

HEADLINES

Dow slides more than 950 points as Trump rips Fed Chair Powell (more)

Traders unfazed in ‘quietest’ market selloff as big days pile up (more)

The Federal Reserve's dual mandate dilemma (more)

Trump hosts Walmart and Target CEOs, Home Depot and Lowe’s execs for tariff meeting (more)

Dollar hits 3-yr low as Trump attacks threaten Fed's independence (more)

Gold extends record run, breaks above $3,400/oz on safe-haven rush (more)

Google: DOJ’s breakup proposal would harm US in ‘global race with China’ (more)

FTC sues Uber over ‘deceptive’ subscription service (more)

China’s trade war playbook is coming into focus (more)

Musk caught in ‘code red’ moment at Tesla (more)

Harvard sues Trump admin as funding fight escalates (more)

DEALFLOW

M+A | Investments

Toyota, Daimler near merger of truck units

Advisory firms Baker Tilly and Moss Adams set to merge in $7 billion deal

UBS to sell its India wealth business to asset manager 360 ONE WAM for $36M

Lexington Medical, a leader in minimally-invasive surgical stapling solutions, received a growth investment from Ampersand Capital Partners

GSR, a crypto trading and investment firm, anchored a $100M PIPE into Upexi, Inc., a brand owner specializing in consumer products

VC

Exaforce, an Agentic SOC platform, raised $75M in Series A funding

Crux, a capital markets tech company, raised $50M in Series B funding

Goodfire, an AI research company, raised $50M in Series A funding

GoldState Music, a music rights investment platform, raised $500M in strategic capital

Electra.aero, Inc., an aerospace company, secured $115M in Series B funding

Yarbo, a multipurpose intelligent yard robot, closed its Series B funding round, raising approximately $27M

Brellium, an AI-powered clinical compliance platform, raised $13.7M in Series A funding

Capsule, a video editor made for enterprise, raised $12M in Series A funding

Roh, a hospitality industry's payments management platform, closed a $9.2M financing round

Kenzo Security, an agentic AI security operations platform provider, emerged from stealth with $4.5M in funding

Cosmic Robotics, a robotics startup, raised $4m in funding

Risa Labs, an oncology AI company, raised $3.5M in funding

CRYPTO

BULLISH BITES

🚨 “A major collapse is about to hit the stock market…” *

💰 Millionaire tax would generate about $400 billion in revenue

🇨🇭 Why high-net-worths are moving their money to Switzerland.

🎬 Hollywood talent shop CAA seeks new client: Billionaire families

👢 Actor Pedro Pascal is inspiring a new zaddy fashion trend: knee-high leather boots.

DAILY SHARES

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.