Good morning.

The Fast Five → Fed holds rates steady but eyes two more cuts this year, Trump calls for 10 Fed rate cuts, investors see quick market drop if US joins Iran conflict, Microsoft abandons high-stakes talks with OpenAI, and the US added 1,000 new millionaires a day last year…

Good News for Stocks

50-year Wall Street veteran, Marc Chaikin is stepping forward to share why history gives him 90% historical confidence that stocks will end 2025 up.

However, he also has bad news: the same data also tells him the REAL market crash will likely arrive in 2026. Go here to see the month and day he estimates it will begin » (from Chaikin Analytics)

Calendar: (all times ET) - Full Calendar

Today:

Consumer sentiment, 10:00A

Monday:

none watched

Your 5-minute briefing for Friday, June 20:

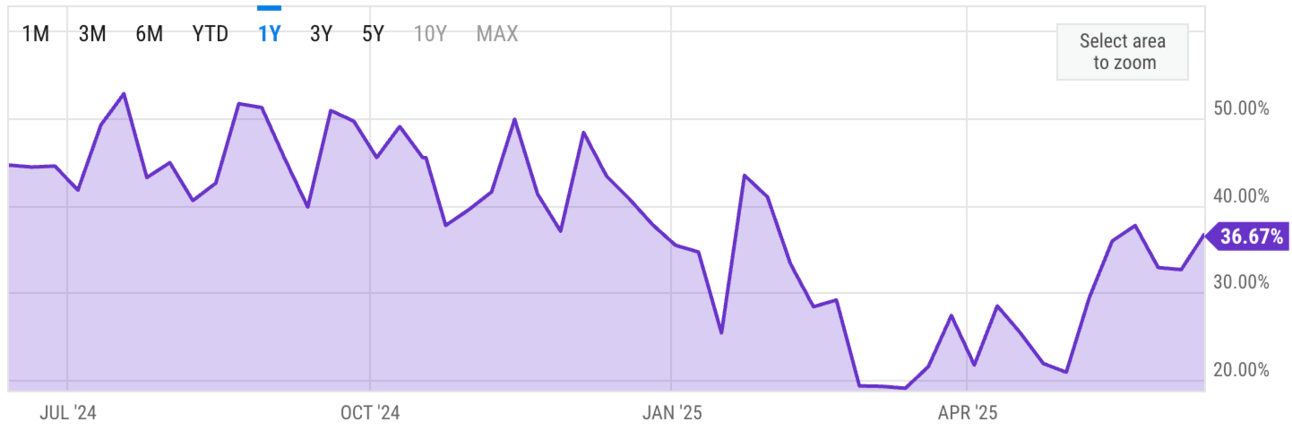

US Investor % Bullish Sentiment:

↑ 36.67% for Week of JUN 12 2025

Previous week: 32.66%.

Market Wrap:

• Dow -44 pts (-0.10%) to 42,171.66; S&P -0.03%; Nasdaq +0.13%

• Fed holds rates steady at 4.25%–4.5%, as expected

• Signals 2 cuts this year, but sees slower growth + hotter inflation

• Core inflation forecast raised to 3.1%; 2025 GDP cut to 1.4%

• Trump: Iran wants to negotiate, may send delegation to D.C.

• Iran warns US of “irreparable damage” if it enters the conflict

EARNINGS

Light earnings week. Here’s what we’re watching:

Today: Kroger $KR ( ▼ 1.88% )

Darden Restaurants $DRI ( ▲ 2.01% ) - $2.94 eps (+10.9% YoY) on $3.3B revenue (+10% YoY)

TOGETHER WITH VIRTUIX

Final Chance to Own a Piece of Virtuix

Virtuix is redefining the future of immersive entertainment — and time is running out to join in. Its flagship “Omni” treadmill lets users physically walk and run in 360 degrees through virtual worlds, with real-world applications across gaming, fitness, and military training.

✅ $18M+ in product sales

✅ 400K+ registered players

✅ 4X revenue growth in the last fiscal year

✅ Backed by $40M+ from top investors, including Shark Tank’s Kevin O’Leary

With over $2.7M raised in this round, investor demand is accelerating — but the raise closes June 20.

This is your final chance to back one of the most exciting players in the VR space.

This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

HEADLINES

Stocks struggle, oil up for 3rd week as Trump weighs US action on Iran (more)

Investors see quick stock market drop if US joins Israel-Iran conflict (more)

Stagflation on the Fed’s mind (more)

Trump calls for the equivalent of 10 Fed rate cuts (more)

Global IPO activity slumps in 2025 as tariffs, volatility weigh (more)

Dollar set to finish week on upbeat note buoyed by safe-haven appeal (more)

Some warning signs for US dollar shorts (more)

Oil set to rise for third week on escalating Israel-Iran conflict (more)

Zero interest rates are back in Europe (more)

Trump extends deadline for US TikTok sale to September (more)

Microsoft prepared to abandon high-stakes talks with OpenAI (more)

Apple eyes using AI to design its chips, technology (more)

Tesla asked to delay robotaxi launch by Texas lawmakers (more)

Billionaire Dai to pocket $237M from Qualcomm deal (more)

DEALFLOW

M+A | Investments

Home Depot seeks to buy GMS in challenge to QXO

Fox acquires sports broadcasting platform Caliente TV

LA Lakers owners sell majority stake in the team at $10 billion valuation

Redwire Corporation acquired Edge Autonomy Intermediate Holdings, LLC

Pearson, a lifelong learning company, acquired eDynamic Holdings LP

Abacus Group, an IT MSP/MSSP, acquired Entara

VC

Teamworks, a sports operating system used by 6,500+ teams, raised $235M in Series F funding at a $1B+ valuation

Tennr, an orchestration platform designed to automate workflows in referral-based care, raised $101M in Series C funding

Actio Biosciences, a clinical-stage biotech company specializing in genetics and precision medicine, raised $66M in Series B funding

Payabli, a payments infrastructure platform for software companies, closed a $28M Series B funding round

Fleet, an open device management platform, raised $27M in Series B funding

Profound, a platform helping marketers with AI-generated responses, raised $20M in Series A funding

Sifflet, a data observability platform, raised $18M in funding

Grifin, an app that links investment to daily spending, raised $11M in Series A funding

PreciseDx, a breast cancer diagnostic provider powered by AI, raised $11M in additional funding

RevelAi Health, a conversational AI platform for musculoskeletal care coordination, raised $3.1M in Seed funding

Athena, a generative engine optimization platform provider, raised $2.2M in Seed funding from Y Combinator and others

CRYPTO

BULLISH BITES

⚠️ 50-year Wall Street quant issues critical warning. *

🥱 Barbarians no more: Private equity is giant now, and a bit boring.

📉 Billionaire Arnault grapples with biggest slump in LVMH history.

📧 Stop saying ‘hope you’re well’ in emails--do this instead.

🏯 Forget the bullet train – the best way to see Japan is by classic car.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.