Good morning.

No morning briefing tomorrow. Wishing you a safe and Happy New Year!

The Fast Five → The year the US economy bent but didn't break, ‘pick-and-shovel’ stocks are next leg in AI trade, gold and silver rebound after sharp sell-off, dollar on track for steepest drop in decade, and Buffett steps back as Berkshire enters a new era…

📌 His $274M Secret is an 18-Digit Code? A former hedge fund manager who made $274 million in profits for his clients says "yes." How? With something he calls "Skim Codes." You just type the code into a regular brokerage account. No stocks. No crypto. No guessing. He's sent out 52 money-making codes so far… with more coming soon. Get the full breakdown here for no cost » (ad)

Calendar: (*Shutdown may affect key data. All times ET) - Full Calendar »

Today:

Unemployment Claims, 8:30A

Tomorrow:

Happy New Year

Your 5-minute briefing for Wednesday, Dec 31 🎉

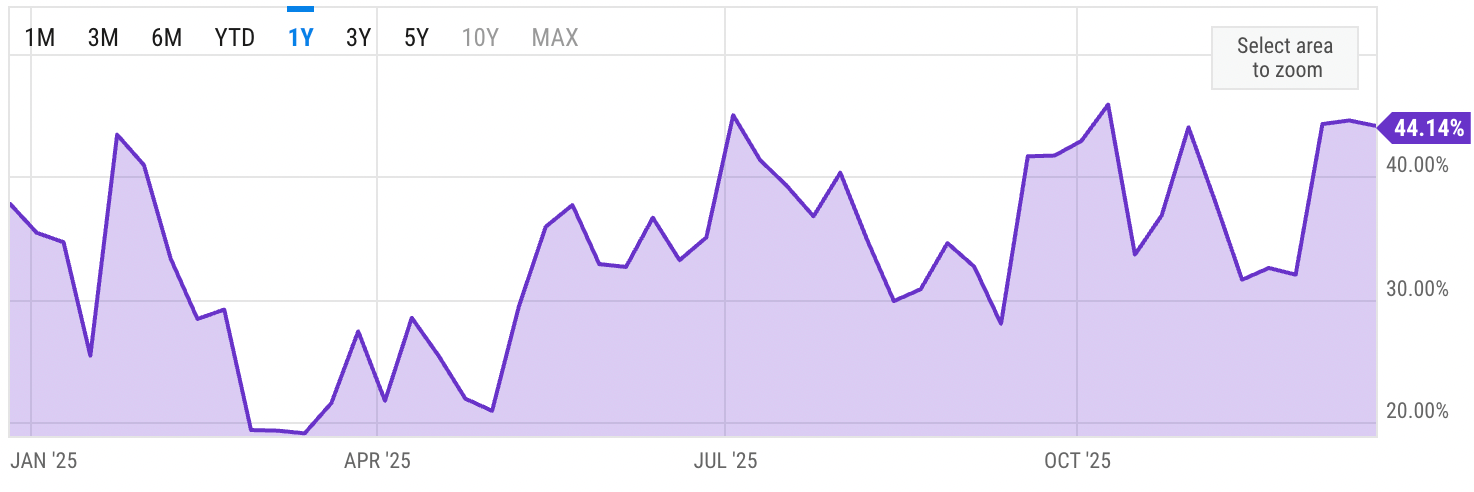

US Investor % Bullish Sentiment:

↓ 44.14% for Week of DEC 18 2025

Previous week: 44.59%

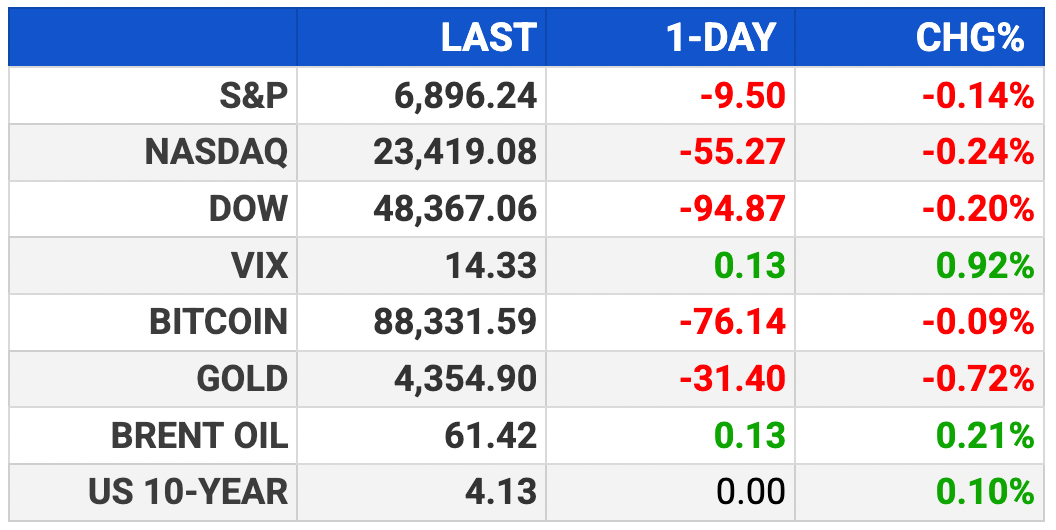

Market Wrap:

Futures flat into the final trading day of 2025

3 straight down days; S&P -0.14%, Nasdaq -0.24%, Dow -95

Santa-rally window is stalling after 3 down sessions

2026 outlook: still bullish, but more chop/range-bound risk

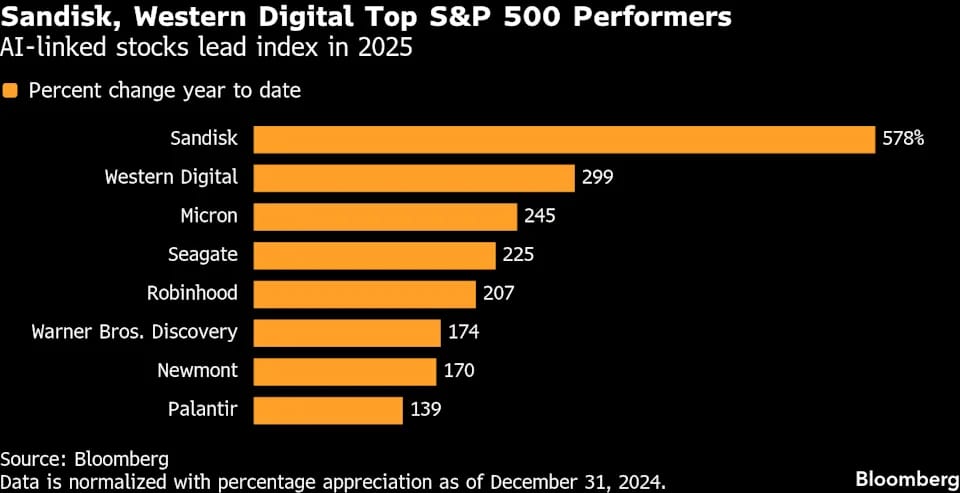

AI drove the year, but leadership broadened; Mag 7 split

Standouts: Alphabet +65% YTD; gold +66%, silver +165%

EARNINGS

No noteworthy earnings scheduled this week.

Picking Stocks Could Leave You Broke in Retirement

If your retirement strategy involves "picking the right stocks," you're one crash away from disaster…

A hedge fund legend who made $95 million in profits during a crash has a different way.

He's using 18-digit codes to "skim" the market without buying stocks.

And his followers have seen an 84%-win rate.

- a sponsored message from The Opportunistic Trader -

HEADLINES

Stocks struggle for gains in last stretch of 2025 (more)

Fed minutes show officials in tight split over Dec. rate cut (more)

US tariff rates are at 80-yr highs — and they're here to stay (more)

Dollar on track for steepest annual drop for almost a decade (more)

Oil slips as Brent heads for longest stretch of annual losses in 2025 (more)

'We're in a metals war': Gold, silver rebound after sharp sell-off (more)

Investors should beware of AI's circular financing trap (more)

Warner Bros. plans to reject Paramount offer next week (more)

Nvidia in advanced talks to buy Israel's AI21 Labs for $3B (more)

Tesla previews downbeat sales numbers in unusual move (more)

SoftBank has fully funded $40B investment in OpenAI (more)

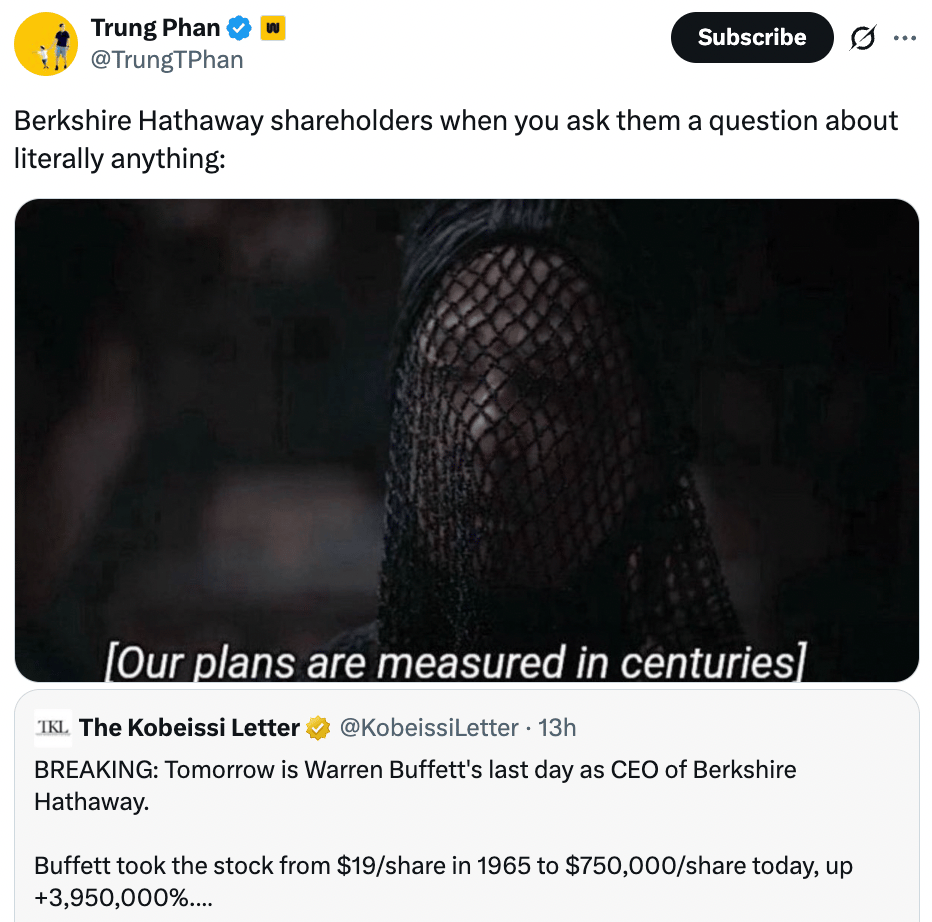

As Buffett steps back, Berkshire enters a new era (more)

CA’s Ro Khanna faces Silicon Valley backlash after embracing wealth tax (more)

DEALFLOW

Listings resume Jan 2nd

CRYPTO

BULLISH BITES

🤖 How bots, banking and stablecoins will dominate fintech in 2026.

🌏 Why American stocks are out of favor on the global stage.

🍷 The 21 most beautiful new restaurants in America of 2025.

👔 "I got a menswear makeover for the most prestigious car show in the world.”

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.