Good morning.

The Fast Five → Fed leaves rates unchanged, Apple set for big sales decline, tech execs internal communications released, Yen gives up ground vs dollar, and another Boeing whistleblower is dead…

We’d ❤️ your feedback. Hit reply to this email and tell us:

1. What do you like about Market Briefing?

2. What do you wish was included that isn’t? -Thank you!

Calendar: (all times ET)

Today: | Jobless claims, 8:30a |

FRI 5/3: | Unemployment report, 8:30a |

Your 5-minute briefing for Thursday, May 2:

US Investor % Bullish Sentiment:

32.13% for Wk of Apr 25 2024 (Last week: 38.27%)

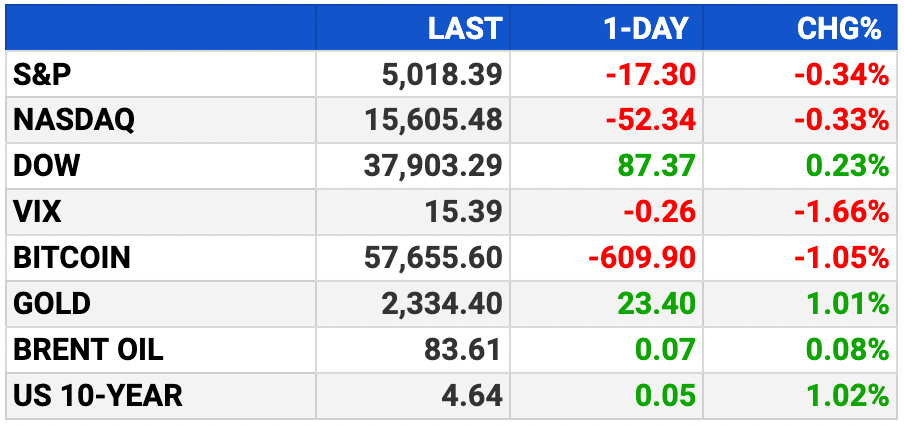

Market Recap:

Stock futures rose ahead of earnings and labor data.

Dow Jones futures up 0.2%, S&P 500 up 0.3%, Nasdaq 100 up 0.3%.

Qualcomm gained 3%, DoorDash fell 15% after earnings.

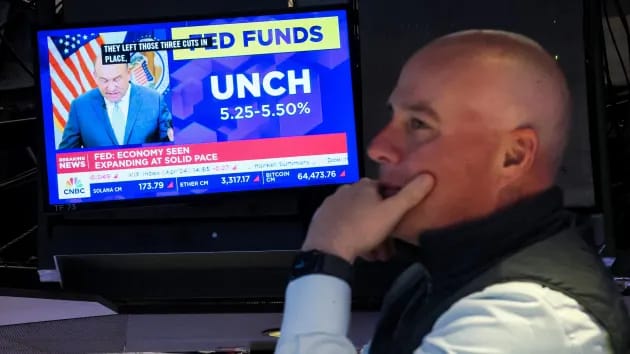

Fed's unchanged rates decision prompted market volatility.

Major indexes cooled by session close, Dow up 0.2%.

Powell's comments hinted at no immediate rate hikes.

EARNINGS

What we’re watching this week:

Apple (AAPL) - earnings of $1.50 EPS (-1.3% YoY) in $90B revenue (-5.0% YoY)

Friday: Hershey Foods (HSY)

Full earnings calendar here

HEADLINES

Powell offered markets a reprieve. It vanished in a blink (more)

Republicans release tech executives’ internal communications (more)

Fed announces reduction in balance sheet runoff pace (more)

Treasury keeps auction sizes unchanged through July, launches buyback (more)

Oil prices pick up on prospect of US replenishing strategic reserve (more)

Yen gives up ground vs dollar following surge on suspected intervention (more)

UnitedHealth CEO testifies to Congress the company paid hackers a $22M ransom (more)

Johnson & Johnson proposes $6.5B deal to settle talc cancer lawsuits (more)

Amazon CEO Andy Jassy broke federal labor law with anti-union remarks (more)

Google lays off hundreds of ‘Core’ employees, moves some positions to India and Mexico (more)

Another whistleblower linked to Boeing is dead (more)

Consumer pullback finally hits restaurants like Starbucks, KFC and McDonald’s (more)

Affordable luxury is in vogue for M&A bankers (more)

DEALFLOW

M+A | Investments

Kroger in talks to bring Disney+ to its grocery delivery program (more)

PE firm Advent explores take over Oman’s OQ Chemicals (more)

British payments group Epos Now explores possible stake sale (more)

GrubMarket, a company providing AI-powered tech for the food supply chain industry, acquired Global Produce, a fresh produce business (more)

Rippl, a dementia-focused specialty care provider, acquires Kinto, a provider of an AI-enabled dementia caregiver support platform (more)

Intel 471, a provider of cyber threat intelligence solutions, acquired Cyborg Security, a company providing advanced threat hunting capabilities and expertise (more)

Climavision, a company specializing in advanced weather modeling and forecasting tech acquired Intersphere, an innovator in subseasonal-to-seasonal forecasting (more)

Bain Capital-backed Rocket Software buys AMC Business (more)

Ventura Foods acquires DYMA Brands (more)

Gryphon-backed Southern Home Services buys David Gray (more)

PE-backed RoadSafe purchases DCS Pavement Marking (more)

Iron Path-backed CPI buys Pain Care Surgery of Louisville (more)

VC

CoreWeave, a specialized cloud provider for AI, raised $1.1 billion in new funding (more)

Island, a company specializing in enterprise browsers, raised $175M in Growth funding (more)

Arbol, a climate risk solutions provider, raised $60M in Series B funding (more)

AiDash, an enterprise SaaS company that enables infrastructure industries to become climate resilient via satellites and AI, raised $58.5M in Serious C funding (more)

Arris, a manufacturer with tech enabling high-performing fiber-reinforced composites at scale, raised $34M in funding (more)

beehiiv, a provider of an email newsletter platform, raised $33M Series B funding (more)

SafeBase, provider of a platform for security reviews, raised $33M in Series B funding (more)

Traceable AI, an API security company, raised $30M in funding (more)

Peregrine, provider of a data integration platform, raised $30M in Series B funding (more)

Qlaris Bio, a clinical-stage biotechnology company, raised $24M in Series B funding (more)

Integrity Orthopaedics, a company providing solutions for soft tissue repair, raised $20.6M in Series B funding (more)

Invent Analytics, a global retail planning solutions provider, raised $17M in funding (more)

LiNova Energy, an ultra-high-energy batteries developer, raised $15.8M in Series A funding (more)

Trovo Health, an AI-powered platform helping health providers extend their capabilities, raised $15M in Seed funding (more)

Remepy, a hybrid drugs developer, closed a $10M seed funding round, which, together with earlier funding, totalled $15M (more)

Apptega, an end-to-end cybersecurity compliance platform company, raised $15M in Growth funding (more)

Ansa, a fintech infrastructure solution enabling merchants to launch branded customer wallets, raised $14M in Series A funding (more)

Screenverse, a provider of programmatic advertising solutions to DOOH media owners, raised $10.5M in funding (more)

Baselayer, a B2B platform utilizing proprietary Graph AI tech to fight fraud and optimize onboarding, emerged from stealth with a $6.5M seed funding round (more)

Unicorn, a provider of a tech-enabled platform for spirits and wine collectors globally, raised $5.8M in Seed funding (more)

Baxus, a global marketplace for collectible spirits, raised $5M in seed funding (more)

StepSecurity, a leader in protecting CI/CD pipelines and infrastructure, closed its $3M seed funding round (more)

RunReveal, provider of a SIEM built to detect threats, raised $2.5M in Seed funding (more)

Kutt, a social betting platform, raised over $1M in funding (more)

Stone Blade Entertainment, publisher of strategy games, raised an undisclosed amount in funding (more)

Any news or data you wish was included in your briefing?

…just hit reply and tell us!

CRYPTO

BULLISH BITES

📊 Stagflation: What is it, and is the US economy in it right now?

🤑 State of VC: An elite cohort of VC firms is still successfully raising huge sums of LP capital.

📈 Pursuits: Berkshire Hathaway’s $354B portfolio will be eventually run by these two investors.

💄 The Science of Beauty: How bleeding-edge biotech is transforming how we look.

🔥 The buzz: Everyone’s eyeing hydrogen therapy. But does it work?

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.