Good morning.

The Fast Five → Nasdaq and S&P 500 soar to end month at record highs, Senate approves bill to avert government shutdown , the Fed’s favored inflation gauge meets expectations, IRS targets wealthy ‘non-filers’ with wave of compliance letters, and Microsoft introduces Copilot AI for Excel…

Calendar:

Today, 3/1: Consumer sentiment (final), 10:00a ET

Your 5-minute briefing for Friday, March 1:

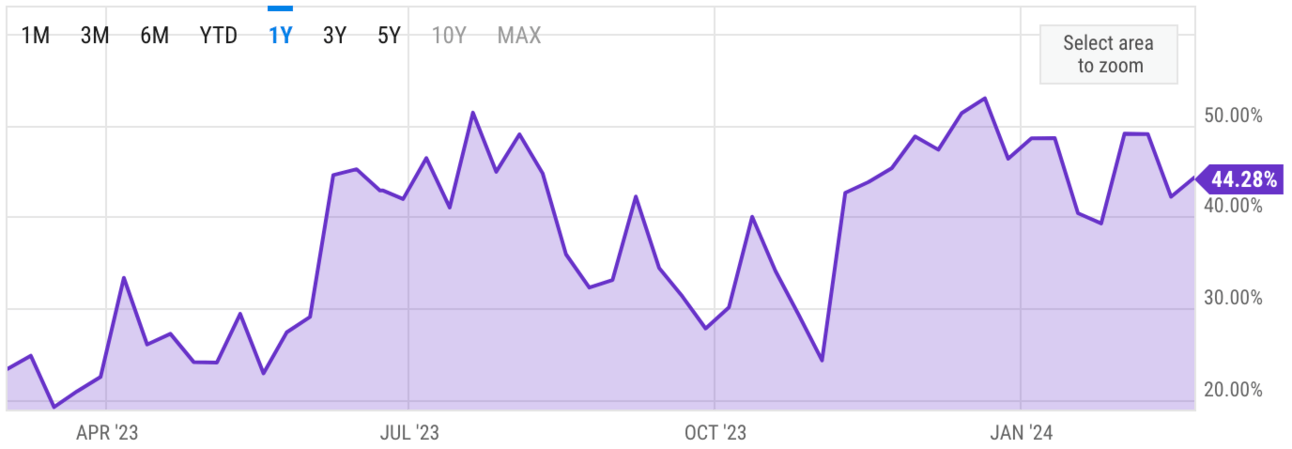

US Investor % Bullish Sentiment:

44.28% for Wk of Feb 22 2024

Market Recap:

Futures steady as Nasdaq hits new high, markets close winning month.

Dow down 19 pts, S&P 500 flat, Nasdaq slightly lower.

NYCB plunges over 20% on leadership change.

February sees AI-driven rally continue, Nasdaq up 6.1%, S&P up 5.2%.

Inflation data in line with expectations, PCE index up 0.4% in Jan.

Bitcoin soars nearly 45% in Feb, crossing $62,000.

Weekly gains: S&P 500 up 0.2%, Nasdaq up 0.6%, Dow down 0.4%.

EARNINGS

Full earnings calendar here

HEADLINES

The tech-heavy Nasdaq composite index and S&P 500 broke records Thursday afternoon.

US Senate approves bill to avert government shutdown, sends it to Biden (more)

Fed’s favored inflation gauge eases to slowest pace in more than two years (more)

Jobless claims jumped more than expected last week (more)

Dollar steady as traders ponder Fed rate cut bets; yen shaky at 150/dlr (more)

SEC investigating OpenAI's communications around its boardroom crisis (more)

Xi’s one-man rule over China’s economy is spurring unrest (more)

US consumers fight back by shifting from name brands to store-brand items (more)

Boeing agrees to $51M settlement for US export violations (more)

Microsoft introduces Copilot AI chatbot for Excel and Outlook (more)

Bud Light boycott likely cost Anheuser-Busch over $1B in lost sales (more)

JPMorgan picks HSBC, StanChart to run $500B custody business in Hong Kong, Taiwan (more)

Oprah leaving WeightWatchers board, sending stock tumbling (more)

Fisker laying off 15% of staff saying more cash needed ahead of a ‘difficult year’ (more)

Millennials set to become the ‘richest generation in history,’ new report shows (more)

A MESSAGE FROM BEHIND THE MARKETS

Dear Fellow Investor,

I have great news to report.

We just pulled off 3 huge biotech wins in one month -

Behind the Markets subscribers saw gains of 118% before the market even opened!

And our premium subscribers saw another 43% gain and 125% gain all within the same month.

But these gains are only the beginning - because the biotech industry is booming, and there's no better time to get in.

Get our next big potential winner here >>>

All the best,

Simmy Adelman, Publisher

Behind the Markets

Tip: If email is clipped by Gmail click “read online” in the top right corner

DEALFLOW

M+A | Investments

Greg Coffey in talks to buy EMSO, create $13B hedge fund firm (more)

NFL helmet maker pauses sale talks, seeks debt for dividend deal (more)

Omers, Harvest consider potential $3B sale of Epiq Systems (more)

JAB seeks up to $2.5B in Keurig Dr Pepper share sale (more)

Totango, a provider of enterprise customer success software, and Catalyst, a provider of a customer growth platform, merged (more)

LMP-backed London & Capital and Waverton merge (more)

Ginkgo Bioworks (DNA), a company building a platform for cell programming and biosecurity, acquires Proof Diagnostics, a life sciences discovery company (more)

First Advantage buys Sterling Check (more)

CenterOak’s Shamrock acquires JG Environmental (more)

Bridgepoint purchases RoC Skincare (more)

Kopper acquires Brown Wood Preserving (more)

Valisure, a healthcare company focused on quality assurance in pharmaceutical drugs, received an investment from AlleyCorp (more)

Insurcomm, Inc, commercial/residential restoration services provider, received majority growth investment from Summit Partners (more)

Ares invests in Bluepeak (more)

Summit Partners invests in Insurcomm (more)

VC

Figure, an AI robotics company developing general purpose humanoid robots, raised $675M in Series B funding, at $2.6B valuation (more)

Fervo Energy, a geothermal development company, raised $244M in funding (more)

Kenai Therapeutics, a biotech company leveraging pluripotent stem cell technology, raised $82M in Series A funding (more)

EasyKnock, the first home equity solutions platform, announced the completion of a $28M Series D funding round (more)

Vibe.co, the 'Google Ads of Streaming,' announced a Series A funding round of $22.5M led by venture firm Singular (more)

Anthro Energy, a provider of lithium-ion batteries, raised $20M in Series A funding (more)

Relish, a provider of solutions for businesses to optimize procurement systems, raised $10M in Series A funding (more)

Gradial, a provider of a content management system, raised $5.4M in seed funding (more)

PawCo Foods announced a $2M seed funding round (more)

Clasp, a provider of a modern employee benefits infrastructure, raised $1.5M in initial funding (more)

Shader, provider of an AI-powered real-time camera app, raised $580K in funding (more)

Autogon AI, a no-code AI orchestration platform, received funding from Fast Forward Venture Studio (more)

CRYPTO

BULLISH BITES

🎲 Gaming: Frenemies in the corporate-loan market.

🎯 Mad men:: The Pentagon is using targeted ads to find its targets.

👞 Style guide: How to dress like Michael Caine.

🍷 House account: What it costs to get VIP status at one of NYC’s hottest restaurants.

📈 Game-changer? The only AI company you should be looking at (BTM)*

*from our sponsor

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.