Good morning.

The Fast Five → Intel sued by shareholders alleging securities fraud, JPMorgan says three quarters of global carry trade unwound, Warner Bros. Discovery takes massive $11.2B in write-downs, Disney flags startling shift in consumer behavior, and Dimon still sees a recession on the horizon …

💡 Google CEO: This Is likely Bigger than Electricity »

- a message from Chaiken Analytics

Calendar: (all times ET) - full calendar

Today: Initial jobless claims, 8:30 AM

Tomorrow: no notable events

Your 5-minute briefing for Thursday, August 8:

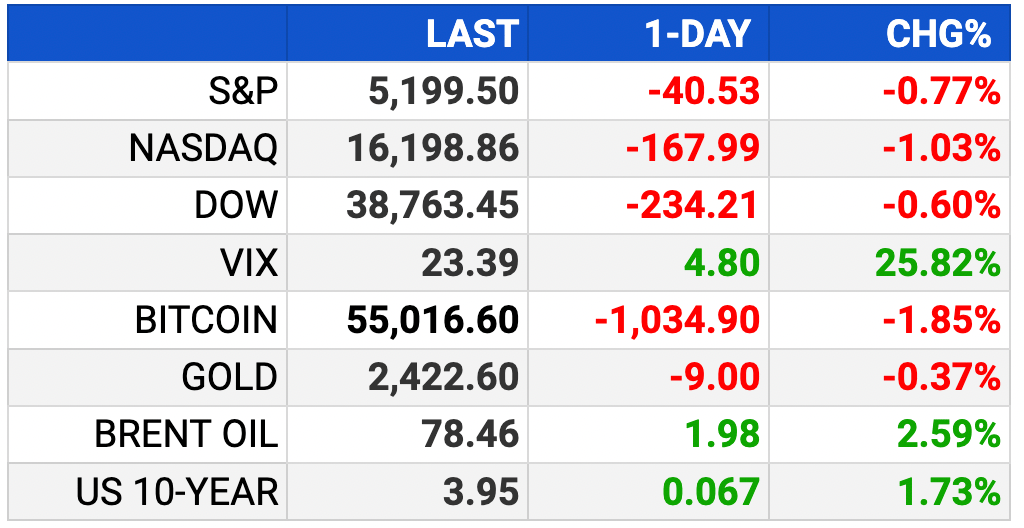

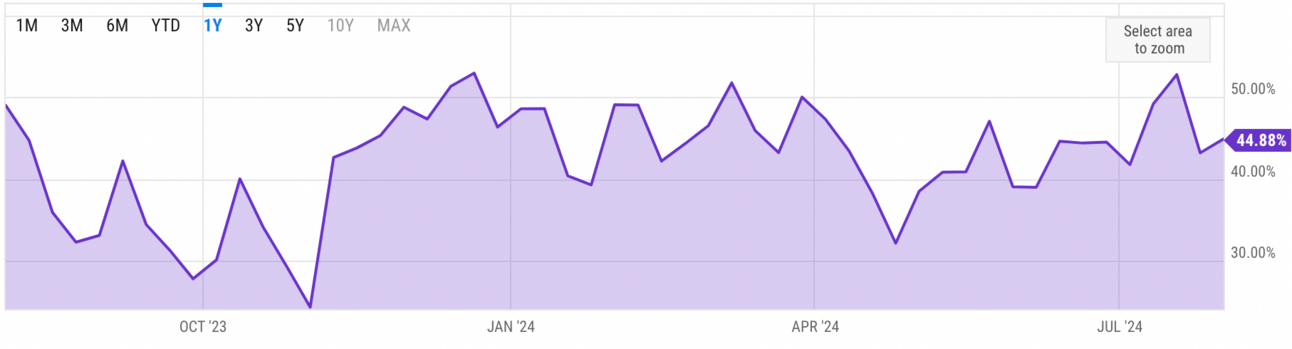

US Investor % Bullish Sentiment:

↑44.88% for Wk of August 01 2024

Last week: 43.17%. Updates every Friday.

Market Wrap:

Stock futures dipped Wednesday evening

Earlier rally fizzled, S&P fell 0.77%, Nasdaq -1.05%, Dow -234 points

Avg’s declined in four of the past five sessions

Volatility expected from economic concerns, geopolitical conflict, elections

Monday's sell-off linked to slowing job growth; today jobless claims in focus

Warner Bros. Discovery and Bumble fell on weak Q2 revenue

EARNINGS

Here’s what we’re watching:

Full earnings calendar here.

A Tech 7.5x Bigger Than

the Internet Economy?

A new technology is about to go mainstream – one Google's CEO has praised as more "profound" than fire or electricity.

- sponsored message -

HEADLINES

Traders brace for more S&P volatility after jobless claims (more)

Traders lose billions on big volatility short after stocks rout (more)

Dimon still sees a recession on the horizon (more)

Asia markets mixed as Wall Street recovery stalls (more)

Dollar down as rate cut bets rise, yen surges (more)

China’s move away from the USD (more)

Oil prices tick up on sharp fall in US crude inventories (more)

30-yr mortgage rate drops on weak jobs data (more)

Politicians join customers in pushing companies to cut prices (more)

Warner Bros. Discovery takes massive $11.2B in write-downs (more)

Disney flags startling shift in consumer behavior at theme parks (more)

Passengers sue Delta following massive IT outage (more)

Gig economy emerges as a bright spot amid gloomy tech earnings (more)

DEALFLOW

M+A | Investments

KKR plans Fuji soft bid in $4B take-private deal (more)

SoftBank unveils $3.4B buyback as son hunts for AI deals (more)

Aramco to buy stake in JV Petro Rabigh from Sumitomo Chem (more)

WPP sells $775M stake in PR firm FGS Global to KKR (more)

C Infinity Solutions LLC, a tech consulting firm, merged with Corgibytes LLC, a software development company (more)

Celero Commerce, a financial services company, acquires Sona, provider of electronic payments to businesses across Canada (more)

Cherry Bekaert, an assurance, tax, and advisory firm, acquired Kerr Consulting, a business applications and cloud tech provider (more)

CloudBees, a software development platform for enterprises, acquired Launchable, an AI-augmented approach to QA (more)

Enverus, a SaaS company that leverages gen AI across its solutions, acquired BidOut, an AI-powered procurement platform (more)

Exiger, a supply chain and third-party risk AI company, acquired logistics intelligence platform XSB (more)

Linked Eats, delivery revenue mngmt software for restaurants, acquired Sauce Technologies, AI solutions for digital-ordering (more)

OPSWAT, a provider of critical infrastructure cybersecurity solutions, acquired InQuest, a cybersecurity solutions provider (more)

BioGliph, a startup biotech software company, received a minority investment from Dotmatics (more)

Clear Demand, an AI Price and Promotion Optimization software provider, received a strategic investment from M33 Growth (more)

Salt & Stone, a fragrance-driven body care brand, received an investment from Humble Growth (more)

Vivace International Corp, a manufacturer of propulsion tanks for space and defense applications, received a growth investment from Cerberus (more)

VC

Anduril raises $1.5B at a $14B valuation (more)

3V Infrastructure, an electric vehicle charging infrastructure owner and operator, raised up to $40M in funding (more)

Neon, a Postgres database for developers, raised $25.6M in funding (more)

Anjuna, the creator of Anjuna Seaglass, the universal confidential computing platform, raised $25M in Series B2 funding (more)

Datch, AI technology for frontline manufacturing, energy and utility sectors, raised $15M in Series A funding (more)

Napkin, visual AI for business storytelling, raised $10M in seed funding (more)

Energy Domain, a tech online marketplace, raised $5M in Series A funding (more)

Carketa, a provider of end-to-end data and intelligence software for the auto industry, raised $4.4M in funding (more)

Avoli, an athletic brand dedicated exclusively to women and girl volleyball athletes, raised $2.1M in funding (more)

CRYPTO

BULLISH BITES

🚨 Trending: This Wall Street stock prediction just went viral *

📉 Inside Look: Intel was once a Silicon Valley leader. How did it fall so far?

🔎 Opinion: The dollar's days as a universal reserve currency are numbered.

🤖 Disrupted: AI is poised to upend India's massive outsourcing industry.

🚴♀️ New Toy: Ford just unveiled e-bikes inspired by the Bronco and the Mustang.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.