Good morning.

The Fast Five → Goldman, Evercore up S&P target to 6,000, people warming to idea of AI money management, retail stocks search for direction, executive pay rises at fastest rate in 14 years, and Gates is ready to put billions into nuclear power…

Calendar: (all times ET)

TUE, 6/18: | US retail sales, 8:30a |

THU, 6/20: | Initial jobless claims, 8:30a |

FRI, 6/21: | Existing home sales, 10:00a |

Your 5-minute briefing for Monday, June 17:

US Investor % Bullish Sentiment:

↑ 44.59% for Wk of June 13 2024 (Last week: 38.97%)

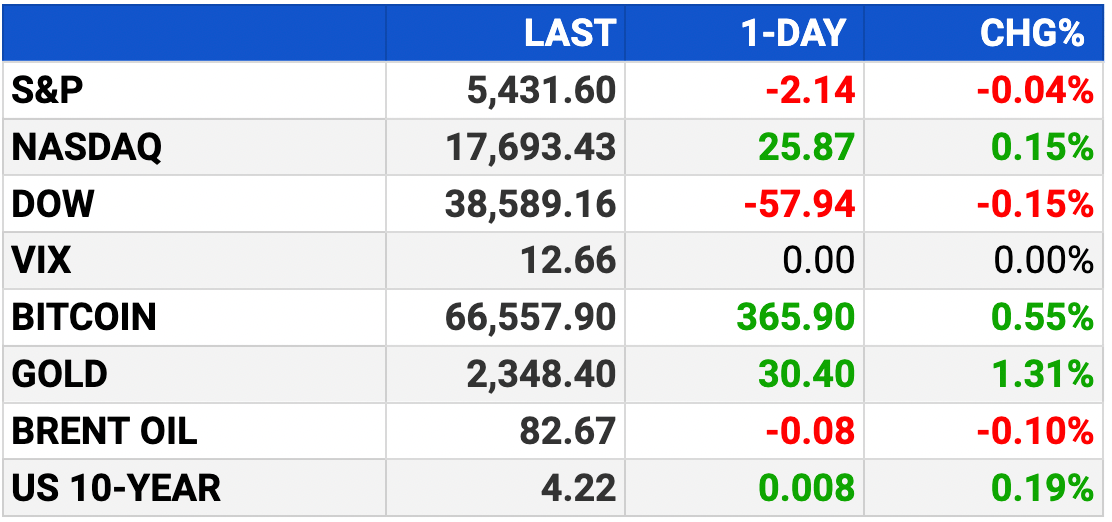

Market Recap:

Stock futures flat ahead of holiday-shortened week.

Dow futures near flat, S&P 500 up 0.03%, Nasdaq 100 up 0.1%.

Last week: Dow down 57 points, S&P down 0.04%, Nasdaq up 0.12%.

Mixed averages: Dow down 3 of 4 weeks; S&P, Nasdaq up 7 of 8.

Markets closed Wednesday for Juneteenth.

Investors watch May retail sales Tuesday, home sales, housing starts.

Earnings: Lennar, Kroger, Darden Restaurants, CarMax.

EARNINGS

Here’s what we’re watching this week:

Monday: Lennar (LEN)

Darden Restaurants (DRI) - earnings of $2.62 per share (+1.6% YoY) on $2.98B (+7.4% YoY)

Friday: Carmax (KMX)

Full earnings calendar here.

Are You Prepared for the Death of the Dollar?

HEADLINES

Retail stocks search for direction as rates stay high (more)

Goldman boosts S&P 500 target on profit outlook (more)

Oil prices inch down on weaker US consumer demand (more)

Asia shares muted on mixed China data, euro pressure (more)

China cbank leaves key policy rate unchanged as expected (more)

Emerging-market bond rally threatened as hawkish flags multiply (more)

TSMC arbitrage trade of buying Taiwan stock, shorting US shares backfires (more)

US executive pay rises at fastest rate in 14 years (more)

Bill Gates says he’s ready to put billions into nuclear power (more)

Boeing tells suppliers it is slowing 737 output goal by 3 months (more)

OpenAI CEO says company could become for-profit corporation (more)

Apple’s slow rollout of intelligence features will stretch into 2025 (more)

McDonald's says it will no longer use its drive-thru AI (more)

Adidas is investigating bribery allegations in China (more)

Your Second Chance to Profit from AI

If you missed out on Nvidia, don't worry.

A 244-year-old pattern is about to trigger a $25.6 trillion AI surge...

And send three overlooked stocks soaring 1,000%+

- sponsored message -

DEALFLOW

M+A | Investments

Fisher wells stake of up to $3 bln to Advent, Abu Dhabi Fund (more)

Carlyle explores sale of electric power producer Cogentrix (more)

Paytm in talks with Zomato to sell movie ticketing business (more)

Phillips 66 to sell 25% stake in Rockies Pipeline for $1.28B (more)

GenNx360-backed GenServe buys Electro-Motion (more)

E78 Partners purchases The Avail Group (more)

Stake, a loyalty company for the rental economy, acquired Circa, a rent payments company, for $9.5M (more)

NetSPI, a security solutions provider, acquired Hubble Technology Inc., a cybersecurity management solution (more)

Clearhaven Partners, a software private equity firm, acquired Zixi, a cloud based and on-premises software-defined video platform (more)

VC

InduPro, a biotech company developing treatment of cancer and autoimmune diseases, raised $85M in Series A funding (more)

Enveda Biosciences, a biotech company using AI to translate nature into new medicines, raised a new financing round of $55M to add to its $119M combined Series B and B1 (more)

Aepnus Technology, an electrochemical platform to reduce emissions in battery supply chain chemicals, raised $8M in Seed funding (more)

Roamless, a travel connectivity startup, raised $5M in seed funding (more)

InScope, an AI powered fintech startup, raised $4.3M in seed funding (more)

Nada, an investment tech platform bridging homeowners and investors, secured a seed extension funding of undisclosed amount (more)

CRYPTO

BULLISH BITES

✈️ Changes: RIP Southwest Airlines of yore.

📈 Investment: The second wave of AI gains is coming… *

⏳ Perspective: Feels like time is moving faster as you age? How to slow it down.

😘 Schmoozer: A killer golf swing is a hot job skill now.

💸 Next level: Top 10 “impossibly unaffordable” cities.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.