☕️ Good morning.

The Fast Five → Alphabet, Microsoft and Meta close at all-time highs, GDP surprises with 3.3% growth last quarter, US extends lead over China in economic race, tech companies slash thousands of jobs pivoting toward AI, and Southwest Airlines removes Boeing Max 7 from 2024 plans…

Your 5-minute briefing for Friday, January 26:

BEFORE THE OPEN

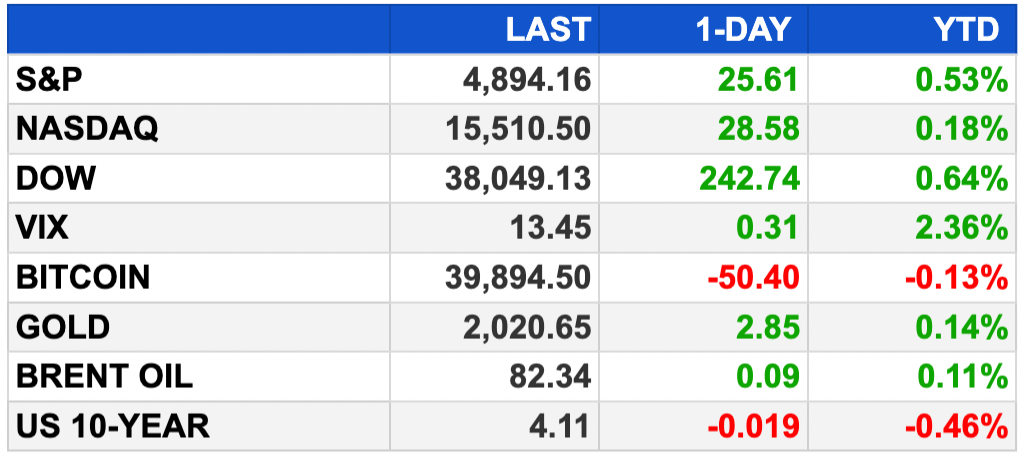

As of market close 1/25/2024.

PRE-MARKET:

MARKETS:

Nasdaq 100 futures down 0.5% after Intel's weak outlook.

S&P 500 futures drop 0.2%; Dow futures slip 0.2%.

Intel stock falls 10% in after-hours trading on disappointing guidance.

S&P 500 and Nasdaq extend winning streak to six days.

Encouraging GDP data boosts investor optimism.

Focus today: upcoming inflation data and earnings reports from Norfolk Southern, Colgate-Palmolive, and American Express.

HEADLINES

US GDP grew 3.3% last quarter, capping unexpectedly strong year (more)

Yellen touts GDP numbers as a boon to the middle class (more)

Biden admin's tightening of natural gas exports raises national security concerns (more)

Mortgage rates climb, adding to affordability woes (more)

KKR-backed BrightSpring raises $693 Million in IPO priced below range (more)

Apple becomes China's top smartphone as shipments dip (more)

Southwest Airlines removes MAX 7 from 2024 plans, cuts delivery forecast from Boeing (more)

Apple overhauls App Store, iPhone features in EU to appease regulators (more)

Tesla stock falls 12% as EV maker warns production growth will be 'notably lower' than 2023 (more)

Tech companies are slashing thousands of jobs as they pivot toward AI (more)

Microsoft lays off 1,900 workers, nearly 9% of gaming division, after Activision Blizzard acquisition (more)

Paramount CEO announces layoffs as cost pressures, take-private talks build (more)

Levi Strauss plans to cut at least 10% of its global corporate workforce in restructuring (more)

Private equity faces pressures of growing old (more)

DEALFLOW

M & A | INVESTMENTS

BPCE sounds out rivals for asset management tie-up (more)

VidIQ, a provider of analytics suite for content creators, acquired Creator Now, a creator education platform (more)

Voltron Data, a company accelerating modular and composable data analytics systems, acquired Claypot AI, a real-time AI platform startup (more)

Taqtile, a maker of Manifest®, a spatially-enabled work-instruction platform serving the industrial and defense sectors, received an investment from Scout Ventures (more)

NPI, a provider of data-driven IT procurement solutions for large enterprises, received an investment from Falfurrias Growth Partners (more)

Woolpert acquires Bermello Ajamil & Partners (more)

Roper Technologies agrees to buy Procare for $1.86B (more)

Halifax Group’s Case FMS merges with LFX (more)

Kain Capital makes follow-on investment in MY DR NOW (more)

VC

Bastille, a supplier of wireless threat intelligence technology to high-tech, banking, and the intelligence community, raised $44M in Series C funding (more)

Captura, a direct ocean capture company, raised $21.5M in Series A funding (more)

Elo Life Systems, a food and ingredient company providing a molecular farming platform, raised $20.5M in Series A2 funding (more)

Doppel, an AI-native digital risk protection company, raised $14M in Series A funding (more)

ZWI Therapeutics, Inc., a biotechnology company focused on the development of protein therapeutics using proprietary new polymers, announced the close of a $10M Series A financing (more)

Circular Genomics, a company specializing in advancing circular RNA biomarkers for precision psychiatry and neurology, raised $8.3M in Series A funding (more)

Dupr, a provider of a pickleball’s international rating system, raised $8M in funding (more)

Marstone, a digital investment and wealth planning firm, raised $8M in Series B funding (more)

Isaac Health, a digital health company, raised $5.7M in Seed funding (more)

Being Health, a psychiatrist-founded modern mental health practice provider, raised $5.4M in funding (more)

AiCure, an AI and advanced data analytics company focused on clinical trials, raised $12M loan refinancing and has also raised an additional $4M+ from its existing investors (more)

Krepling, an e-commerce channel management platform, raised $3.3M in seed funding (more)

Birdwatch, a home maintenance tech and services company, secured $3.2M in seed funding (more)

Attune, provider of an engagement banking platform, closed a seed funding round, raising $2.25M (more)

ViralMoment, a provider of AI-powered social video insights and analytics solutions, raised $2.5M in Seed funding (more)

FUNDRAISING

Was this briefing forwarded to you? Sign Up Here

CRYPTO

BULLISH BITES

👀 Eye opening: Read the explosive resignation letter sent by the chairman of Sports Illustrated's publisher.

💥 Game-changer: How a lucky break fueled Eli Lilly’s $600 Billion weight-loss empire.

🔎 In the spotlight: The sleepy copyright office in the middle of a high-stakes clash over A.I.

👜 Palm Beach: What the ultrarich wear to the grocery store.

🛳 Icon of the sea: Here’s why Americans are obsessed with big cruise ships.

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

Disclaimer: MarketBriefing is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the MarketBriefing team.