Good morning.

The Fast Five → Trump to ‘demand’ interest rates drop immediately, Trump signs EO paving the way for crypto stockpile, Benioff predicts today’s CEOs will be the last with all-human workforces, UnitedHealthcare has a new CEO, and OpenAI unveils 'operator' agent to handle web tasks…

🚨 Trump Revokes AI Executive Order – Buy NVDA Now?

- from Chaikin Analytics

Calendar: (all times ET) - Full Calendar

Today:

Existing home sales, 10:00A

Monday:

New home sales, 10:00A

Your 5-minute briefing for Friday, January 24:

US Investor % Bullish Sentiment:

↑ 43.43% for Week of January 23 2025

Previous week: 25.43%. Updates every Friday.

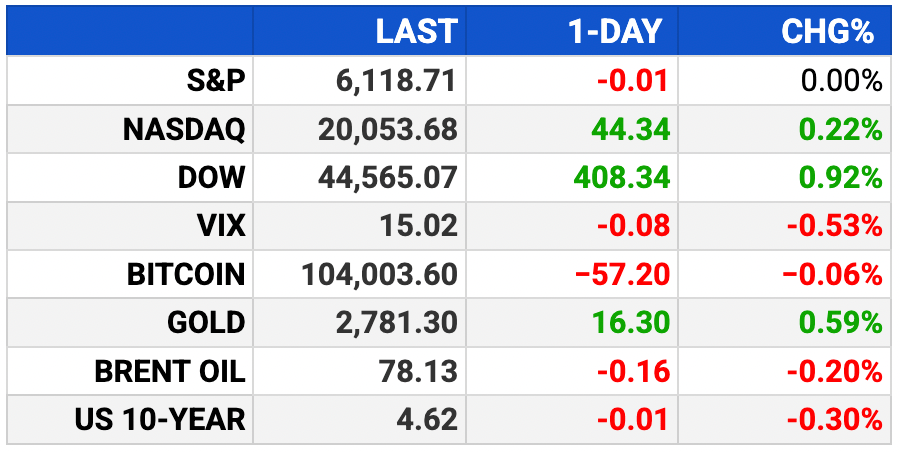

Market Wrap:

Stock futures dipped after S&P 500 hit a record close.

Trump called for rate cuts and lower oil prices at Davos.

Optimism over Trump’s pro-business stance lifted markets.

Dow up 2.5% this week, S&P 500 up 2%, Nasdaq gained 2.2%.

Rising 10-year yield fuels inflation concerns; eyes on 5% level.

EARNINGS

Here’s what we’re watching:

Today: Verizon (VZ)

American Express (AXP) - earnings of $3.05 per share (+16.4% YoY) on $17.2B revenue (+8.7% YoY)

HEADLINES

Trump signs executive order promoting crypto, paving way for digital asset stockpile (more)

Trump’s demands push S&P to new record (more)

US jobless claims rise slightly but recurring applications surge (more)

Big Banks have entered the ‘debanking’ chat (more)

Oil set for first weekly drop this year as Trump rattles market (more)

US store closures to again outpace openings this year (more)

Boeing expects $4 billion loss for fourth quarter after chaotic 2024 (more)

Shares of cash-strapped Nikola nosedive on report of potential sale (more)

OpenAI unveils 'operator' agent that handles web tasks (more)

Morgan Stanley star banker Michael Grimes is eyeing a position in Elon Musk's DOGE (more)

UnitedHealthcare has a new CEO (more)

Airlines flex pricing power, signaling higher fares in 2025 (more)

A MESSAGE FROM CHAIKIN ANALYTICS

After weeks of volatility…

Did President Trump just turn Nvidia (NVDA) into a raging BUY?

The beloved chipmaker has struggled this year, facing increased competition and regulatory pressure.

But now that President Trump has revoked an executive order that aimed to regulate Nvidia and its competitors, the stock is back in the green.

In fact, NVDA rose over 1% on Trump's first trading day back in the Oval Office.

Is it time to buy...

Take any potential profits?

Or wait to buy the next dip?

It's part of a story that's bigger than President Trump... Nvidia... and the entire Artificial Intelligence investing trend.

For all the details - including the name and ticker of the #1 AI stock to buy instead of NVDA, click here.

Kelly Brown

Senior Researcher, Chaikin Analytics

DEALFLOW

M+A | Investments

Mitsubishi Motors considering not joining planned Nissan-Honda merger (more)

Blackstone to buy $1 billion Virginia power plant near data centers (more)

Monte Paschi explores deal for Italy's Mediobanca (more)

Altium, an electronics design systems company, acquired Part Analytics, an AI-powered supply chain management platform (more)

Workera, an AI-powered skills intelligence platform, received an investment from Accenture (more)

Dunmor, a provider ground-up construction and DSCR rental loans for real estate developers across the US, received a minority equity investment from Newfi Lending (more)

Fundraise Up, a fundraising platform for nonprofits globally, received a $70M growth investment (more)

VC

Baya Systems, a company specializing in system IP technology, raised $36M+ in Series B funding (more)

StructuredWeb, a company specializing in AI-powered channel sales and marketing SaaS solutions, raised $30M in funding (more)

Palona AI, a provider of AI solutions that accelerate the growth of consumer facing businesses, raised $10M in Seed funding (more)

Lanai, an enterprise AI navigation system provider, raised $10M in Seed funding (more)

Realfinity, a finance platform designed for the real estate industry, raised $5M in warehouse facility from Bank of the Sierra (more)

Degree Analytics, a provider of data-informed campus solutions, raised $5M in funding (more)

Riley AI, an AI-powered product insights assistant, raised $3M in Seed funding (more)

CapeZero, a software platform that streamlines financial workflow for clean energy developers, raised $2.6M in Seed funding (more)

Cyclic Materials, a recycling company building a circular supply chain for Rare Earth Elements, received $2M from InMotion Ventures (more)

Almanax, an AI web3 security engineer company, raised $1M in funding (more)

CRYPTO

BULLISH BITES

🤡 Someone bought the domain ‘OGOpenAI’ and redirected it to a Chinese AI lab.

👨🏻🍳 What it's like to be a private chef in a towering skyscraper on Billionaire's Row.

🤑 Tom Brady looks to sell “Billionaire Bunker” mansion for $150 million.

🍪 Oreo is releasing this flavor for the first time ever.

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.