Good morning.

The Fast Five → Amazon announces largest layoffs in company history, Qualcomm stock soars on new chips, Fed poised to cut rates this week, gold declines to $4,000 amid sell-off, and US Dept of Energy forms $1 billion supercomputer and AI partnership with AMD…

📌 Warren Buffett's #1 AI Stock Not Even on Nasdaq— It's not in the Mag 7. And most people have never heard its name. Yet billionaire Warren Buffett is buying millions of shares. Go here to see its name and ticker symbol for free » (ad)

Calendar: (*Shutdown may affect key data. All times ET) - Full Calendar »

Today:

Consumer Confidence (tentative)

Tomorrow:

Fed Interest-Rate Decision, 2:00P

Powell Press Conference, 2:30P

Your 5-minute briefing for Tuesday, Oct 28:

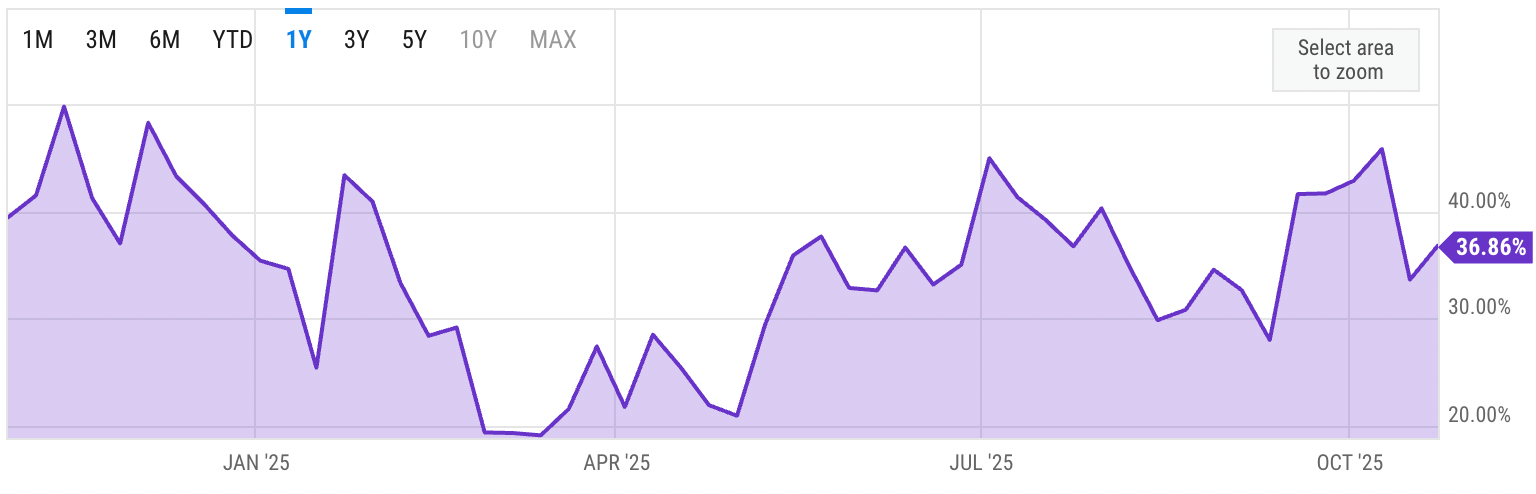

US Investor % Bullish Sentiment:

↑33.86% for Week of OCT 23 2025

Previous week: 33.66%

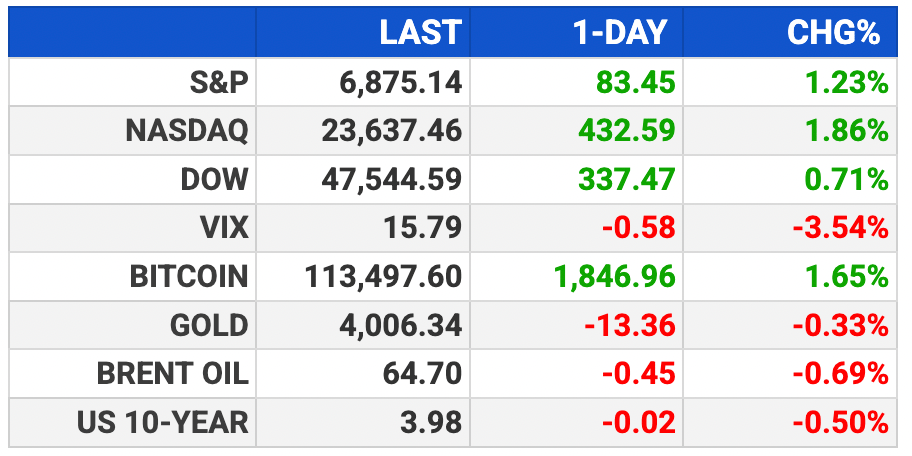

Market Wrap:

Futures flat: Dow +15, S&P flat, Nasdaq +0.1%.

S&P closed above 6,800 for first time; all major indexes hit records.

Trump–Xi meeting Thursday; trade deal covers minerals, soybeans, TikTok.

Fed meeting starts Tuesday; second rate cut expected Wednesday.

“Mag 7” earnings ahead: Alphabet, Amazon, Apple, Meta, Microsoft.

Amazon to begin biggest layoffs in its history Tuesday.

LPL’s Turnquist: strong earnings, easing inflation, rate cuts fuel rally.

EARNINGS

Here’s what we’re watching this week:

Today: *JetBlue $JBLU ( ▲ 1.1% ), *PayPal $PYPL, SoFi $SOFI ( ▼ 1.45% ), *UnitedHealth $UNH ( ▲ 0.02% ), UPS $UPS ( ▲ 1.03% ), Visa $V ( ▲ 0.63% ), *Wayfair $W ( ▲ 2.34% )

WED: *Boeing $BA ( ▼ 0.72% ), Chipotle $CMG ( ▼ 1.13% ), Meta $META ( ▲ 1.69% ), Microsoft $MSFT ( ▼ 0.31% ), Starbucks $SBUX ( ▲ 1.76% ), *Verizon $VZ ( ▲ 1.25% )

*Alphabet $GOOGL ( ▲ 4.01% ) - $2.28 EPS (+7.5% YoY) on $100B revenue (+13.2% YoY)

THU: *Eli Lilly $LLY ( ▼ 1.34% ), Estee Lauder $EL ( ▲ 2.23% ), Reddit $RDDT ( ▲ 2.77% ), *Roblox $RBLX ( ▼ 3.79% ), *Roku $ROKU ( ▼ 0.61% ), Shake Shack $SHAK ( ▲ 0.41% ), *SiriusXM $SIRI ( ▲ 0.1% )

Amazon $AMZN ( ▲ 2.56% ) - $1.56 EPS (+9.1% YoY) on $177.7B revenue (+11.8% YoY)

Apple $AAPL ( ▲ 1.54% ) - $1.76 EPS (+81.4% YoY) on $102.1B revenue (+7.6% YoY)

FRI: *Chevron $CVX ( ▼ 0.46% ), *Exxon $XOM ( ▼ 2.44% )

A MESSAGE FROM SURF LAKES

Final Day to Invest: Every City’s a Potential Surf Destination

Topgolf revolutionized golf by turning it into a social, tech-driven game for anyone. And they’ve made billions in annual revenue doing it. Surf Lakes is applying that same model to surfing, and investors can still join them until 10/30 at 11:59 PM PT.

This is a paid advertisement for Surf Lakes’ Regulation CF offering. Please read the offering circular at https://invest.surflakes.com

HEADLINES

The layoffs will amount to the largest cuts to Amazon’s corporate workforce in the company’s history, according to a person familiar with the matter.

Qualcomm, which is known for its chips in smartphones, also announced a deal with Humain, a Saudi-backed A.I. company. The news sent Qualcomm’s share price soaring.

Wall St scales fresh highs on tech earnings, US-China trade optimism (more)

Fed poised to cut rates this week, with more easing likely on tap (more)

US Dept of Energy forms $1 bln supercomputer and AI partnership with AMD (more)

Gold declines to $4,000 amid sell-off (more)

Tesla chair: Elon Musk could leave Tesla without $1 trillion pay package (more)

OpenAI’s spending spree has Wall St focused on capex in Big Tech earnings (more)

Google to buy power from NextEra Nuclear Plant being revived (more)

Berkshire Hathaway downgraded to sell by KBW, citing Buffett succession (more)

Robinhood stock pops 5% as analyst raises price target (more)

Lululemon is partnering with the NFL to release apparel for all 32 teams (more)

Chegg slashes 45% of workforce, blames ‘new realities of AI’ (more)

Paramount to Ax 1,000 jobs Wednesday in first round of cuts (more)

Blackstone and Apollo court small-time investors they used to snub (more)

DEALFLOW

M+A | Investments

Apollo and KKR inject $7 billion into Keurig Dr Pepper

Regional lender Huntington to buy smaller rival Cadence Bank in $7.4B deal

Gravity acquires Cityspan

Janus RX receives investment from FFL Partners

Linen Cloud receives investment from enterprise tech leaders

XNRGY climate systems receives growth investment

VC

Mercor, a startup that connects AI labs with experts for training their AI models, raised $350M in Series C funding

SavvyMoney, a provider of financial wellness and growth solutions, received a $225M minority investment

Seneca, a resilience technology and infrastructure company, raised $60M in funding

CourtReserve, a club management software platform provider, received a $54M strategic growth investment

Natural, a fintech company building the infrastructure powering agentic payments, raised $9.8M in Seed funding

PodPlay Technologies, Inc., a SaaS platform for participatory sports venues, announced the closing of an $8M Series A funding round

VitVio, an AI-powered platform that autonomously coordinates operating room staff closed an $8M Seed funding round

WorkHero, an AI-powered back-office for small HVAC contractors, raised $5M in Seed funding

Paygentic, an AI-powered billing and payments infrastructure startup, raised $2M in Pre-Seed funding

"AI Energy" Could Be Worth Trillions

It has enough power to fuel our economy for decades... with zero need for foreign oil. A small group of US stocks own the rights to it.

Learn about the American companies supplying this new "AI Energy" here »

- a message from Altimetry -

CRYPTO

BULLISH BITES

🤖 The US must act fast to win the AI race.

⌛️ Americans face a retirement ‘confidence paradox’—How to gauge readiness.

🤦🏻♂️ The next legal frontier is your face and AI.

🍇 Grape Camp: Where wine lovers pay big bucks to do hard labor.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.