Good morning.

The Fast Five → Fed views upbeat CPI data as ‘progress’, the inflation breakdown in one chart, S&P and Nasdaq close at record highs, Apple overtakes Microsoft most valuable company, and GME hodl’rs anticipate today’s annual shareholder meeting…

Calendar: (all times ET)

Today: | Initial jobless claims, 8:30a |

FRI, 6:14: | Consumer sentiment, 10:00a |

Your 5-minute briefing for Thursday, June 13:

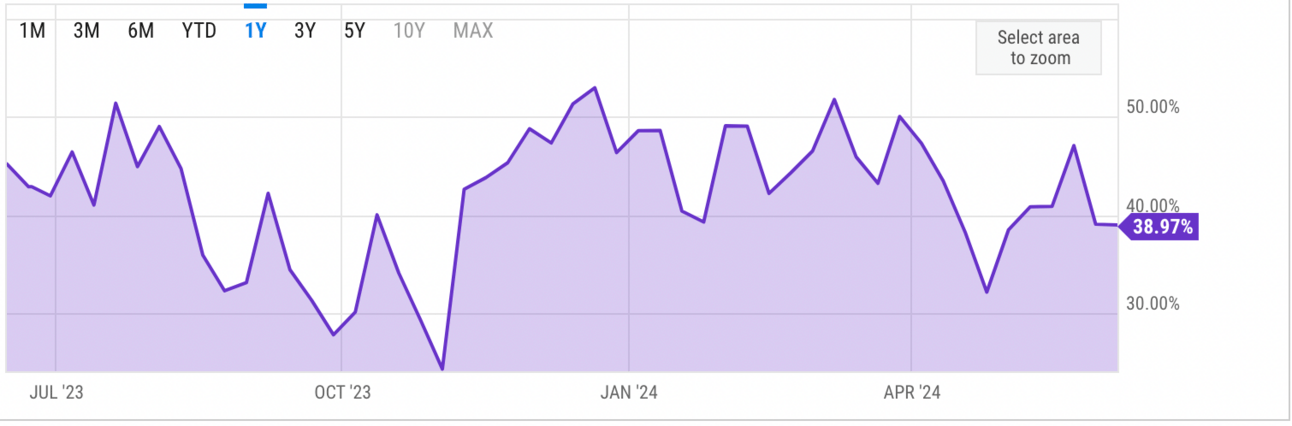

US Investor % Bullish Sentiment:

↓ 38.97% for Wk of June 06 2024 (Last week: 39.04%).

Market Recap:

S&P futures +0.10%, Nasdaq +0.45%, Dow down 34 points.

Broadcom surged 14% post-earnings and stock split.

Dave & Buster's dropped 10% on revenue miss.

S&P (+0.85%) and Nasdaq (+1.53%) hit record highs; Dow fell 0.09%.

Fed indicated one rate cut in 2024, down from three.

Cooler May CPI boosted optimism, lowered Treasury yields.

May PPI expected to rise 0.1%, down from 0.5%.

EARNINGS

What we’re watching this week:

Today:

Adobe (ADBE) - earnings of $4.39 per share (+12.5% YoY) on $5.3B revenue (+10.4% YoY)

Full earnings calendar here.

Are You Prepared for the Death of the Dollar?

Explosive Sector Alert: Profit from The Inflationary Market

HEADLINES

Inflation slows in May, with consumer prices +3.3% from a year ago (more)

Here’s the inflation breakdown for May 2024 — in one chart (more)

Benign US inflation could support stock market laggards (more)

US Treasury posts $347B deficit for May (more)

401(k) matches on student loan payments gain foothold in corporate America (more)

Dollar and euro trade halted on Russian exchange due to new US sanctions (more)

EU hits Chinese EVs with tariffs, drawing rebuke from Beijing (more)

Apple overtakes Microsoft as world's most valuable company (more)

Apple to 'pay' OpenAI for ChatGPT through distribution, not cash (more)

Keith Gill has some tough choices to make on his GameStop options with Wall Street ready to pounce (more)

Musk, SpaceX sued by former employees alleging harassment, retaliation (more)

Southwest CEO will not resign, will consider input from activist investor Elliott (more)

Broadcom to carry out 10-for-1 stock split (more)

PRESENTED BY STANSBERRY RESEARCH

Have you spotted this surprising device in your hometown yet?

It might not look like a lot at first glance... but it currently has the full attention of some of the world's brightest minds - including Bill Gates, Jeff Bezos, Elon Musk, and Peter Thiel.

Meanwhile, Congress just approved billions to put devices just like this one in every town and city across America.

What exactly does this device do?

How is it going to change America... and make some early investors very wealthy?

One of Wall Street's leading experts (a former hedge-fund manager who's predicted many of the biggest financial stories of the last 25 years and has recommended some of the best-performing stocks of our lifetimes) explains everything you need to know right here.

-Brett Aiken

Publisher, Stansberry Research

- please support our sponsor -

DEALFLOW

M+A | Investments

Sony Pictures is buying Alamo Drafthouse theater chain (more)

Matador agrees to buy Permian oil assets worth $1.9B (more)

AlphaSense, a market intelligence and search platform, acquired Tegus, an expert research, private company content, and financial data and workflow tools, for $930M (more)

Blackstone nears deal to expand NYC office space on Park Avenue (more)

Congo to buy out UAE partner in gold venture as shipments slump (more)

France's Atos to sell Worldgrid unit to Alten for about $290M (more)

Pente Networks, a company providing infrastructure to promote private LTE/5G networks for enterprises, received an investment from Mitsubishi Electric Corporation ME Innovation Fund (more)

VC

Apex, a spacecraft manufacturing company, raised $95M in Series B funding (more)

Canary Technologies, a hotel guest management tech company, raised $50M in Series C funding (more)

Learn to Win, enterprise training software, raised $30M in Series A funding (more)

Swift Solar, a solar technology company, raised $27M in Series A funding (more)

ElectronX, an energy exchange to accelerate the US grid transition to renewable sources, raised $15M in seed funding (more)

Canary Speech, a voice biomarker health tech company, raised $13M in Series A funding (more)

Aidentified, Inc., a relationship intelligence platform for financial services professionals, raised $12.5M in Series B funding (more)

Daisy, a home and small business technology installation and services company, raised $11M in Series A funding (more)

Grayce, a social care platform for families, raised $10.4M in Series A funding (more)

Auxilius, clinical trial financial management software, raised $10M in funding (more)

Stanly, a platform for fans to connect, engage, and celebrate their favorite fandoms, raised $8M in Pre-Series A funding (more)

CargoSense, a ‘Visibility OS’ platform for supply chain automation using visibility data, raised $8M in Series A funding (more)

Alida Biosciences, an innovator in epigenomic research tools, raised $7.5M in Series A funding (more)

Arya, a holistic sexual wellness platform, raised $7.5M in Seed funding (more)

Pyte, a computation platform for data-first global enterprises, raised $5M in funding (more)

BlinqIO, a gen-AI software testing platform, raised $5M in funding (more)

Koda Health, a company specializing in digital advance care planning, raised an undisclosed amount in Seed+ funding (more)

CRYPTO

BULLISH BITES

📊 The masters: The Microsoft Excel superstars throw down in Vegas.

📈 Investment: What's got Musk, Bezos, and Gates so excited? *

🤥 Imposters: Fake family offices are trying to pry wealth from Asia's rich.

🥊 New arena: Influencer Jake Paul launching men’s skin care line at Walmart.

💻 Disgruntled: Young employees are increasingly struggling at work, while older workers fare better.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.