Good morning.

The Fast Five → Wall Street’s ‘KHive’ fired up to back Harris, Wiz rejects Alphabet’s $23 billion offer, SEC approves first spot Ether ETFs to start trading Tuesday, Xi cements role as ‘Chief Economist,’ and Google cancels plans to kill off cookies…

📈 From Traders Edge Network: Master Weekly Options Income: Get Your Free Guide Here »

Calendar: (all times ET)

WED, 7/24: | New home sales, 10:00 AM |

THU, 7/25: | GDP, 8:30 AM |

FRI, 7/26: | PCE index, 8:30 AM |

Your 5-minute briefing for Tuesday, July 23:

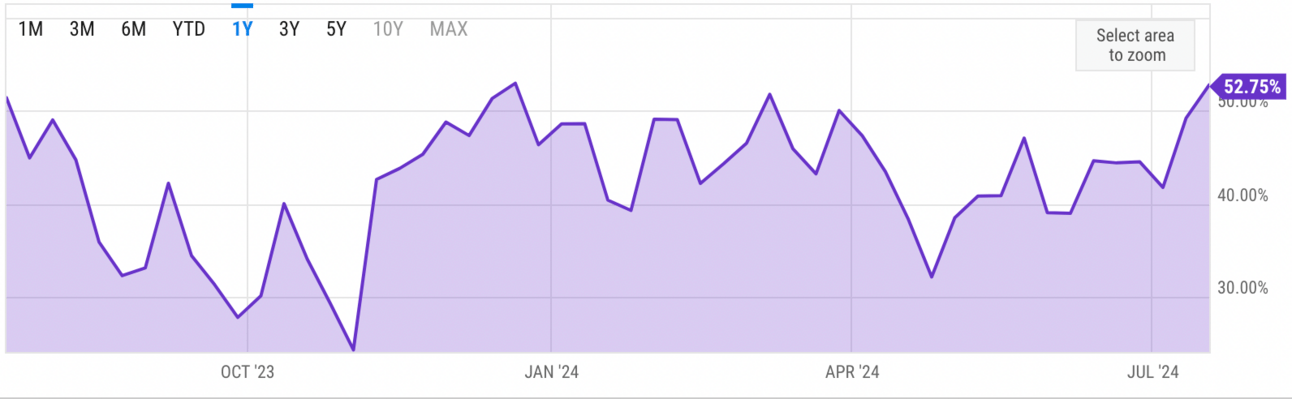

US Investor % Bullish Sentiment:

↑ 52.75% for Wk of July 18 2024 (Last week: 49.18%)

Chart updates every Friday.

Market Recap:

S&P rose 1%, best session since early June; Dow +0.3%.

Nasdaq outperformed, climbing 1.6%.

Investors optimistic about Fed rate cuts aiding smaller, cyclic stocks.

Earnings from GM, Coca-Cola, Comcast, UPS, Spotify before the bell.

Alphabet, Tesla, Mattel report after the bell.

Nonmanufacturing and existing home sales data due Tuesday.

EARNINGS

Here’s what we’re watching this week:

Today: Albertsons (ACI), Capital One Financial (COF), Coca-Cola (KO), General Motors (GM), Kimberly-Clark (KMB), Lockheed Martin (LMT), Spotify (SPOT), Tesla (TSLA), UPS (UPS), Visa (V)

Alphabet (GOOGL) - earnings of $1.84 per share (+27.8% YoY) on $84.2B revenue (+12.9% YoY)

Chipotle (CMG) - earnings of $.32 per share (+28% YoY) on $2.9B revenue (+16.3% YoY)

Friday: Bristol-Myers Squibb (BMY)

3M (MMM) - earnings of $1.68 per share (-22.6% YoY) on $5.9B revenue (-25.4% YoY)

Full earnings calendar here.

HEADLINES

Wall St closes higher as investors return to megacap stocks

category (more)

SEC approves first spot Ether ETFs to start trading Tuesday (more)

Xi cements role as ‘Chief Economist’ shrinking space for debate (more)

Bond markets haunted by bigger debt loads and erratic politics (more)

Chip stocks rebound ahead of megacap earnings (more)

Dip buyers wade back in to drive Wall Street gains (more)

Cracks in stock market calm boost allure of portfolio protection (more)

CrowdStrike shares tumble as fallout from global tech outage continues (more)

Alphabet to report double-digit Q2 growth (more)

Google cancels plans to kill off cookies for advertisers (more)

Tesla to use humanoid robots next year (more)

EU threatens to fine Meta for saying Facebook is ‘free’ (more)

Berkshire Hathaway offloads more BYD, taking its stake below 5%

Fidelity Director Predicts $1 BILLION Bitcoin

That's why Fidelity – the world's 4th largest asset manager – has acquired $11 billion worth of Bitcoin.

They're desperate to claim their stake in this modern gold rush.

And you should be, too.

But before you buy bitcoin (or any other crypto), you'll want to watch this interview.

In it, an 11-year crypto veteran names his #1 crypto to buy (it's not bitcoin or Ethereum). Learn more here.

- sponsored message -

- We’re on a short break this week -

The Dealflow and Crypto sections

will resume on Monday 7/29.

BULLISH BITES

⚖️ Justice: ‘Wolf of Airbnb’ gets 4 years for New York City rental fraud

💰 Protect Your Money: Fed’s shocking new power play.

💻 Second Wave: AI pattern poised to transform the investment landscape.

🤦🏻♂️ Roll Call: The $12,000 Harvard class celebrities are fighting to get in.

What did you think about today's briefing?

Have a comment or suggestion?

💌Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.