Good morning.

The Fast Five → AI warnings build as investors go all-in, Xi is never giving up his newfound leverage over Trump, central banks feeling FOMO over gold prices, Treasuries rally drives home haven role, and bank lending risk puts stock market on edge…

📌 26,598,293 views and counting — This man's simple investment advice has gone viral... with 26 million-plus people watching. It details where to invest $1,000 right now – a breakthrough technology that's said to be bigger than AI, EVs, cryptos, or anything else. See where he says you should put your money today right here » (ad)

Calendar: (*Shutdown may affect key data. All times ET) - Full Calendar

Today:

Leading Economic Indicators, 10A

Tomorrow:

None scheduled

Your 5-minute briefing for Monday, Oct 20:

US Investor % Bullish Sentiment:

↓ 33.66% for Week of OCT 16 2025

Previous week: 45.87%

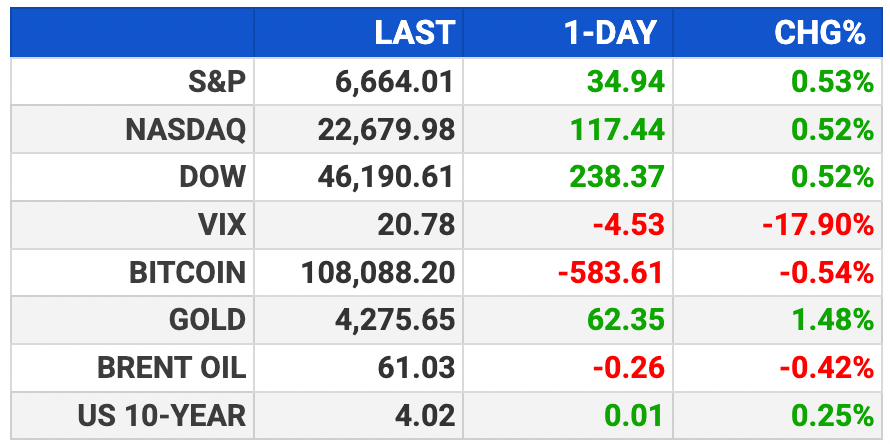

Market Wrap:

Futures rise: Dow +84, S&P +0.2%, Nasdaq +0.3%.

Trump eases tariff stance, offering new product exemptions.

Last week volatile — bank, AI, and China worries hit markets.

Earnings lift sentiment; Netflix, Tesla, Coke, Intel ahead.

Fed expected to cut rates again at late-Oct meeting.

CPI due Friday amid shutdown-driven data blackout.

Shutdown enters week 4, raising mild GDP concerns.

EARNINGS

Here’s what we’re watching this week:

TUE: *Coca-Cola $KO ( ▲ 1.18% ), *General Motors $GM ( ▲ 0.05% )

Netflix $NFLX ( ▲ 2.17% ) - EPS of $6.94 (+28.5% YoY) on $11.51B revenue (+17.2% YoY).

WED: *AT&T $T ( ▲ 0.36% ), Tesla $TSLA ( ▲ 0.03% )

THU: *American Airlines $AAL ( ▲ 1.8% ), *Blackstone $BX ( ▼ 3.57% ), Ford $F ( ▲ 1.67% ), Intel $INTC ( ▼ 1.14% )

Newmont $NEM ( ▼ 2.61% ) - EPS of $1.42 (+75.3% YoY) on $5.23B revenue (+13.6% YoY)

FRI: *Procter & Gamble $PG ( ▲ 1.4% )

Big Oil Firm Stakes $1 Billion in Startup That Could Kill Big Oil

On September 22, the unthinkable happened...

One of the world's biggest oil producers poured $1 billion into a startup that could KILL the oil industry.

This obscure startup is the front-runner in a technology that could generate virtually limitless energy.

Bill Gates says that it "could be as transformative as the invention of the steam engine before the Industrial Revolution."

No wonder Microsoft recently inked a massive deal to generate electricity from this breakthrough power source.

Even the firms that are most vulnerable to its disruptive potential are piling into it.

Oil supermajors ExxonMobil, Chevron, Eni, and Shell are staking billions of dollars in a technology that – according to Live Science – could "make oil obsolete."

And now – thanks to a little-known "backdoor" into this technology – it's your turn.

If you make one investment before the end of the year, I recommend making it this one.

But hurry, this backdoor opportunity won't be open for much longer.

-Whitney Tilson

Editor, Stansberry Research

- sponsored message from Stansberry Research -

HEADLINES

US stock futures steady with shutdown, earnings season in focus (more)

Bessent, Chinese vice premier to meet to try to defuse US tariff hike (more)

Treasuries rally drives home haven role as credit worries swirl (more)

Traders spooked as bank lending risk puts stock market on edge (more)

America's wealthiest shoppers are propping up the economy (more)

Gold prices are so high, even central banks are feeling FOMO (more)

Oil’s long-awaited surplus arrives on billion-barrel flotilla (more)

Global finance chiefs wait on Trump and Xi as trade war simmers (more)

China’s economy grows at weakest pace in a year (more)

Banking shares' wobbles reveal growing unease over credit risks (more)

Nvidia CEO to attend APEC CEO Summit in South Korea (more)

Jensen Huang says Nvidia went from 95% market share in China to 0% (more)

Kering sells beauty division to L’Oreal in $4.7 billion deal (more)

Crypto miners riding the AI wave are leaving Bitcoin behind (more)

- We’re on a short break -

The sections: Dealflow, Crypto & Bullish will be back

on Tuesday, 10/21/25. Thank you for reading!

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.