☕️ Good Morning.

The Fast Five → Attack on Israel likely to boost gold and safe-haven assets, U.S. sends warships in show of force, ‘Made in USA’ revival sparks building boom, Exxon’s blockbuster Pioneer merger needs Biden’s blessing, and Ozempic causing major slump in snack and beer stocks…

Here’s your 5-minute MarketBriefing for Monday:

BEFORE THE OPEN

As of market close 10/5/2023. Bitcoin as of 10/8/2023.

MARKETS:

Stocks rally despite stronger-than-expected U.S. jobs data and rising Treasury yields.

Dow up 288.01 points (0.87%), S&P 500 gains 1.18%, Nasdaq rises 1.60%.

U.S. adds 336,000 jobs in September, surpassing expectations; wages rise less than expected.

Intriguing intraday reversal with Dow initially down, surging over 400 points later.

Possible reasons for rally: softer wage number, yield pullback, oversold market.

10-year Treasury rate hits 16-year high, later eases but remains up 6 basis points at 4.78%.

EARNINGS

Here’s what we area watching this week:

Tuesday: PepsiCo (PEP)

Thursday: Delta Air Lines (DAL)

Friday: Wells Fargo (WFC), BlackRock (BLK), Citigroup (C)

NEWS BRIEFING

US sends warships, aid in show of force as Israel strikes back (more)

As Israel-Hamas war rages, oil traders focus on Iran (more)

‘Knee-jerk surge’: Oil experts predict market impact of Israel-Hamas conflict (more)

10-year Treasury yield rises after strong U.S. jobs report (more)

Wall Street is worried the bear market has ‘unfinished business’ (more)

Big-company bankruptcies hang over economy (more)

The IMF’s $43 billion Argentina problem is about to get worse (more)

Exxon move on Pioneer signals big oil’s tightening grip on shale (more)

Exxon’s blockbuster Pioneer merger needs Biden’s blessing first (more)

Kaiser Permanente health workers threaten more strikes if demands not met (more)

UAW will not expand strikes at Detroit automakers after last-minute GM proposal (more)

Ozempic threat is spurring a slump in snack and beer stocks (more)

Hacker puts 23andMe user data up for sale on the internet (more)

The big AI and robotics concept that has attracted both Walmart and Softbank (more)

Amazon sellers sound off on the FTC’s ‘long-overdue’ antitrust case (more)

Sex, Signal messages, and sabotaging FTX’s code: SBF execs and Bahamas roommates tell all in court (more)

a16z-backed fintech Synapse lays off 40% of its staff (more)

Quant hedge fund Two Sigma accuses employee of misconduct that cost clients money (more)

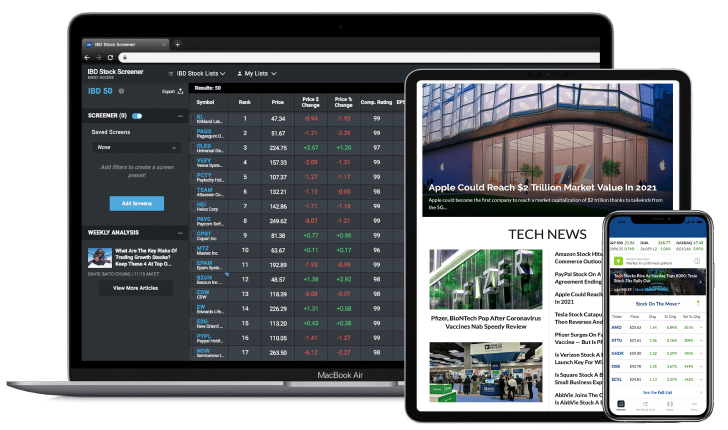

TOGETHER WITH INVESTORS BUSINESS DAILY

Boost your investment strategy

For over 35 years, Investor’s Business Daily has armed people like you with the tools and strategies to consistently outperform the market and prosper — no matter the conditions. Now, in a single subscription, you can access all their pro-level tools and strategies designed to boost your profits.

🔥 Exclusively for MarketBriefing Readers: Grab IBD's Premium Annual Subscription for only $249. Save 40% today (it’s like getting 5 months free!). Act quickly, this is a limited-time offer you won’t find anywhere else.

DEALFLOW

Disney reportedly in talks with Adani, Sun TV to sell India assets (more)

UAE’s ADIA to buy stake in Ambani’s retail unit for $597M (more)

AEA closes $1.3B AEA SBF V (more)

Lovell Minnick Partners invests in S&S Health (more)

Section 32, a venture capital firm, closed its Fund 5, at $525M (more)

CAZ Investments, an investment manager, made a $200M commitment to Grafine Partners, an investment management firm that identifies differentiated sources of alpha by investing in new firms led by experienced private equity investors (more)

Iambic Therapeutics, a biotechnology company developing novel therapeutics from its generative AI discovery platform, closed a $100M Series B financing (more)

Diana Health, a network of modern women’s health practices, raised $34M in Series B funding (more)

Machina Labs, an advanced manufacturing company, raised $32M in Series B funding (more)

Connections Health Solutions, an innovator in immediate-access behavioral health crisis care, closed a $28M growth financing (more)

Beat The Bomb, an interactive social video game company, raised $15M in Series B funding (more)

Vibrant Planet, a wildfire protection and ecosystem restoration company, raised $15M in Series A funding (more)

Castelion, a defense production company, raised $14.2M in funding (more)

EV Life, a climate finance platform making it cheaper and easier for anyone to buy electric vehicles, closed an $8M debt facility led by Trisolaris, LLC (more)

Concentric Educational Solutions, a provider of an education support system, raised $5M in Series A funding (more)

Atalan Tech, a provider of a platform to accelerate early prediction and prevention of healthcare worker burnout and turnover, raised $2.5M in seed funding (more)

iCleanse, a startup that develops Swift UV units for phone disinfection and advertising revenue for businesses, received $1M credit financing from Enhanced Capital (more)

Electric Era Technologies, a provider of PowerNode™ EV high-speed charging stations for the EV fast charging infrastructure, received an investment from Chevron Technology Ventures (more)

Amalgam Rx, a specializing in enabling data-driven health care decision making, received an investment of undisclosed amount from CVS Health Ventures in its Series B round (more)

M & A:

Was this briefing forwarded to you? (Sign up here.)

CRYPTO

U.S. dollar ‘collapse’—shock $8 trillion predicted Fed inflation flip to spark a ‘critical’ Bitcoin, Ethereum, XRP and Crypto price boom to rival gold (more)

FTX’s Gary Wang tells court Alameda got ‘special privileges’ to exchange’s funds (more)

3 reasons why Ethereum price can't break $2K (more)

Binance launches new domain in UK ahead of new financial promotions regime (more)

Ripple CTO seeks community consensus for XRPL AMM feature adoption (more)

BULLISH BITES

⬆️ The Future of Social Media Is Vertical → TechCrunch

No one actually knows what social media will look like five years from now. Many startups like Mastodon, Bluesky, Spill, and large legacy players like Meta appear to think that there will be a new catch-all platform that will capture people’s attention in the way that Twitter and Facebook did — I’m not so sure

🤖 How Will A.I. Learn Next? → NewYorker

As chatbots threaten their own best sources of data, they will have to find new kinds of knowledge.

✈️ To Attend or Not To Attend: TechCrunch Asked 52 Founders Whether Events Are Useful or a Waste of Time? → TechCrunch

A few months ago, Alexis Ohanian, the former co-founder of Reddit and current VC at Seven Seven Six, tweeted that if he could go back in time and do one thing differently when he was building Reddit, he would have spent significantly less time attending events.

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Subscribe Now

Keep the curation going! Buy the team a coffee ☕️

Have any suggestions for MarketBriefing? We’d love to hear it.

Share your thoughts here -mb