☕️ Good Morning.

WeWork tumbles, ESPN getting into sports betting with Penn, Wall Street WhatsApp, texting fines exceed $2.5B, shares drop as Moody’s cuts ratings of US banks, and UPS job searches surge after $170K driver pay union deal…

Here’s your market briefing for Wednesday:

BEFORE THE OPEN BEFORE

As of market close 8/8/2023.

MARKETS:

U.S. stock futures show little change after recent major averages selloff.

Dow futures down by 27 points, a 0.08% decrease.

S&P futures dip 0.06%, while Nasdaq 100 futures decline 0.06%.

Penn Entertainment surges 12% in extended trading on the announcement of ESPN Bet partnership.

Recent session saw major averages facing a down day, with the Dow closing 0.45% lower.

The S&P slid 0.42%, while Nasdaq dropped 0.79% amid Moody's regional bank downgrade.

Some view the selloff as an expected correction after substantial equity gains this year.

Roblox to release earnings before today’s open; Disney and Wynn Resorts to follow with post-close results.

EARNINGS

What we’re watching this week:

Today: Roblox (RBLX), The Trade Desk (TTD), Walt Disney (DIS)

Thursday: Alibaba (BABA)

Friday: Spectrum Brands (SPB)

Full earnings calendar here

NEWS BRIEFING

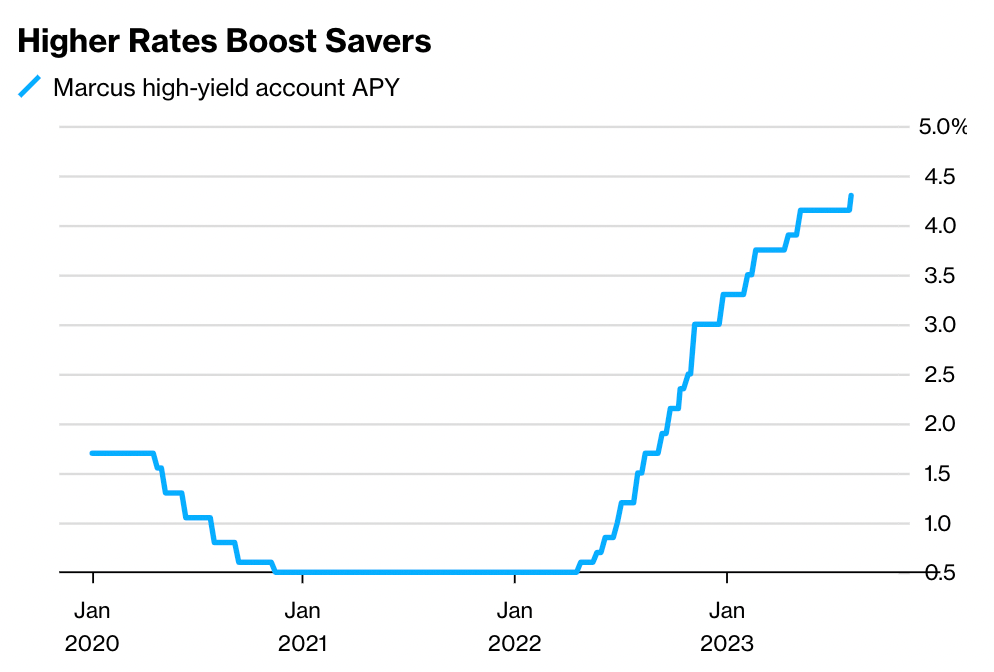

Millions of Americans have a higher rate on their savings account than they’re paying for their mortgage. Marcus by Goldman Sachs Group Inc. recently raised the interest rate on its high-yield accounts to an all-time high of 4.3%, following the latest hike in the Federal Reserve’s key benchmark rate.

Treasury auctions off to good start, with strong demand for three-year notes (more)

Oil holds near four-month high as report sees US stockpile gain (more)

S&P drops ESG scores from debt ratings after investor confusion (more)

US Bank shares drop as Moody’s cuts ratings, warns on risks (more)

Wall Street WhatsApp, txt-message fines exceed $2.5B (more)

Banks hit with $549M in fines for use of Signal, WhatsApp to evade regulators’ reach (more)

Credit card balances jumped in the second quarter and are above $1 trillion for the first time (more)

Cloud stocks falter as Datadog trims 2023 revenue expectations (more)

UPS drivers' new $170K per year deal shows that unions may just save the middle class after all (more)

L.A. city workers stage one-day strike, latest in series of walkouts (more)

Amazon in talks to become anchor investor in Arm ahead of IPO (more)

Disney’s ESPN inks $2B deal with Penn Entertainment to launch sportsbook (more)

Disney taps two former execs to help sell ESPN stake (more)

Disney creates task force to explore AI and cut costs (more)

Nvidia launches new chip platform to cash in on generative AI demand (more)

Amazon is running a second Prime Day sale in October (more)

Twitter looks to bring advertisers back with expanded ad features (more)

Robinhood says it’s acing investigation from New York state (more)

KKR scoops up auto loan portfolio as regional banks shed assets

(more)

Alibaba, Tencent’s $66 billion party starts to fade (more)

Private-jet firm Wheels Up seeks rescue funding (more)

DEALFLOW

Apple and Samsung to invest in SoftBank's Arm at IPO (more)

Amazon in talks to become anchor investor in Arm ahead of IPO (more)

Adani Enterprises weighs exiting $6B Wilmar Venturen (more)

ConocoPhillips to offer notes to fund $3B Surmont oil facility buyout (more)

PE firm KKR acquires $373M portfolio of Synovus Bank's prime auto loans (more)

Security firm ADT's commercial unit to be taken private by GTCR for $1.6B (more)

JD Sports to take full ownership of Poland's MIG (more)

Charlie Ergen reunites Dish, EchoStar in all-stock deal (more)

Australia's Woodside to sell 10% stake in Scarborough to LNG Japan for $500M (more)

Molson Coors makes big whiskey play with acquisition of Blue Run Spirits (more)

Glacier Bancorp to acquire Community Financial Groups (more)

PeopleGrove acquires jobZology® and their flagship product PathwayU strengthening science-based academic and career exploration capabilities (more)

Struengmann brothers, worth $24B, deepen private equity ties (more)

InComm Payments acquires Zenda (more)

Accenture completes acquisition of Anser Advisory (more)

Tyler Technologies buys Computing System Innovations (more)

Extendly acquires stake in ChatHQ (more)

Catch+Release, a content licensing marketplace for brands and creators, raised an additional $8.8M in Series A funding (more)

Chargeflow, a chargeback automation solution tailored exclusively for online businesses, closed an $11M financing round (more)

Figur8, a leader in the measure of musculoskeletal (MSK) health, has successfully closed a $25M Series A-1 funding (more)

Dropzone AI, an autonomous alert investigation platform for security operations teams, closed on $3.5M in seed funding (more)

Clinetic, a healthtech company focused on streamlining clinical research, closed a Series A financing round (more)

Membrion, an electro-desalination membrane manufacturer, held a second close of $5.5M in its Series B funding round, bringing the total to $12.5M (more)

MindsDB, an artificial intelligence virtual database enabling the creation of AI-centered applications, received an investment from NVentures, NVIDIA’s venture capital arm (more)

Birdstop, Inc., a remote sensing company, raised $2.3M in funding (more)

Grapevine, a collaborative giving platform, raised $1.67M in equity financing with an additional $180K in grants (more)

Simon Data, a customer data platform (CDP) provider, closed $54M Series D funding round (more)

Horizon3.ai, a provider of autonomous security solutions, raised $40M in Series C funding (more)

ConductorOne, Inc., a leader in identity security and access governance, raised an additional $12M in Series A funding (more)

Stamus Networks, a network security company, closed a $6M series A funding (more)

Beond, a premier leisure airline, closed an over $17M Seed funding round (more)

Verdagy, a developer of scaling electrolyzer technologies for industrial markets, closed a $73M Series B funding round (more)

Inrix, Inc., a provider of transportation analytics and connected car services, completed a $70M financing round (more)

Thunder, a Salesforce and Cloud consulting, implementation and managed services company, raised $16M in Series A funding (more)

Tenant Inc., a vertical SaaS technology platform company which offers a complete ecosystem tailored to the self-storage industry, closed a $25M third seed funding round (more)

Daybreak Health, a provider of school-based mental health services, raised $13M in Series B funding (more)

Gomboc.ai, an AI-powered cloud infrastructure remediation platform provider, raised a $5.2M seed funding round (more)

CRYPTO

BULLISH BITES

🎙 The Barstool Deal Is the Talk of Twitter…

The company was sold for $500M to Penn in 2020. Three years later, Portnoy acquired 100% of the brand back for $0. But that's not the whole truth. Here's what really happened…

🤩 The Weight-Loss Drug Frenzy Is Outrunning the Company Behind It…

Novo Nordisk A/S’s bestsellers Ozempic and Wegovy have given the Danish company a Hollywood sizzle. The drugs that help people lose significant amounts of weight were name-checked at the Oscars, touted by Elon Musk, feature in countless TikTok videos and even have a song dedicated to them. Now it faces a struggle to keep up…

Know someone who would enjoy this?

What did you think about today's briefing?

Catch you in the morning, thanks for reading… -mb