☕️ Good Morning.

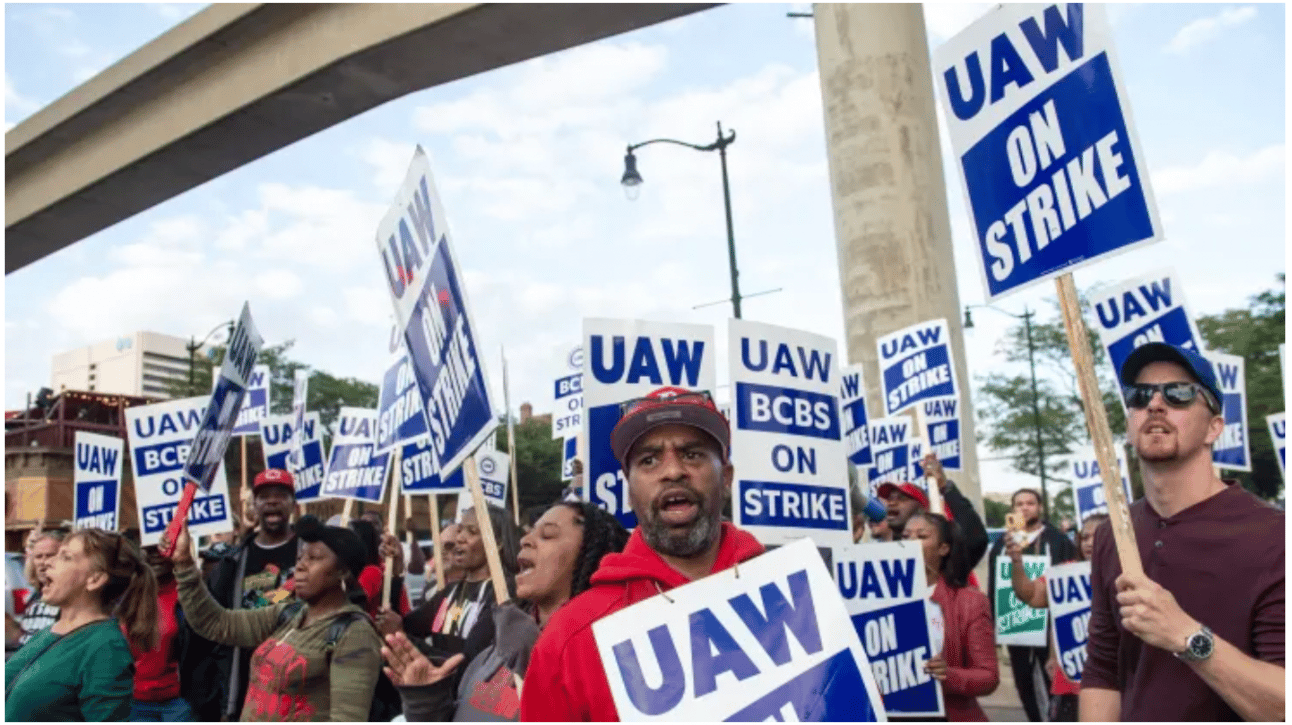

The Fast Five → White House deploys team to Detroit to help resolve UAW strike, US is trending in the Fed’s direction, the GME short squeeze is now ‘Dumb Money’, Sequoia, Andreessen get hosed on 2021 Instacart investment, and Byron Allen makes $10 billion bid for Disney’s ABC and other networks…

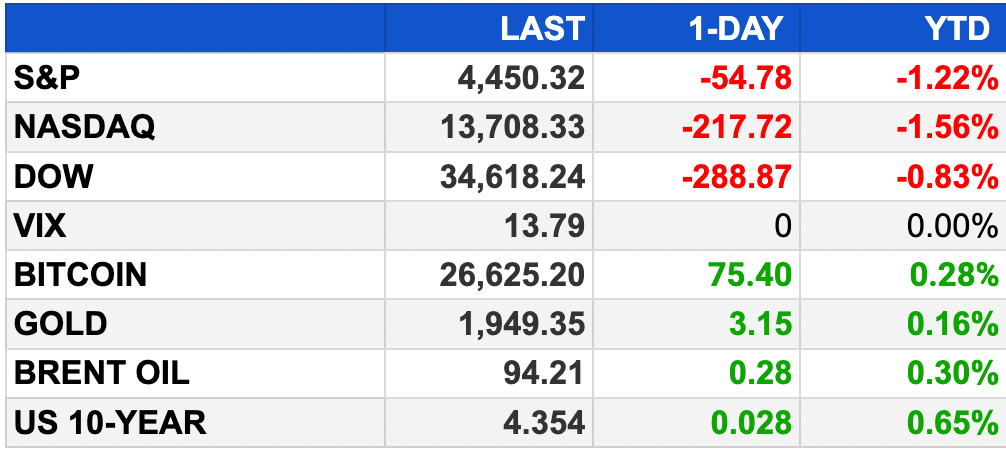

Here’s your MarketBriefing for Monday:

BEFORE THE OPEN

As of market close 9/15/2023.

MARKETS:

U.S. stock futures edge up ahead of the Fed's policy decision

Dow futures, S&P 500, and Nasdaq 100 futures each gain 0.1%

Last week, S&P 500 and Nasdaq had two consecutive losing weeks, while Dow slightly rose

Focus on Fed's stance on inflation; recent data mostly in line with expectations

Strong labor market and auto worker strike could drive future price increases

Upcoming economic data releases include Housing Market Index and Business Leaders Survey results

EARNINGS

Wednesday: FedEx (FDX)

Thursday: Darden Restaurants (DRL)

NEWS BRIEFING

‘A real big deal’: Biden backs economic corridor as shifting geopolitical alliances fragment world (more)

Wall Street comes to grips with how wrong it’s been in 2023 (more)

U.S. economy is trending in the Fed’s direction, so expect Powell to tread carefully this week (more)

Cash-squeezed developer Country Garden faces another dollar coupon deadline (more)

China Evergrande shares tumble 25% after wealth management staff detained (more)

EU may become as hooked on China batteries as it was on Russian energy (more)

UAW strike brings blue-collar vs. billionaire battle to the Motor City (more)

Automakers, UAW spend strike’s first day in war of words (more)

ARM options to be available for Ttading on Monday after IPO (more)

SoftBank left millions on the table to engineer a win for Masayoshi Son (more)

Sequoia and Andreessen get hosed on 2021 Instacart investment after 75% plunge in valuation (more)

Disney asset sales won’t break the bank, but they will move legacy media forward (more)

Mogul Byron Allen makes $10 billion bid for Disney's ABC, other networks (more)

Hollywood is paying a steep price for never really figuring out the streaming model (more)

World is struggling to make enough diesel (more)

Bank of Montreal to close retail auto finance business, flags job losses (more)

German economic weakness belies France's outperformance (more)

Billionaires’ Row in NYC retreats from its shock-and-awe pricing (more)

Was this briefing forwarded to you? (Sign up here.)

DEALFLOW

SoftBank seeks OpenAI tie-up as Son plans deal spree after Arm IPO (more)

Pfizer’s $43 billion Seagen takeover gets EU merger review (more)

Feminine-care products maker Honey Pot is exploring a sale (more)

Discover considers possible sale of its student-loan arm (more)

All3Media owners kick off sale process (more)

Hitachi offers to sell assets to win EU okay for Thales rail deal (more)

Generate:Biomedics, a clinical-stage biotherapeutics company, raised $273M in Series C funding (more)

Helsing, a defense AI company, raised €209M in Series B funding (more)

Cervin Ventures, an early-stage venture capital firm, closed $162m in new capital (more)

Sonex Health, a company specializing in the ultrasound-guided treatment of common orthopedic syndromes affecting the extremities, raised $40M in Series B funding (more)

Linear, a provider of a project and issue tracking system that teams, raised $35M in Series B funding (more)

Duckbill, a maker of an execution engine that gives people a personal assistant combined with AI’s efficiency, raised $33M in seed and Series A funding (more)

Moment, a fintech startup providing an institutional-grade fixed income solution, raised $17M in Series A funding (more)

Evolectric, an Electric Vehicle (EV) technology company, raised $15M from Seismic Capital (more)

Goodles, a noodle brand, raised $13M in Series A funding (more)

Superorder (fka Forward Kitchens), a provider of growth management tools to restaurants, raised $10M in Series A and angel funding (more)

Carenostics, a healthcare AI startup for chronic disease, raised $5M in Seed funding (more)

Learn.xyz, a generative AI learning startup, closed a $3M seed financing round (more)

Spectro Cloud, a provider of a platform about Kubernetes management, received an investment from Qualcomm Ventures (more)

NY-based Superorganism has launched as venture capital firm supporting early-stage technology startups dedicated to the global biodiversity crisis (more)

Vortex Companies, a provider of trenchless infrastructure rehabilitation products and services, received an investment from Quad-C Management (more)

M & A:

London-Listed Rockfire to buy suspended Dubai gold refinery (more)

Ardonagh sells £1.2 billion insurance unit to Markerstudy (more)

777 Partners agrees to buy Everton, tightening US grip on English football (more)

GTCR, a private equity firm, acquired Foundation Source, a provider of philanthropy management solutions (more)

CRYPTO

BULLISH BITES

🎓 Ultra-Rich Buy Ultra-Luxury Counseling to Get Kids Into Harvard

With 24/7 tutors and lots of hand-holding, high-end consultants are taking the admissions race to the next level. Sooner or later, every parent asks Christopher Rim the same question: What will it take to get my kid into Harvard or Yale? → Bloomberg

🍎 Behind Warren Buffett's $100 Billion-Plus Bet on Apple and the iPhone

The "Oracle of Omaha" called the iPhone "an extraordinary product" and Apple a better business than any of Berkshire's wholly-owned subsidiaries. → CNBC

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Subscribe Now

Keep the curation going! Buy the team a coffee ☕️

Have any suggestions for MarketBriefing? We’d love to hear it.

Share your thoughts here -mb